ENRICHING LIVES EXPANDING HORIZONS - Maxis

ENRICHING LIVES EXPANDING HORIZONS - Maxis

ENRICHING LIVES EXPANDING HORIZONS - Maxis

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>ENRICHING</strong><br />

<strong>LIVES</strong><br />

<strong>EXPANDING</strong><br />

<strong>HORIZONS</strong><br />

ANNUAL REPORT 2011<br />

<strong>Maxis</strong> Berhad (867573-A)<br />

Level 18, Menara <strong>Maxis</strong><br />

Kuala Lumpur City Centre<br />

Off Jalan Ampang<br />

50088 Kuala Lumpur<br />

<strong>Maxis</strong> Berhad (867573-A) ANNUAL REPORT 2011<br />

maxis.com.my

<strong>Maxis</strong> is all about enriching lives and expanding horizons for our customers. By pioneering the<br />

convergence of mobile telephony and the internet. By introducing new devices and delivery systems.<br />

Expanding wireless and fixed solutions for business and for the home. Expanding content, access,<br />

storage, and on-demand services for a richer internet experience. And more importantly, enriching<br />

lives and bringing people closer.

CONTENTS<br />

Introduction<br />

2 Our Company<br />

3 Our Mission, Vision and Values<br />

6 Corporate Structure<br />

7 Corporate Information<br />

8 Investor Relations<br />

12 Awards and Recognition<br />

14 Milestones<br />

The Board of Directors and<br />

Senior Management<br />

22 Board of Directors<br />

24 Board of Directors Profiles<br />

30 Organisation Structure<br />

32 Senior Management<br />

34 Senior Management Profiles<br />

Performance Highlights<br />

40 Performance at a Glance<br />

42 Financial Highlights<br />

44 Value Added Statement<br />

45 Quarterly Financial Performance<br />

46 Summarised Statement of<br />

Financial Position<br />

47 Segmental Analysis<br />

48 Operating Performance<br />

Indicators<br />

49 Financial Calendar<br />

Business Review<br />

50 Chairman’s Statement<br />

56 CEO’s Statement<br />

65 Segments, Products and Services<br />

78 Customers First<br />

84 Inspiring People<br />

87 Corporate Responsibility<br />

96 Outlook<br />

Financial Statements 2011<br />

100 Directors’ Report<br />

Financial Statements<br />

106 Income Statements<br />

107 Statements of<br />

Comprehensive Income<br />

108 Statements of<br />

Financial Position<br />

110 Statements of<br />

Changes in Equity<br />

113 Statements of Cash Flows<br />

116 Notes to the Financial<br />

Statements<br />

197 Supplementary Information<br />

198 Statement by Directors<br />

199 Statutory Declaration<br />

200 Independent Auditors’ Report to<br />

the Members of <strong>Maxis</strong> Berhad<br />

Corporate Governance<br />

204 Audit Committee Report<br />

211 Statement on Corporate<br />

Governance<br />

230 Internal Control Statement<br />

235 Directors’ Responsibility<br />

Statement<br />

236 Risk Management<br />

239 Ethical Business Practices<br />

Analysis of Shareholdings<br />

241 Size of Shareholdings<br />

242 Distribution Table According to<br />

Category of Shareholders<br />

243 Directors’ Interest in Shares<br />

244 30 Largest Shareholders<br />

246 Information on Substantial<br />

Shareholders<br />

Other Information<br />

248 List of Properties Held by<br />

<strong>Maxis</strong> Berhad<br />

250 Disclosure of Recurrent Related<br />

Party Transactions<br />

279 Additional Disclosures<br />

280 Material Contracts<br />

286 Glossary<br />

289 <strong>Maxis</strong> Centres<br />

290 <strong>Maxis</strong> Exclusive Partners<br />

Annual General Meeting<br />

301 Notice of Annual<br />

General Meeting<br />

Form of Proxy<br />

Request Form

2<br />

Introduction<br />

OUR<br />

COMPANY<br />

<strong>Maxis</strong> Up Close and Personal<br />

At <strong>Maxis</strong> we take the idea of being<br />

up close and personal to a whole<br />

new level. We are Malaysia’s biggest<br />

integrated communications service<br />

provider but we keep our customer<br />

relationships intimate, sustaining<br />

close ties over great lengths of time.<br />

Both businesses and individuals<br />

realise that the ubiquitous reach of<br />

our services has enabled a rich<br />

customer experience.<br />

Our commitment to taking the<br />

technology and innovation high<br />

ground for mobile and fixed voice,<br />

messaging, mobile internet and wired<br />

and wireless broadband has allowed<br />

our almost 14 million subscribers to<br />

embrace 24/7 lifestyles. This means<br />

easy interfaces between work and<br />

leisure, education and entertainment<br />

and most importantly business-to<br />

business communications and social<br />

interaction. At <strong>Maxis</strong> we are building a<br />

brave new world where the virtual and<br />

real meet seamlessly.<br />

Front Runners with a Cause<br />

On a day-to-day basis we push the<br />

frontiers of available technology as<br />

well as the mobile experience for our<br />

customers. How can we deliver more<br />

to our customers by harnessing the<br />

technologies of the future? How can<br />

we increase data speeds and embellish<br />

communications exponentially? We<br />

are confident that the quality of our<br />

people and their drive to stay the course<br />

will result in clever and exciting ideas<br />

to enhance the ways in which our<br />

customers communicate. We thrive on<br />

the unexpectedness of making these<br />

discoveries. We like to keep our game<br />

fresh. We are the biggest in the business<br />

but also the most nimble.<br />

<strong>Maxis</strong> has the largest high-speed network<br />

footprint in the country with 95%<br />

2G coverage and 81% 3G coverage.<br />

This means our customers are able to<br />

‘thread’ their lives from work to home<br />

seamlessly. Since our inception in 1995,<br />

we have always been at the forefront<br />

of technology. We were the first to<br />

launch high-speed networks in Malaysia<br />

including 3G, 3.5G, 3.5G+ and the first<br />

to conclude LTE (Long Term Evolution)<br />

trials. We have taken the lead in active<br />

network sharing in the country. In<br />

October 2011, <strong>Maxis</strong> and U Mobile Sdn<br />

Bhd entered into a landmark agreement<br />

to share <strong>Maxis</strong>’ 3G radio access networks<br />

(RAN), making the partnership the first<br />

active 3G RAN sharing arrangement to be<br />

deployed in Malaysia.<br />

Being simply the best means we have to<br />

push boundaries, making our products<br />

and service offerings hard to beat. <strong>Maxis</strong><br />

was the first to bring the BlackBerry,<br />

Apple iPhone, Galaxy Tab, Windows 7<br />

and Android smartphones to Malaysia.<br />

We were also first to launch innovative<br />

services which were world-firsts; <strong>Maxis</strong>-<br />

PayPal partnership, myDEALs and<br />

<strong>Maxis</strong>@Formula1. Regionally, <strong>Maxis</strong><br />

created milestones by being a frontrunner<br />

with <strong>Maxis</strong> 1Store, ONEMusic,<br />

<strong>Maxis</strong> Games and <strong>Maxis</strong> Movies. In<br />

Malaysia, FINDER301, Unity Solutions<br />

and Fashionista set fresh benchmarks in<br />

mobile communications experiences.<br />

We actively pursue partnerships for<br />

life-enriching services such as online<br />

payment, remittance, social networking,<br />

music, games and movies. We continue<br />

to nurture our customer relationships<br />

with the launch of <strong>Maxis</strong> Home. This full<br />

suite of integrated services encompasses<br />

high-speed internet via fibre, mobile<br />

and fixed wireless access, voice, valueadded<br />

services and content, which can<br />

be experienced across multiple screens<br />

– mobile, tablet and personal computer.<br />

Not surprisingly, <strong>Maxis</strong>’ non-voice revenue<br />

earnings spotlights us as one of the top<br />

performers in the Asian region with<br />

45.3% of mobile revenue being nonvoice<br />

revenue and with over 7.5 million<br />

of our customer base being active mobile<br />

internet users as at Q4 2011.<br />

First Among Equals<br />

<strong>Maxis</strong>’ growth and strong track record of<br />

enabling innovation, excellent customer<br />

experience and value to stakeholders<br />

have won the company numerous awards<br />

including FinanceAsia’s Best Managed<br />

Company Award 2011 (Top 3), Asia’s Best<br />

Employer Award 2010 and 2011 from<br />

Singapore’s Employer Branding Institute;<br />

Frost & Sullivan’s Malaysia Excellence<br />

Awards 2011 for Mobile Service Provider<br />

of the Year; and the Brand of the Year<br />

Award at the Putra Brand Awards 2011.<br />

<strong>Maxis</strong> also swept 15 awards at the 12th<br />

Customer Relationship Management<br />

and Contact Centre Association (CCAM)<br />

Annual Awards, including the prestigious<br />

Gold Award for the Best In-house<br />

Inbound Contact Centre above 100 seats.<br />

This marks the second consecutive year<br />

that <strong>Maxis</strong> has won this award. <strong>Maxis</strong><br />

also won the Corporate Nationhood<br />

Initiatives Award in recognition of its<br />

contribution to national unity, integration<br />

and 1Malaysia.<br />

Reciprocity with the community is an<br />

integral part of <strong>Maxis</strong>. <strong>Maxis</strong>’ Corporate<br />

Responsibility (CR) efforts focus on<br />

making a ‘Positive Impact’, harnessing<br />

leading-edge technology and innovation<br />

to create value for the economy, society<br />

and the environment. <strong>Maxis</strong> has been<br />

dedicated to working alongside the<br />

Ministry of Information Communication<br />

and Culture Malaysia (KPKK) and<br />

the Malaysian Communications and<br />

Multimedia Commission (SKMM) on<br />

community investment programmes<br />

namely <strong>Maxis</strong> Cyberkids and <strong>Maxis</strong><br />

Mobile Content Challenge to increase<br />

people’s access to the digital platform.<br />

Additionally, <strong>Maxis</strong> contributes towards<br />

the nation’s capacity-building by providing<br />

scholarships to outstanding and deserving<br />

Malaysians to pursue their education in<br />

leading local and overseas universities.<br />

<strong>Maxis</strong> was listed on the Main Market<br />

of Bursa Malaysia Securities Berhad in<br />

November 2009.<br />

For more information, please visit:<br />

www.maxis.com.my

MAXIS BERHAD<br />

ANNUAL REPORT 2011<br />

3<br />

Introduction<br />

OUR MISSION,<br />

VISION<br />

AND VALUES<br />

To become the nation’s premier integrated<br />

communications service provider.<br />

To bring the future to our customers’ lives<br />

and businesses, in a manner that is simple,<br />

personalised and enriching, by efficiently and<br />

creatively harnessing leading-edge technology<br />

and delivering a brand of service experience<br />

that is reliable and enchanting.<br />

SIMPLE<br />

TRUSTWORTHY<br />

CREATIVE<br />

BRAVE

4<br />

FARTHER. FASTER<br />

Enjoy the scenery while you enjoy the coverage. No matter how<br />

remo<br />

te. Today, we have<br />

the fastest, most advanced high-speed<br />

networ<br />

ork.<br />

We are already wo<br />

rking on ‘what next?’. The <strong>Maxis</strong><br />

next gen<br />

eneration 4G network<br />

is coming soon to a phone (and<br />

fiel<br />

eld) near you.<br />

NETWORK<br />

HOME<br />

ROAMING<br />

MOBILE INTERNET

MAXIS BERHAD<br />

ANNUAL REPORT 2011<br />

5<br />

CUSTOMERS FIRST<br />

LIFE SERVICES<br />

CLOUD<br />

DISTRIBUTION

6<br />

Introduction<br />

CORPORATE<br />

STRUCTURE<br />

MAXIS<br />

BERHAD<br />

100%<br />

<strong>Maxis</strong> Mobile<br />

Sdn Bhd<br />

100%<br />

<strong>Maxis</strong> Mobile<br />

(L) Ltd<br />

100%<br />

<strong>Maxis</strong> Broadband<br />

Sdn Bhd<br />

100%<br />

<strong>Maxis</strong> Online<br />

Sdn Bhd<br />

100%<br />

<strong>Maxis</strong> International<br />

Sdn Bhd<br />

100%<br />

<strong>Maxis</strong> Asia<br />

Access Pte Ltd<br />

100%<br />

<strong>Maxis</strong> Mobile<br />

Services Sdn Bhd<br />

75%<br />

Advanced Wireless<br />

Technologies Sdn Bhd<br />

100%<br />

UMTS (Malaysia)<br />

Sdn Bhd<br />

100%<br />

<strong>Maxis</strong> Collections<br />

Sdn Bhd<br />

100%<br />

<strong>Maxis</strong> Multimedia<br />

Sdn Bhd<br />

NOTE:<br />

The above structure represents <strong>Maxis</strong><br />

Berhad and its subsidiaries. Please refer<br />

to pages 155 and 156 of this Annual<br />

Report for principal activities of the<br />

subsidiaries.

MAXIS BERHAD<br />

ANNUAL REPORT 2011<br />

7<br />

Introduction<br />

CORPORATE<br />

INFORMATION<br />

Board of Directors<br />

Raja Tan Sri Dato’ Seri Arshad<br />

bin Raja Tun Uda<br />

Chairman/<br />

Independent Non-Executive Director<br />

Robert William Boyle<br />

Independent Non-Executive Director<br />

Dato’ Mokhzani bin Mahathir<br />

Independent Non-Executive Director<br />

Asgari bin Mohd Fuad Stephens<br />

Independent Non-Executive Director<br />

Ghassan Hasbani<br />

Non-Executive Director<br />

Dr Zeyad Thamer H. AlEtaibi<br />

Non-Executive Director<br />

Dr Fahad Hussain S. Mushayt<br />

Non-Executive Director<br />

Augustus Ralph Marshall<br />

Non-Executive Director<br />

Chan Chee Beng<br />

Non-Executive Director<br />

Sandip Das<br />

Chief Executive Officer/Executive Director<br />

Senior Independent Director<br />

Dato’ Mohkzani bin Mahathir<br />

e-mail : mmokhza@maxis.com.my<br />

Company Secretary<br />

Dipak Kaur<br />

(LS 5204)<br />

Auditors<br />

PricewaterhouseCoopers<br />

Level 10, 1 Sentral<br />

Jalan Travers<br />

Kuala Lumpur Sentral<br />

50470 Kuala Lumpur<br />

Malaysia<br />

Tel : + 603 2173 1188<br />

Fax : + 603 2173 1288<br />

Head of Internal Audit<br />

Chow Chee Yan<br />

(Profile as disclosed on page 36<br />

of this Annual Report)<br />

General Counsel<br />

Stephen John Mead<br />

(Profile as disclosed on page 36<br />

of this Annual Report)<br />

Head of Regulatory<br />

Yap Chong Ping<br />

Investor Relations<br />

Roselina Khong<br />

Tel : + 603 2330 7000<br />

Fax : + 603 2330 0555<br />

e-mail : ir@maxis.com.my<br />

Registered Office<br />

<strong>Maxis</strong> Berhad<br />

(Company No 867573-A)<br />

Level 18, Menara <strong>Maxis</strong><br />

Kuala Lumpur City Centre<br />

Off Jalan Ampang<br />

50088 Kuala Lumpur<br />

Malaysia<br />

Tel : + 603 2330 7000<br />

Fax : + 603 2330 0590<br />

Website : www.maxis.com.my<br />

Share Registrar<br />

Symphony Share Registrars Sdn Bhd<br />

Level 6, Symphony House<br />

Block D13, Pusat Dagangan Dana 1<br />

Jalan PJU 1A/46<br />

47301 Petaling Jaya<br />

Selangor<br />

Tel : + 603 7841 8000<br />

Fax : + 603 7841 8008<br />

Stock Exchange Listing<br />

Main Market of Bursa Malaysia<br />

Securities Berhad<br />

Listed since 19 November 2009<br />

Stock Code : 6012<br />

Enquiries/Assistance pertaining<br />

to matters relating to the<br />

Third Annual General Meeting<br />

Toll Free Number : 1800 828 001<br />

e-mail : agm2012@maxis.com.my<br />

(valid from 2 May 2012 to 8 June 2012)

8<br />

Introduction<br />

INVESTOR<br />

RELATIONS<br />

Commitment to Shareholders<br />

As a leading communications service<br />

provider in Malaysia, <strong>Maxis</strong> is committed<br />

to creating value for its shareholders,<br />

and its strategic achievements and<br />

directions for value creation are outlined<br />

in the CEO’s statement. In addition,<br />

<strong>Maxis</strong> is committed to returning value<br />

to shareholders via a dividend policy of<br />

active capital management (see section<br />

on Dividend Policy).<br />

Since its listing in November 2009, <strong>Maxis</strong><br />

has declared interim dividends on a<br />

quarterly basis, and a final dividend in<br />

each financial year, thus providing cash<br />

returns to shareholders on a regular basis.<br />

For 2011, <strong>Maxis</strong> has declared/<br />

recommended dividends totaling<br />

RM3.0 billion (40.0 sen/share) to our<br />

shareholders, comprising:<br />

• four interim dividends of RM600<br />

million (8.0 sen/share) per quarter<br />

totaling RM2.4 billion (32.0 sen/<br />

share) for the year; and<br />

• a recommended final dividend of<br />

RM600 million (8.0 sen/share) subject<br />

to shareholders’ approval.<br />

The total represents a dividend yield<br />

of 7.3% based on the closing price of<br />

RM5.48 as at end of 2011.<br />

<strong>Maxis</strong> Share Price Performance – 1 January 2011 to 31 December 2011<br />

5.55<br />

5.50<br />

5.48<br />

5.45<br />

5.40<br />

5.35<br />

5.30<br />

Last Price 5.48<br />

High on 03/04/11 5.53<br />

Average 5.395<br />

Low on 10/10/11 5.19<br />

5.25<br />

5.20<br />

Volume 2.665M<br />

10M<br />

5M<br />

2.665M<br />

Jan<br />

Feb<br />

Mar<br />

Apr<br />

May<br />

Jun<br />

2011<br />

Jul<br />

Aug<br />

Sep<br />

Oct<br />

Nov<br />

Dec<br />

20<br />

0

MAXIS BERHAD<br />

ANNUAL REPORT 2011<br />

9<br />

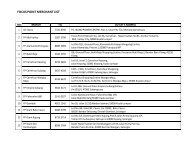

2011 2010 2009<br />

Dividends (RM’m) Interims 2,400 2,400 900<br />

Final 600 600 225<br />

Total 3,000 3,000 1,125<br />

Dividend Per Share (sen) Interims 32.0 32.0 12.0<br />

Final 8.0 8.0 3.0<br />

Total 40.0 40.0 15.0<br />

Earnings Per Share (sen) 33.7 30.6 n/m<br />

Payout Ratio 118.7% 130.7% n/m<br />

Dividend Yield 7.3% 7.5% n/m<br />

Dividend Policy<br />

Our full dividend policy, as stated in our<br />

IPO Prospectus dated 28 October 2009, is<br />

reproduced below for your reference:<br />

“The declaration of interim dividends and<br />

the recommendation of final dividends<br />

are subject to the discretion of the Board<br />

and any final dividend for the year is<br />

subject to shareholders’ approval. It is the<br />

Company’s intention to pay dividends to<br />

shareholders in the future. However, such<br />

payments will depend upon a number<br />

of factors, including <strong>Maxis</strong>’ earnings,<br />

capital requirements, general financial<br />

conditions, the Company’s distributable<br />

reserves and other factors considered<br />

relevant by the Board.<br />

The Company has proposed to adopt<br />

a dividend policy of active capital<br />

management, and proposes to pay<br />

dividends out of cash generated by its<br />

operations after setting aside necessary<br />

funding for network expansion and<br />

improvement and working capital needs.<br />

As part of this policy, the Company<br />

targets a payout ratio of not less than<br />

75% of its consolidated Profit After Tax<br />

under Malaysian GAAP in each calendar<br />

year beginning financial year ending<br />

31 December 2010, subject to the<br />

confirmation of the Board and to any<br />

applicable law, licence and contractual<br />

obligations and provided that such<br />

distribution would not be detrimental to<br />

its cash needs or to any plans approved<br />

by its Board. Investors should note that<br />

this dividend policy merely describes<br />

the Company’s present intention and<br />

shall not constitute legally binding<br />

statements in respect of the Company’s<br />

future dividends which are subject to<br />

modification (including reduction or<br />

non-declaration thereof) at the Board’s<br />

discretion.<br />

As the Company is a holding company,<br />

its income, and therefore its ability<br />

to pay dividends, is dependent upon<br />

the dividends and other distributions<br />

that it receives from its subsidiaries.<br />

The payment of dividends or other<br />

distributions by the Company’s<br />

subsidiaries will depend upon their<br />

operating results, financial condition,<br />

capital expenditure plans and other<br />

factors that either respective boards of<br />

directors deem relevant. Dividends may<br />

only be paid out of distributable reserves.<br />

In addition, covenants in the loan<br />

agreements, if any, for the Company’s<br />

subsidiaries may limit their ability to<br />

declare or pay cash dividends.”<br />

Notwithstanding the above, the payout<br />

ratios for 2010 and 2011 were 131%<br />

and 119% respectively.

10<br />

Introduction<br />

INVESTOR<br />

RELATIONS<br />

Continued<br />

Investor Engagement<br />

<strong>Maxis</strong> engages proactively and regularly<br />

with the investment community to share<br />

our strategy and vision and to discuss<br />

our operations, business and financial<br />

performance, whilst ensuring timely and<br />

fair dissemination of information. We<br />

value the relationship we have with our<br />

investors and communication with them<br />

is of primary importance to us.<br />

The key spokespersons and representatives<br />

for Investor Relations of the Company are<br />

the Chief Executive Officer and the Chief<br />

Financial Officer (see Board of Directors<br />

Profile and Senior Management Profile<br />

for their biographies) who engage with<br />

research analysts and institutional investors<br />

directly. From time to time, the Joint Chief<br />

Operating Officers also participate in these<br />

discussions. Such interaction is facilitated<br />

by an Investor Relations unit.<br />

We maintain ongoing dialogue with<br />

the investment community through<br />

a programme of Investor Relations<br />

activities. Some of these activities are<br />

described below.<br />

Announcement of Quarterly<br />

Financial Results<br />

Each quarter, our financial results are<br />

released publicly through announcements<br />

to Bursa Securities. These announcements<br />

contain detailed financial statements,<br />

summary of financial and operational<br />

indicators and an analysis of performance.<br />

Following this release, a media briefing is<br />

held to update members of the press and<br />

other media and to provide clarification<br />

on questions which they may have. In<br />

addition to this, a conference call is held<br />

for analysts who are based in Malaysia or<br />

abroad.<br />

The media briefing is usually led by the<br />

Chairman and analyst conference call<br />

by the CEO. For both events, the Joint<br />

COOs, CFO and other members of<br />

senior management are in attendance,<br />

reflecting the commitment to providing<br />

a high degree of clarity to the public and<br />

investment community.<br />

The presentation material for the<br />

media briefing and analyst call<br />

is simultaneously made available<br />

publicly on the <strong>Maxis</strong> website. In the<br />

presentation material, financial and<br />

operational indicators relating to the<br />

quarterly results are depicted primarily in<br />

graphical form, with messages in point<br />

form, to facilitate ease of understanding<br />

and analysis.

MAXIS BERHAD<br />

ANNUAL REPORT 2011<br />

11<br />

Meetings, Conferences and<br />

Roadshows<br />

<strong>Maxis</strong> continues to attract strong interest<br />

from both the local and international<br />

investment communities.<br />

In order to maintain regular contact<br />

and interaction with these parties, we<br />

engage in a variety of investor relations<br />

activities in addition to meetings with<br />

investors and analysts at our offices.<br />

These activities include participation<br />

in major investment conferences, both<br />

locally and in the region. In 2011, <strong>Maxis</strong><br />

attended the annual Credit Suisse<br />

Asian Investment Conference in Hong<br />

Kong and the annual Invest Malaysia<br />

conference in Kuala Lumpur. We also<br />

held group briefings for local fund<br />

managers, and undertook a non-deal<br />

roadshow covering the major financial<br />

market centres of Singapore, Hong Kong<br />

and London. These events provide an<br />

excellent opportunity to maintain regular<br />

contact with shareholders, to reach<br />

potential investors and to build rapport<br />

with international investors.<br />

Website<br />

Our corporate website has a section on<br />

Investor Relations which provides relevant<br />

information of interest to investors such<br />

as announcements to Bursa Securities,<br />

financial results, presentation materials<br />

and annual reports. In addition, a list<br />

of press releases may be found in the<br />

adjacent Media Centre section of the<br />

website.<br />

Feedback and Enquiries<br />

As part of our continuing improvement<br />

process, we welcome feedback on our<br />

Investor Relations endeavours<br />

and information provided, in order<br />

to further improve our interaction<br />

with the investment community.<br />

In this respect investors with useful<br />

suggestions, requests or clarification<br />

required are encouraged to contact<br />

us at ir@maxis.com.my. We look<br />

forward to the continued engagement.<br />

WE VALUE THE<br />

RELATIONSHIP<br />

WE HAVE<br />

WITH OUR<br />

INVESTORS AND<br />

COMMUNICATION<br />

WITH THEM IS<br />

OF PRIMARY<br />

IMPORTANCE<br />

TO US

12<br />

Introduction<br />

AWARDS AND<br />

RECOGNITION<br />

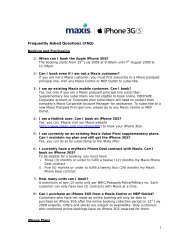

(L) Nasution Mohamed,<br />

<strong>Maxis</strong> Chief Financial<br />

Officer receiving the Best<br />

CFO Award (2nd Runner-<br />

Up) at FinanceAsia’s Best<br />

Companies Award 2011.<br />

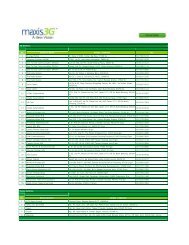

Awards and Recognition (2011)<br />

Frost & Sullivan<br />

Malaysia Excellence Awards 2011<br />

Mobile Service Provider of the Year<br />

FinanceAsia’s Best Companies<br />

2011 (Malaysia)<br />

Best Managed Company – 3rd<br />

Best Corporate Governance – 4th<br />

Best Investor Relations – 3rd<br />

Best Corporate Social Responsibility – 3rd<br />

Most Committed to a Strong Dividend<br />

Policy – 4th<br />

UDC Business Awards 2011<br />

UDC Asia Best Telecommunications<br />

Company of the Year 2011 (Malaysia)<br />

Malaysia 1000<br />

Certificate of Excellence<br />

Industry Excellence Awards<br />

Telecommunications Sector<br />

2010/2011<br />

BASIS Publications House and Bernama<br />

Putra Brand Awards 2011<br />

The People’s Choice (all categories)<br />

Brand of the Year<br />

Gold Award<br />

Communication Networks Category<br />

PC.com Product Awards 2010<br />

Best Postpaid Telco<br />

Best CSR<br />

PIKOM<br />

ICT Leadership Awards 2011<br />

Member Excellence Award<br />

Global Telecoms Business (GTB)<br />

Power 100 List<br />

Sandip Das, Chief Executive Officer,<br />

<strong>Maxis</strong> Berhad<br />

BCI Asia<br />

Business Continuity Awards<br />

Group Excellence in Business Continuity<br />

Management 2011<br />

Business Continuity Planning Asia Pte Ltd<br />

2nd Top Team 50 Enterprise<br />

Awards Malaysia 2011<br />

Honorary Award<br />

Malaysia Entrepreneurs’ Association<br />

(Persatuan Usahawan Maju Malaysia-<br />

PUMM)<br />

12th CCAM Excellence Awards 2011<br />

Gold Awards<br />

Best In-House Inbound Contact Centre<br />

(above 100 seats) in Malaysia<br />

Best In-House Outbound Contact Centre<br />

(below 100 seats) in Malaysia<br />

Best CRM Programme<br />

Best Social Media Programme in<br />

Contact Centre<br />

Prestige Award in Corporate Social<br />

Responsibility<br />

Best Manager (above 100 seats)<br />

Silver Awards<br />

Best People Contact Centre<br />

Best Manager (above 100 seats)<br />

Best Contact Centre Support Professional<br />

Best Telemarketer<br />

Bronze Awards<br />

Best Green Contact Centre<br />

Most Creative Contact Centre<br />

Best Process Excellence<br />

Best Telemarketer<br />

Best Contact Centre Professional<br />

Global Telecoms Business (GTB)<br />

Innovation Awards 2011<br />

SMS Network Innovation<br />

Winner: <strong>Maxis</strong> with Acision<br />

Missed SMS Notification Service<br />

Game Axis Malaysia Survey 2010<br />

Editor’s Choice Awards<br />

Favourite Mobile Game<br />

Telecommunications Provider<br />

Asia’s Best Employer Brand Awards<br />

By Employer Branding Institute of<br />

Singapore<br />

Malaysia’s 100 Leading Graduate<br />

Employers 2011<br />

Most Popular Graduate Employer Finalist<br />

Telecommunications

MAXIS BERHAD<br />

ANNUAL REPORT 2011<br />

13<br />

The company was also<br />

awarded the coveted<br />

Mobile Service Provider of<br />

the Year award at the 2011<br />

Frost & Sullivan Malaysia<br />

Excellence Awards. It was<br />

the third time that <strong>Maxis</strong><br />

had been conferred the<br />

prestigious award.<br />

Awards and Recognition (2010)<br />

Awards and Recognition (2009)<br />

World Communications<br />

Awards 2010<br />

Top Five Best Mobile Operators<br />

Corporate Nationhood Initiatives<br />

Award 2010<br />

By The New Straits Times<br />

Reader’s Digest Trusted<br />

Brand Awards<br />

Phone Service (Fixed Line/Mobile)<br />

KLIFF Islamic Finance Awards 2010<br />

Most Outstanding Islamic Finance Product<br />

– <strong>Maxis</strong> Islamic IPO US$3.3 billion<br />

CMO Asia Awards for Excellence<br />

in Branding and Marketing<br />

Asia’s Best Brand 2010<br />

“thebrandlaureate” The Grammy<br />

Awards for Branding<br />

Specialty Awards Best Brands in Brand<br />

Communications 2009 – 2010<br />

11th CCAM Excellence<br />

Awards 2010<br />

Gold Awards<br />

Best In-House Contact Centre<br />

(above 100 seats) in Malaysia<br />

Best CRM Programme Implementation<br />

in Malaysia<br />

Silver Awards<br />

Mystery Shopper Results, In-House<br />

Contact Centre<br />

Best Contact Centre Professional<br />

(above 100 seats)<br />

Bronze Awards<br />

Best Contact Centre Team Leader<br />

Best Contact Centre Professional<br />

(over 100 seats)<br />

Best Contact Centre Support Professional<br />

(over 100 seats)<br />

11th CCAM Prestige Awards 2010<br />

Corporate Social Responsibility Award<br />

Computerworld Malaysia’s 4th<br />

Customer Care Awards 2010<br />

Telecommunications Services<br />

South East Asia HR<br />

Excellence Awards<br />

Employer of the Year 2010<br />

Malaysian HR Awards 2010<br />

Gold Award – HR Innovation Category<br />

Malaysia’s 100 Leading Graduate<br />

Employers 2010<br />

Most Popular Graduate Employer<br />

(Telecommunications)<br />

Asia HRD Congress 2010<br />

Contribution to HR Community Award<br />

for Outstanding Contribution Towards<br />

Human Capital Development<br />

2009 FinanceAsia<br />

Achievement Awards<br />

Deal of the Year<br />

Best Malaysia Deal<br />

Best Equity Deal<br />

IFR Asia 2009 Roll of Honour<br />

Malaysia Capital Markets Deal<br />

– <strong>Maxis</strong>’ RM11.2 billion IPO<br />

Frost & Sullivan Malaysia<br />

Telecoms Awards 2009<br />

Mobile Data Service Provider of the Year<br />

PC.com Power Brand 2009<br />

Top Ten Tech Brands<br />

10th PC.com Product Awards 2009<br />

Best Postpaid Telco<br />

Best Mobile Content<br />

Special CSR Award<br />

Brand Finance Awards 2009<br />

No 4 Brand in Malaysia<br />

Reader’s Digest Trusted Brand<br />

Awards 2009<br />

Brand of Choice – Phone Service (Fixed<br />

Line/Mobile)

14<br />

Introduction<br />

MILESTONES<br />

13 January 2011<br />

<strong>Maxis</strong> honoured with Corporate<br />

Nationhood Initiatives Award<br />

<strong>Maxis</strong> was conferred the Corporate<br />

Nationhood Initiatives Award for 2010, in<br />

recognition of its contribution to national<br />

unity, integration and 1Malaysia.<br />

17 January 2011<br />

<strong>Maxis</strong> was Presenting Sponsor of<br />

MRCA 8TV 2011 Entrepreneur Awards<br />

The 2011 MRCA 8TV Entrepreneur<br />

Awards welcomed <strong>Maxis</strong> as presenting<br />

sponsor at the awards night graced<br />

by Yang Berhormat Dato’ Saifuddin<br />

Abdullah, Deputy Minister of Higher<br />

Education.<br />

25 January 2011<br />

<strong>Maxis</strong> celebrated Mobile Content<br />

Challenge Entrepreneurs<br />

<strong>Maxis</strong> hosted Mobile Content Challenge<br />

entrepreneurs who had successfully<br />

commercialised their content,<br />

applications, or services, or who had<br />

started new business ventures.<br />

YB Dato’ Joseph Salang, Deputy Minister<br />

of Information Communication and<br />

Culture officiated at the event.<br />

7 February 2011<br />

<strong>Maxis</strong> launched Managed M2M<br />

<strong>Maxis</strong> introduced <strong>Maxis</strong>’ Managed M2M<br />

(Machine-to-Machine), the country’s<br />

first managed wireless M2M service. The<br />

launch was officiated by Ms Ng Wan<br />

Peng, Chief Operating Officer of the<br />

Multimedia Development Corporation<br />

(MDeC).<br />

11 February 2011<br />

<strong>Maxis</strong> launched new Movies<br />

Applications and <strong>Maxis</strong> Movie Day<br />

<strong>Maxis</strong> launched a new <strong>Maxis</strong> Movies<br />

Application that is integrated with<br />

PayPal’s mobile payment service, and the<br />

Buy-1-Get-1 Free movie ticket offer every<br />

<strong>Maxis</strong> Movie Day (every Tuesday), on<br />

movies screened after 6.00pm.<br />

25 February 2011<br />

<strong>Maxis</strong> won Best Postpaid Telco and<br />

Best CSR Award at PC.com Awards<br />

2011<br />

<strong>Maxis</strong> walked away with the Best<br />

Postpaid Telco and Best CSR awards at<br />

the PC.com Awards Night 2011. This is<br />

the sixth year in a row that <strong>Maxis</strong> has<br />

been named Best Postpaid Telco by the<br />

awards organiser.<br />

11 March 2011<br />

<strong>Maxis</strong> won top awards at the 2011<br />

Putra Brand Awards<br />

<strong>Maxis</strong> was named the Putra Brand of the<br />

Year at the 2011 Putra Brand Awards.<br />

<strong>Maxis</strong> also received the Gold award in the<br />

Communications Network Category for<br />

the second year in a row.<br />

15 March 2011<br />

<strong>Maxis</strong> first to introduce GPRS Data<br />

Roaming Service for prepaid users<br />

<strong>Maxis</strong> Hotlink customers were the first<br />

prepaid customers in Malaysia to enjoy<br />

GPRS Data Roaming. The service allowed<br />

outbound prepaid users to use mobile<br />

data while roaming internationally.<br />

16 March 2011<br />

Easy Top-Ups and Easy Rewards<br />

Anywhere, Anytime<br />

<strong>Maxis</strong>’ new self-service Hotlink iChannels<br />

was introduced for customers looking<br />

for an easier way to top up their Hotlink<br />

prepaid accounts. <strong>Maxis</strong>’ Mobile2Top-Up<br />

enables customers to use any Malaysianissued<br />

Visa or Mastercard, prepaid, credit<br />

and debit cards to pay for top-ups.<br />

18 March 2011<br />

<strong>Maxis</strong> customers first to enjoy the<br />

Google Nexus S<br />

<strong>Maxis</strong> customers were the first to enjoy<br />

the revolutionary Android device, the<br />

Google Nexus S, also known as the<br />

“Google Phone”.<br />

31 March 2011<br />

<strong>Maxis</strong> scored a first in multiple-play<br />

<strong>Maxis</strong> launched the first multiple-play<br />

service in Malaysia with <strong>Maxis</strong> Home<br />

Services. Dato’ Joseph Salang, Deputy<br />

Minister of Information Communication<br />

and Culture, officiated at the launch.

MAXIS BERHAD<br />

ANNUAL REPORT 2011<br />

15<br />

1 April 2011<br />

<strong>Maxis</strong> kicked off new decade of<br />

Golf Rewards<br />

<strong>Maxis</strong> launched the <strong>Maxis</strong> Team Golf<br />

Tour (MTGT) 2011, Malaysia’s biggest<br />

and most prestigious amateur team<br />

golf event. The grand final was held in<br />

Thailand at two of the top golf courses<br />

in the country - the well-known Siam<br />

Country Club and the Jack Nicklausdesigned<br />

Laem Chabang International<br />

Country Club.<br />

5 April 2011<br />

Malaysian Universities chose <strong>Maxis</strong><br />

as their Integrated Communications<br />

Service Partner<br />

<strong>Maxis</strong> launched the <strong>Maxis</strong> Integrated<br />

Partner in Education (MIPE) programme,<br />

a fully-integrated communications<br />

suite of solutions to enrich campus<br />

life by providing quality broadband<br />

connectivity and services; internship and<br />

entrepreneurial opportunities; as well as<br />

preferential rates for smart devices.<br />

8 April 2011<br />

Dunia Internetmu from <strong>Maxis</strong><br />

empowered Malaysians with Internet<br />

offerings across multiple screens<br />

<strong>Maxis</strong> launched Dunia Internetmu, an<br />

initiative empowering Malaysians through<br />

access to relevant, reliable and secure<br />

local content that is aggregated on a<br />

single URL via myLaunchpad on their<br />

mobile devices and the web.<br />

14 April 2011<br />

<strong>Maxis</strong> won coveted Mobile Service<br />

Provider of The Year award at the<br />

2011 Frost & Sullivan Malaysia<br />

Excellence Awards<br />

<strong>Maxis</strong> was declared the Mobile Service<br />

Provider of the Year at the 2011 Frost<br />

& Sullivan Malaysia Excellence Awards.<br />

Sandip Das, Chief Executive Officer of<br />

<strong>Maxis</strong>, received the award from the<br />

Secretary-General of the Ministry of<br />

International Trade and Industry, Datuk<br />

Dr Rebecca Fatima Sta Maria.<br />

14 April 2011<br />

<strong>Maxis</strong> extended 3G leadership to<br />

80% of the country’s population<br />

<strong>Maxis</strong> announced a major milestone in<br />

the Malaysian broadband industry when<br />

it became the first service provider to<br />

surpass 5,000 sites spanning Peninsular<br />

Malaysia, Sabah and Sarawak.<br />

19 April 2011<br />

<strong>Maxis</strong> presented <strong>Maxis</strong> Scholarship<br />

for Excellence Awards<br />

<strong>Maxis</strong> presented 21 brilliant young<br />

Malaysians with the <strong>Maxis</strong> Scholarship<br />

for Excellence Awards (MSEA). These<br />

students will pursue undergraduate<br />

programmes locally and abroad.<br />

27 April 2011<br />

KSL Properties and <strong>Maxis</strong> to provide<br />

Integrated End-to-End High-Speed<br />

Broadband Solutions in Johor<br />

More customers in Johor Bahru will be<br />

able to experience high-speed internet<br />

in 2012 following an agreement signed<br />

between <strong>Maxis</strong> and KSL Properties.<br />

TOP<br />

<strong>Maxis</strong> received the<br />

Corporate Nationhood<br />

Initiatives Award for its<br />

contribution to national<br />

unity and integration.<br />

BELOW<br />

<strong>Maxis</strong> celebrated<br />

technopreneurs from its<br />

Mobile Content Challenge<br />

programme who had<br />

successfully commercialised<br />

their content, applications<br />

and services. Dato’<br />

Joseph Salang, Deputy<br />

Minister of Information<br />

Communication and<br />

Culture graced the event.

16<br />

Introduction<br />

MILESTONES<br />

Continued<br />

11 May 2011<br />

<strong>Maxis</strong> customers benefit from<br />

Data and Device Protection with<br />

<strong>Maxis</strong> Secure<br />

<strong>Maxis</strong> launched its <strong>Maxis</strong> Secure initiative<br />

which offers a suite of services including<br />

<strong>Maxis</strong> Anti-Theft, Complete Phone Back<br />

Up, Anti-Virus, Internet Security and<br />

Remote Surveillance services.<br />

19 May 2011<br />

<strong>Maxis</strong> Employees benefit from<br />

Wellness Programme<br />

<strong>Maxis</strong> launched a complete, customised<br />

wellness programme entitled “My<br />

Wellness, My Choice” to ensure a<br />

sustainable lifestyle for over 3,400 of its<br />

employees nationwide.<br />

7 June 2011<br />

<strong>Maxis</strong> won 2011 Global Telecoms<br />

Business Innovation Award<br />

<strong>Maxis</strong> Berhad received the prestigious<br />

2011 Global Telecoms Business (GTB)<br />

Innovation Award for its Missed SMS<br />

Notification Service, developed with its<br />

partner Acision.<br />

14 June 2011<br />

<strong>Maxis</strong> Customers in Kuantan enjoy<br />

fastest Wireless Broadband speed<br />

<strong>Maxis</strong> was declared the “speed king”<br />

by leading publication Mobile World for<br />

its broadband speed. Road tests were<br />

carried out in three different locations in<br />

Kuantan and results showed that <strong>Maxis</strong><br />

broadband users in Kuantan enjoyed<br />

download speeds of up to 4 to 5 Mbps<br />

on the <strong>Maxis</strong> network.<br />

21 June 2011<br />

<strong>Maxis</strong> Customers in Johor Bahru<br />

enjoy Fastest Wireless Broadband<br />

Speed<br />

Mobile World confirmed that Johor<br />

Bahru customers enjoyed the fastest<br />

broadband speeds with <strong>Maxis</strong>. Road tests<br />

were carried out in different locations in<br />

Johor Bahru and results showed <strong>Maxis</strong><br />

customers experienced browsing speeds<br />

of between 2 Mbps and 3 Mbps.<br />

28 June 2011<br />

<strong>Maxis</strong> Cyberkids Camp reached<br />

out to the Sabah community with<br />

Sustainable E-education<br />

<strong>Maxis</strong> took its award-winning <strong>Maxis</strong><br />

Cyberkids corporate responsibility<br />

programme to Kampung Moyog in<br />

Sabah, training children and parents on<br />

the use of internet applications.<br />

2 July 2011<br />

<strong>Maxis</strong> Community Training<br />

Programmes<br />

<strong>Maxis</strong> reinforced its commitment to local<br />

communities by organising technologybased<br />

training programmes in Kampung<br />

Chennah and Kuala Klawang in Negeri<br />

Sembilan to complement the WiFi<br />

service in the area. YB Dato’ Seri Utama<br />

Dr Rais Yatim, Minister of Information<br />

Communication and Culture, presented<br />

certificates to participants and launched<br />

blogs which they created as part of the<br />

programme.<br />

6 July 2011<br />

<strong>Maxis</strong> nurtures a new generation of<br />

world-class Malaysian athletes<br />

<strong>Maxis</strong> signed up seven Malaysian Sports<br />

Ambassadors as part of its continued<br />

commitment to nurturing the country’s<br />

best and most dedicated athletes.<br />

15 July 2011<br />

<strong>Maxis</strong> introduced the BlackBerry<br />

Playbook<br />

<strong>Maxis</strong> launched the most powerful ultraportable<br />

tablet to hit Malaysian shores at<br />

an exclusive “by invitation only” event for<br />

300 members of the media and selected<br />

customers.<br />

27 July 2011<br />

<strong>Maxis</strong> mZakat Services for Muslim<br />

customers during Ramadhan<br />

<strong>Maxis</strong>’ Muslim customers enjoyed the<br />

convenience of being able to pay Zakat<br />

Fitrah via SMS in Selangor, Melaka,<br />

Sabah, Kedah, Perlis, Pahang and<br />

Terengganu thanks to <strong>Maxis</strong>’ mZakat<br />

services. <strong>Maxis</strong> mZakat service is open to<br />

both postpaid and prepaid customers.<br />

2 August 2011<br />

<strong>Maxis</strong> won Asia’s Best Employer<br />

Brand Award for the second time<br />

<strong>Maxis</strong> was declared Asia’s Best Employer<br />

at the second Asia’s Best Employer<br />

Brand Awards, hosted by the Employer<br />

Branding Institute of Singapore.

MAXIS BERHAD<br />

ANNUAL REPORT 2011<br />

17<br />

9 August 2011<br />

<strong>Maxis</strong> and Alcatel-Lucent deployed<br />

First 100G Core Transmission Network<br />

in Asia Pacific<br />

<strong>Maxis</strong> with Alcatel-Lucent undertook<br />

a major transformation of <strong>Maxis</strong>’<br />

core transmission network to cope<br />

with increased data traffic, simplify<br />

its network, and reduce costs while<br />

providing higher efficiency and<br />

robustness.<br />

22 August 2011<br />

<strong>Maxis</strong> launched Malaysia’s most<br />

advanced Cloud Computing Services<br />

<strong>Maxis</strong> launched <strong>Maxis</strong> Cloud, the most<br />

advanced on-demand, real-time, fully<br />

managed cloud service in Malaysia,<br />

accessible via the country’s highest-speed<br />

business broadband.<br />

23 August 2011<br />

<strong>Maxis</strong> reinforced its commitment to<br />

nurturing Malaysian talent<br />

<strong>Maxis</strong> presented <strong>Maxis</strong> Scholarship<br />

for Excellence Awards (MSEA) to 30<br />

outstanding young Malaysians for<br />

postgraduate and undergraduate studies<br />

at universities of their choice, locally and<br />

overseas.<br />

8 September 2011<br />

Easy connectivity for<br />

Malaysian pilgrims<br />

<strong>Maxis</strong> introduced a special Saudi Telecom<br />

Company (STC) SIM card which enabled<br />

pilgrims performing the Haj to make<br />

or receive calls and SMS within Saudi<br />

Arabia at local rates. With assistance<br />

from Tabung Haji, 17,000 SIM cards were<br />

distributed free of charge.<br />

9 September 2011<br />

<strong>Maxis</strong> enhanced distribution<br />

channels in Sabah<br />

About 150,000 residents in the East<br />

Coast of Sabah were able to enjoy the<br />

full suite of <strong>Maxis</strong> services with the<br />

opening of the new <strong>Maxis</strong> Centre in<br />

Sandakan, the first store built to serve<br />

customers in the East Coast of Sabah.<br />

22 September 2011<br />

<strong>Maxis</strong> swept seven awards at<br />

FinanceAsia’s Best Managed<br />

Companies Awards Ceremony<br />

<strong>Maxis</strong> Chief Executive Officer, Sandip<br />

Das and Chief Financial Officer, Nasution<br />

Mohamed, each ranked amongst the<br />

top three in the Best CEO and Best CFO<br />

categories in the 2011 awards. The<br />

Company was also voted into the top ranks<br />

of Malaysia’s Best Managed Companies;<br />

and won awards for Most Committed<br />

to Dividend Policy, Best Corporate<br />

Governance, Best Investor Relations and<br />

Best Corporate Social Responsibility.<br />

TOP<br />

Mark Dioguardi, <strong>Maxis</strong><br />

Joint Chief Operating<br />

Officer, and Mohd Fazlin<br />

Shah Bin Mohd Salleh,<br />

President and Managing<br />

Director of Alcatel-Lucent<br />

Malaysia, marked the<br />

roll-out of the <strong>Maxis</strong> optical<br />

backbone network, the first<br />

100G single carrier with<br />

optical coherent technology<br />

system commercially<br />

deployed in Asia-Pacific.<br />

BELOW<br />

<strong>Maxis</strong> reached out to East<br />

Malaysian communities with<br />

sustainable e-education<br />

programmes. Children and<br />

parents were trained in the<br />

use of Internet applications,<br />

at Kampung Moyog in Sabah.

18<br />

Introduction<br />

MILESTONES<br />

Continued<br />

23 September 2011<br />

<strong>Maxis</strong> employees celebrated Hari<br />

Raya with over 180 children and<br />

senior citizens<br />

More than 180 underprivileged children<br />

and senior citizens were given a special<br />

Hari Raya treat by employees of <strong>Maxis</strong><br />

at the KLCC Convention Centre, Kuala<br />

Lumpur.<br />

25 September 2011<br />

<strong>Maxis</strong> staff planted 7,500 trees<br />

As part of an initiative to offset its carbon<br />

footprint, <strong>Maxis</strong> staff took part in a<br />

tree-planting programme at the Sungai<br />

Renggam River Bank in Shah Alam,<br />

organised by Majlis Bandaraya Shah Alam<br />

(MBSA), Jabatan Pengairan dan Saliran<br />

(JPS), Sathya Sai Organisation, Forest<br />

Research Institute Malaysia (FRIM) and<br />

the Forestry Department of Selangor.<br />

18 October 2011<br />

Battle of The Sexes makes it to the<br />

world’s top Five<br />

<strong>Maxis</strong> revealed that membership to its<br />

homegrown social networking initiative,<br />

Battle of the Sexes, has spiralled to 1.5<br />

million Malaysians since its inception in<br />

2009. The social networking programme<br />

also gained accolades from two global<br />

innovation awards bodies in 2011,<br />

ranking in each case within the top five,<br />

and was selected as a Finalist for Best<br />

Social Media service at the Meffys mobile<br />

content awards 2011.<br />

19 October 2011<br />

<strong>Maxis</strong> recognised for Exceptional<br />

Customer Service<br />

<strong>Maxis</strong> swept 15 awards at the 12th<br />

Customer Relationship Management<br />

and Contact Centre Association (CCAM)<br />

Annual Awards. It won Gold in the<br />

biggest and most coveted award of<br />

the night - the Best In-house Inbound<br />

Contact Centre above 100 seats, as well<br />

as in Best In-House Outbound Contact<br />

Centre below 100 seats (Sales), Best<br />

CRM Programme, Best Social Media<br />

Programme in Contact Centre and the<br />

Prestige Award for Corporate Social<br />

Responsibility (CSR).<br />

20 October 2011<br />

<strong>Maxis</strong> launched its Home Wireless<br />

Internet service<br />

<strong>Maxis</strong> launched its Home Wireless<br />

Internet service on its 3G/HSPA network.<br />

The Home Wireless Internet service<br />

enables customers to set up a WiFi<br />

spot anywhere in their home for family<br />

sharing, allowing for seamless internet<br />

connectivity.<br />

21 October 2011<br />

<strong>Maxis</strong> and U Mobile in Malaysia’s<br />

First Active 3G Radio Access Network<br />

Sharing Agreement<br />

<strong>Maxis</strong> and U Mobile entered into a<br />

landmark agreement to share <strong>Maxis</strong>’ 3G<br />

radio access networks (RAN), the first<br />

active 3G RAN sharing arrangement to<br />

be deployed in Malaysia. The agreement<br />

incorporates LTE sharing which will<br />

deliver even better benefits to customers.<br />

27 October 2011<br />

<strong>Maxis</strong> and KiddyTrack to bring<br />

Malaysian parents a Unique Child<br />

Locator Solution<br />

<strong>Maxis</strong> announced its official partnership<br />

with KiddyTrack in the launch of the<br />

first-of-its-kind child locator solution.<br />

This innovative GPS/GSM application is<br />

powered by <strong>Maxis</strong>’ Managed Machineto-Machine<br />

(M2M) technology, allowing<br />

users to locate their children or loved<br />

ones by sending a simple SMS.<br />

16 November 2011<br />

<strong>Maxis</strong> partnered MEASAT to provide<br />

High-Speed, Satellite Broadband<br />

Connectivity to customers across<br />

Malaysia<br />

<strong>Maxis</strong> signed on as anchor partner for<br />

the MEASAT-5 satellite that is designed<br />

for high-speed communications over an<br />

Internet Protocol platform, facilitating<br />

two-way broadband connectivity,<br />

products and solutions. This will give<br />

<strong>Maxis</strong> customers a better broadband<br />

experience in terms of higher data<br />

rate, faster service deployment time<br />

and lower costs versus C-band satellite<br />

services.

MAXIS BERHAD<br />

ANNUAL REPORT 2011<br />

19<br />

17 November 2011<br />

Residents in Bandar Utama to enjoy<br />

seamless communication experiences<br />

with <strong>Maxis</strong> Home Services<br />

<strong>Maxis</strong> continued to strengthen its service<br />

offerings on the home front following<br />

a strategic alliance agreement signed<br />

between <strong>Maxis</strong> and BU One Management<br />

to provide Fibre-to-the-Home (FTTH)<br />

solutions for residents.<br />

21 November 2011<br />

Free online education service for<br />

2,300 secondary schools in Malaysia<br />

<strong>Maxis</strong> and the Ministry of Education<br />

(MOE) embarked on a smart partnership<br />

to increase ICT usage in schools through<br />

creative learning. <strong>Maxis</strong> provides free<br />

access to <strong>Maxis</strong>’ flagship education<br />

service leveraging on readily available<br />

school ICT infrastructure.<br />

23 November 2011<br />

<strong>Maxis</strong> celebrated Christmas with<br />

an underprivileged community<br />

in Sarawak<br />

<strong>Maxis</strong> employees treated 80 members of<br />

Sarawak’s underprivileged community to<br />

a special Christmas Party at the Sheraton<br />

Hotel in Kuching.<br />

25 November 2011<br />

<strong>Maxis</strong> Christmas Party for<br />

underprivileged in Sabah<br />

Christmas came early this year for about<br />

100 underprivileged people in Sabah who<br />

were given a special Christmas Party treat<br />

by <strong>Maxis</strong> employees at Sutera Harbour<br />

Resort in Kota Kinabalu.<br />

8 December 2011<br />

Brand new experiences at<br />

revamped <strong>Maxis</strong> Concept Store<br />

<strong>Maxis</strong> officially unveiled its concept store<br />

at The Gardens Mid Valley, incorporating<br />

a new touch and feel experience for its<br />

customers, including a new home and<br />

device corner, and the use of iPads to<br />

assist with customer enquiries or requests.<br />

16 December 2011<br />

<strong>Maxis</strong> brought the eagerly<br />

anticipated iPhone 4S to customers<br />

<strong>Maxis</strong> introduced the eagerly anticipated<br />

iPhone 4S to its customers in Kuala<br />

Lumpur, Johor Bahru, Penang, Kuantan,<br />

Kota Kinabalu and Kuching at the stroke<br />

of midnight, with a special launch event<br />

at the Kuala Lumpur Convention Centre.<br />

TOP<br />

<strong>Maxis</strong> was a partner of<br />

the Sahabat Korporat<br />

Tabung Haji programme,<br />

distributing 17,000 special<br />

STC SIM cards to pilgrims.<br />

At the partnership event<br />

were (L to R) Mariam Bevi<br />

binti Batcha, <strong>Maxis</strong> Head<br />

of Corporate Affairs;<br />

YBhg. Datuk Ismee Ismail,<br />

Chief Executive Officer<br />

of Lembaga Tabung Haji;<br />

YB Mejar Jeneral Dato’<br />

Seri Haji Jamil Khir bin<br />

Haji Baharom (B), Minister<br />

in the Prime Minister’s<br />

Department; and YBhg.<br />

Tan Sri Dato’ Sri Abi Musa<br />

Asa’ari bin Mohamed Nor,<br />

Chairman of Lembaga<br />

Tabung Haji.<br />

BELOW<br />

<strong>Maxis</strong> management<br />

members dressed up in<br />

their home attire to launch<br />

its Home Wireless Internet<br />

Service. (L to R) Michael<br />

Raj Murty, <strong>Maxis</strong> Head of<br />

Northern Region; Harold<br />

Quek, <strong>Maxis</strong> Head of Home<br />

Products; Jeff Chong, <strong>Maxis</strong><br />

Head of Mobility Products<br />

and International Services.

20<br />

LITTLE MIRACLES<br />

We’ve brought the internet home as never before. Because<br />

that’s where “connectivity” truly belongs. As in sharing.<br />

Bridging generations. Building understanding. Seeing the joy<br />

on grandpa’s face when he created his first Facebook page.<br />

Reconnecting to a sense of wonder.<br />

NETWORK<br />

HOME<br />

ROAMING<br />

MOBILE INTERNET

MAXIS BERHAD<br />

ANNUAL REPORT 2011<br />

21<br />

CUSTOMERS FIRST<br />

LIFE SERVICES<br />

CLOUD<br />

DISTRIBUTION

22<br />

The Board of Directors and Senior Management<br />

BOARD OF<br />

DIRECTORS<br />

2<br />

1<br />

3 4<br />

1 Raja Tan Sri Dato’ Seri Arshad<br />

bin Raja Tun Uda<br />

Chairman/Independent<br />

Non-Executive Director<br />

2 Robert William Boyle<br />

Independent<br />

Non-Executive Director<br />

3 Dato’ Mokhzani bin Mahathir<br />

Independent<br />

Non-Executive Director<br />

4 Asgari bin Mohd<br />

Fuad Stephens<br />

Independent<br />

Non-Executive Director<br />

5 Ghassan Hasbani<br />

Non-Executive Director<br />

6 Dr Zeyad Thamer H. AlEtaibi<br />

Non-Executive Director<br />

7 Dr Fahad Hussain S. Mushayt<br />

Non-Executive Director<br />

8 Augustus Ralph Marshall<br />

Non-Executive Director<br />

9 Chan Chee Beng<br />

Non-Executive Director<br />

10 Sandip Das<br />

Chief Executive Officer<br />

Executive Director

MAXIS BERHAD<br />

ANNUAL REPORT 2011<br />

23<br />

5<br />

6 7<br />

8<br />

9 10

24<br />

The Board of Directors and Senior Management<br />

BOARD OF<br />

DIRECTORS<br />

PROFILES<br />

Raja Tan Sri Dato’ Seri Arshad bin Raja Tun Uda<br />

Chairman/Independent Non-Executive Director<br />

Raja Tan Sri Dato’ Seri Arshad bin Raja Tun Uda, aged 65,<br />

a Malaysian, was appointed as Chairman and Director of<br />

<strong>Maxis</strong> on 16 October 2009.<br />

He is presently a director of Khazanah Nasional Berhad,<br />

Yayasan DayaDiri and ACR Retakaful SEA Berhad. Raja Arshad<br />

is the chairman of Binariang GSM Sdn Bhd, Ekuiti Nasional<br />

Berhad, Yayasan Raja Muda Selangor and Yayasan Amir. He is<br />

also the Chancellor of University Selangor.<br />

He was formerly executive chairman and senior partner of<br />

PricewaterhouseCoopers (PwC), Malaysia, chairman of the<br />

Leadership Team of PwC Asia 7, and chairman of the Malaysian<br />

Accounting Standards Board and Danamodal Nasional Berhad.<br />

His previous international appointments include being a member<br />

of the PwC Global Leadership Team, the PwC Global IFRS<br />

Board and the Standards Advisory Council of the International<br />

Accounting Standards Board. His previous public appointments<br />

include being a member of the Securities Commission, the<br />

Malaysian Communications and Multimedia Commission, the<br />

Investment Panel of the Employees Provident Fund and the<br />

board of trustees of the National Art Gallery.<br />

He is a Fellow of the Institute of Chartered Accountants in<br />

England and Wales, and a member of the Malaysian Institute<br />

of Accountants. He is also a member of the Malaysian Institute<br />

of Certified Public Accountants and served on its council for 24<br />

years, including three years as its president.<br />

He sits as Chairman of the Nomination Committee.

MAXIS BERHAD<br />

ANNUAL REPORT 2011<br />

25<br />

Robert William Boyle<br />

Independent Non-Executive Director<br />

Dato’ Mokhzani bin Mahathir<br />

Independent Non-Executive Director<br />

Robert William Boyle, aged 64, a British citizen, was<br />

appointed as a Director of <strong>Maxis</strong> on 17 September 2009.<br />

He is a non-executive director of Witan Investment Trust plc,<br />

Centaur Media plc, Schroder AsiaPacific Fund plc and Prosperity<br />

Voskhod Limited, all London listed companies. Previously he<br />

was a senior partner of PwC in London, with experience in<br />

leading and participating in global teams on client and PwC<br />

projects, including chairing the PwC European Entertainment<br />

and Media and UK Telecommunications Groups. His expertise<br />

includes financial reporting, shareholder communications, risk<br />

management and corporate governance. During his career he<br />

has worked in France and Africa and been seconded to the UK<br />

civil service.<br />

He holds a Master of Arts in Law from Oxford and is a Fellow of<br />

the Institute of Chartered Accountants of England and Wales.<br />

He sits as Chairman of the Audit Committee and is a member of<br />

the Remuneration and Nomination Committees.<br />

Dato’ Mokhzani bin Mahathir, aged 51, a Malaysian, was<br />

appointed as a Director of <strong>Maxis</strong> on 16 October 2009.<br />

He began work in 1987 as a wellsite operations engineer with<br />

Sarawak Shell Berhad and resigned in 1989 to pursue business<br />

opportunities in Kuala Lumpur. By investing in Tongkah Holdings<br />

Berhad (listed on the then Kuala Lumpur Stock Exchange),<br />

he ventured into the component manufacturing, oil and gas,<br />

finance and healthcare sectors. He held positions as the group<br />

chief executive officer of Pantai Holdings Berhad (healthcare),<br />

chairman of THB Industries Berhad (electronics) and group<br />

executive chairman of Tongkah Holdings Berhad (oil and gas,<br />

finance). A divestment exercise in 2001 saw him relinquish all<br />

positions and equity in these companies. Presently his portfolio<br />

of investments includes businesses in IT, oil and gas support<br />

services, structural steel engineering and fabrication, automotive<br />

sector and property development. He is a director and group<br />

chief executive officer of Kencana Petroleum Berhad (Kencana),<br />

ranked as one of Malaysia’s top Oil & Gas support services<br />

companies. He sits on all Kencana main subsidiaries. Through<br />

his private holding company, Kencana Capital Sdn Bhd, he has<br />

investments in IT, property and other businesses. He also holds<br />

dealerships for Porsche automobiles in Malaysia. He is currently<br />

the chairman of Sepang International Circuit Sdn Bhd, which<br />

hosts the FIA Formula One World Championship and is a regular<br />

GT race car driver. He also serves as non-executive director on<br />

the Board of Opcom Holdings Berhad and a director of Royal<br />

Automotive Club of Malaysia.<br />

He is a qualified Petroleum Engineer. He pursued his tertiary<br />

education at the University of Tulsa, Oklahoma in the USA,<br />

where he graduated with a Bachelor of Science in Petroleum<br />

Engineering.<br />

He sits as Chairman of the Remuneration and Employee Share<br />

Option Scheme (ESOS) Committees and is a member of the<br />

Audit and Nomination Committees.

26<br />

The Board of Directors and Senior Management<br />

BOARD OF<br />

DIRECTORS<br />

PROFILES<br />

Continued<br />

Asgari bin Mohd Fuad Stephens<br />

Independent Non-Executive Director<br />

Ghassan Hasbani<br />

Non-Executive Director<br />

Asgari bin Mohd Fuad Stephens, aged 51, a Malaysian,<br />

was appointed as a Director of <strong>Maxis</strong> on 16 October 2009.<br />

He is a director and founding member of Intelligent Capital<br />

Sdn Bhd (Intelligent Capital) and an independent non-executive<br />

director of Mudajaya Group Berhad. He also serves as nonexecutive<br />

director on the boards of JayCorp Berhad and Privasia<br />

Technology Berhad. He has extensive experience in both public<br />

and private equity investing in Malaysia. He has been involved<br />

in several start-up companies as an angel investor and has been<br />

actively involved in building their businesses as mentor.<br />

Several of these companies have gone public. He started his<br />

career working in general management in companies involved<br />

in a wide range of industries. He joined Usaha Tegas Sdn Bhd<br />

(UTSB) in 1988 where he worked in various capacities. He<br />

left in 1990 to join the stockbroking industry. He returned to<br />

UTSB in 1992 before leaving in 1995 to co-found Kumpulan<br />

Sentiasa Cemerlang Sdn Bhd (KSC), an investment advisory<br />

and fund management group. He took a year off to work with<br />

the National Economic Action Council (NEAC) in 1998. After<br />

his period at the NEAC, he started two venture capital firms,<br />

Intelligent Capital and iSpring Venture Management Sdn Bhd,<br />

while continuing to work with KSC. He was previously the<br />

chairman of the Malaysian Venture Capital Association.<br />

He holds a Bachelor of Commerce (Honours) from the<br />

University of Melbourne in Australia and a Masters of Business<br />

Administration from Cranfield University in the UK.<br />

He is a member of the Audit, Remuneration and ESOS<br />

Committees.<br />

Ghassan Hasbani, aged 39, a British citizen, was appointed<br />

as a Director of <strong>Maxis</strong> on 25 September 2009.<br />

He is the chief executive officer of the International Operations<br />

group of Saudi Telecom Company (STC). He joined STC from the<br />

global management consulting firm, Booz & Company, where<br />

he led the firm’s Middle East Communications and Technology<br />

practice. He has more than 17 years experience with telecom<br />

operators in the Middle East, Asia, Europe and Africa. He brings<br />

a wide spectrum of capabilities covering all aspects of the<br />

telecommunications industry including investment strategies,<br />

mergers and acquisitions, post-merger integration, marketing,<br />

product and service development, organisational restructuring<br />

and governance, technology plans, retail and distribution,<br />

channel strategy and management, customer care, business<br />

development and chief financial officer and chief executive<br />

officer agendas. He has worked with leading organisations in<br />

the telecommunication and technology industries, including<br />

Nortel Networks and Cable & Wireless and spent the past ten<br />

years operating within the Middle East Region. In addition to the<br />

Middle East, his global experience also includes markets such<br />

as Europe, South East Asia, Africa and Latin America. He is the<br />

President Commissioner of PT AXIS Telekom Indonesia (formerly<br />

known as PT Natrindo Telepon Seluler) in Indonesia and vice<br />

chairman of Viva Bahrain BSC (C) in Bahrain. He also serves on<br />

various boards of directors, including <strong>Maxis</strong> Communications<br />

Berhad (the holding company of <strong>Maxis</strong>), Binariang GSM Sdn<br />

Bhd, BGSM Capital Sdn Bhd, Kuwait Telecom Company in<br />

Kuwait, Turk Telecom and OJER TELEKOMÜNİKASYON ANONİM<br />

ŞİRKETİ in Turkey.<br />

He holds a Master of Business Administration from Hull<br />

University in the UK and a Bachelor of Engineering with first<br />

class honours from the University of Westminster in the UK. He<br />

is also a Chartered Engineer and a member of the Institution of<br />

Engineering and Technology in the UK.<br />

He is a member of the Nomination and Remuneration<br />

Committees.<br />

Please refer to Note 7.

MAXIS BERHAD<br />

ANNUAL REPORT 2011<br />

27<br />

Dr Zeyad Thamer H. AlEtaibi<br />

Non-Executive Director<br />

Dr Fahad Hussain S. Mushayt<br />

Non-Executive Director<br />

Dr Zeyad Thamer H. AlEtaibi, aged 50, a Saudi citizen, was<br />

appointed as a Director of <strong>Maxis</strong> on 10 February 2011.<br />

Dr Zeyad is the STC Group chief technology officer (CTO). In<br />

his current position, he provides continuous leadership and<br />

direction to three major STC units being Network Sector, IT<br />

Sector and the Wholesale Business Unit. In his role as Group<br />

CTO, Dr Zeyad also provides technology and infrastructure<br />

guidance to the subsidiaries within the STC Group of companies<br />

such as Viva Bahrain, Viva Kuwait and AXIS-Indonesia. As Group<br />

CTO he provides overall strategies, coaching of direct reports,<br />

setting of aggressive goals and objectives for his various STC<br />

units. The Group CTO is also a permanent member of STC’s<br />

General Management Committee.<br />

Dr Zeyad has more than 20 years experience in the<br />

telecommunications service provider industry and is proficient<br />

in all major aspects of a Telecom Service Provider, through<br />

progressive promotions from Director to General Manager to<br />

Vice-President Network Sector and finally as STC Group CTO.<br />

He has expanded and modernised STC’s Network Broadband<br />

Networks into the largest in the Middle East.<br />

He serves as a director on various boards of directors, including<br />

<strong>Maxis</strong> Communications Berhad (the holding company of <strong>Maxis</strong>),<br />

PT AXIS Telekom Indonesia (formerly known as PT Natrindo<br />

Telepon Seluler) and Viva Bahrain BSC (C) in Bahrain. In addition,<br />

he is vice-chairman of Viva Kuwait where he also serves as the<br />

chairman of the Executive Committee and a member of the<br />

Audit Committee.<br />

He holds a Bachelor of Science in Engineering in year 1985<br />

and a Master’s Degree in Engineering in year 1992 from King<br />

Saud University, Riyadh KSA, and obtained his Doctorate in<br />

Mobile Communications from the University of Bradford in the<br />

UK in 1996. He has also completed a variety of management<br />

programmes from Japan, Project Management Development<br />

at Harvard University and attended multiple forums and<br />

International conferences such as ITU, TM-Forum and GSM<br />

Mobile World.<br />

Dr Fahad Hussain S. Mushayt, aged 43, a Saudi citizen, was<br />

appointed as a Director of <strong>Maxis</strong> on 25 September 2009.<br />

He is the vice president – Corporate Strategy and head of<br />

the Strategic Investment Unit at Saudi Telecom Company<br />

(STC). He joined STC in October 2000 as a senior business<br />

analyst in corporate planning and has held the positions of<br />

capital allocation project manager, balanced scorecard project<br />

manager and concept controlling manager. Before assuming<br />

his current position at STC in June 2011, he was head of the<br />

Strategic Investment Unit, the strategic planning director and<br />

business development director at STC. He has served as a vice<br />

president of the Telecom Development Advisor Group of the<br />

International Telecommunications Union. He serves on various<br />

boards of directors, including <strong>Maxis</strong> Communications Berhad<br />

(holding company of <strong>Maxis</strong>), PT AXIS Telekom Indonesia<br />

(formerly known as PT Natrindo Telepon Seluler) in Indonesia<br />

and Telecom Commercial Investment Company, Arabian Internet<br />

& Communications Services Provider Co. Ltd, Contact Center<br />

Company and Sale for Distribution and Communication Co. Ltd<br />

in Saudi Arabia, Aircel Limited, Aircel Cellular Limited and Dishnet<br />