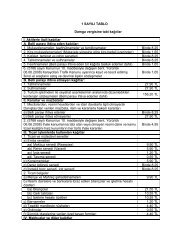

2004 YILI BÃTÃESâ¹Nâ¹N UYGULAMA SONUÃLARI AÃIKLANDI ...

2004 YILI BÃTÃESâ¹Nâ¹N UYGULAMA SONUÃLARI AÃIKLANDI ...

2004 YILI BÃTÃESâ¹Nâ¹N UYGULAMA SONUÃLARI AÃIKLANDI ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

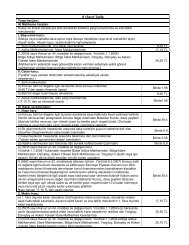

VERG‹DE GÜNDEMFUNDAMENTALS ANDPROCEDURES OF V.A.T.EXEMPTIONAPPLICATION FOR THEDELIVERIES ANDSERVICES REGARDINGTHE ACTIVITIES OFPROSPECTING, MINING,EXTENDING ANDREFINING OFPRECIOUS MINERALSThrough article 14 of “Law No. 5228Introducing Amendments on Certain Lawsand Statutory Decree No. 178” that hascome into effect by being promulgated inthe Official Gazette No. 25539 dated31.07.<strong>2004</strong>, fundamental changes havebeen introduced in article 13 of the ValueAdded Tax Code.Through article 14 of the aforementionedlaw, the caption of article 13 of the ValueAdded Tax Code has been amended as“Exemption on vehicles, precious metalsand oil research and national securityexpenses and investments”, and theabolished clause (be) has been readjusted,clause (c) has been amended and clauses(e) and (f) have been added.1. Exemption on Deliveries andServices Concerning Research,Operation, Enrichment andRefining Operations on Gold,Silver and Platinum1.1 Goods and Services within the Scopeof the ExemptionThe purchases of goods and services thatwould be subject to the exemption inquestion should be related with research,operation, enrichment, and refiningoperations of gold, silver or platinum. Theexpenses incurred by enterprises engagingin the operations mentioned above, whichare related with purchases of furniture,fixtures and fittings and the like, a well aspassenger automobiles and spare parts,fuel, repair and maintenance expenses inrelation with these economic assets cannotbenefit from the exemption in question.Again, the expenses of the aforementionedenterprises related with delivery andservice purchase of every kind of officematerial, stationary, food and clothing,i.e., general administrative expenses shallnot be able to benefit from the exemptionin question.On the other hand, expenses related withservices and deliveries concerningpurchase, hiring or leasing equipment,machinery, apparatus, consumables, spareparts, labor machines, energy, preliminarystudy, project, consulting, constructionwork, transportation (excluding renting ofpassenger automobiles), as well as theexpenses related with their repair,maintenance and modification shall beconsidered within the scope of theexemption.1.2. Exemption on Research OperationsPrimarily, pursuant to article 24 of theMinerals At, research reports shall besubmitted to the Ministry of Energy andNatural resources by firms that have beengranted mineral research license. If it isascertained by the related ministry that theresearch operations in question are aimingat finding gold, silver or platinum withinthe period covered by the report, a kindof exemption certificate that has beenattached to the communiqué shall be drawnup in the name of the firms and the firmsin question shall declare the value addedtax that they have borne in relation withthe purchases that would be evaluated tobe within the scope of the exemption withinthis period as refundable VAT in the firsttax return to be submitted.The VAT receivable that would bedeclared in the tax return shall be refundedin cash or on account by way of a SwornFiscal Consultant certification report oran inspection report.After approval of the activity reportsubstantiating the existence of gold, silveror platinum by the Ministry of Energy andNatural Resource, if the research activityis continued, the firms shall submit to theMinistry in question a list detailing thegoods and services to be used in researchactivities and these lists shall be reviewedby the Ministry and if required, some ofthe goods and services will be excludedfrom the list and shall be approved througha letter whose sample has been submittedin attachment to the communiqué.The firms that have been granted the letterin question shall submit a copy of thisletter and the list in its attachment signedby company authorities to seller firms toensure value added tax exemption onpurchases of goods and services. Thus theseller firm shall not apply value added tax,however, the letter and the attached listshall be kept in accordance with the TaxProcedures Code provisions by the sellerfirm.1.3. EffectivenessThe amendment introduced in clause (c)of article 13 has come into effect as of01.01.<strong>2004</strong>. However, if tax liables wish,they can submit a refund request for thepurchases that have been subjected to valueadded tax although they are within thescope of an exemption or since they haveeffected the purchase before 01.01.<strong>2004</strong>.1.4. Monetary LimitThe Council of Ministers has determinedthe lower limit to apply on the exemptionin question as NTL 100 through its DecreeNo. <strong>2004</strong>/8127 that has come to effectafter being promulgated in the OfficialGazette dated 03.12.<strong>2004</strong>, based on theauthority granted to it.Accordingly, the exemption shall beapplicable on purchase of goods andservices that are over or equal to NTL 100,excluding value added tax. If through adocument given for the purchase of a goodor service more than one transaction thatare within and/or outside the scope of theexemption, the value added tax shall becalculated only over those transactionsthat are not within the scope of exemption.16MART 2005