Quarterly Report 1/2009 - Munich Re Group

Quarterly Report 1/2009 - Munich Re Group

Quarterly Report 1/2009 - Munich Re Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Interim management report Business experience<br />

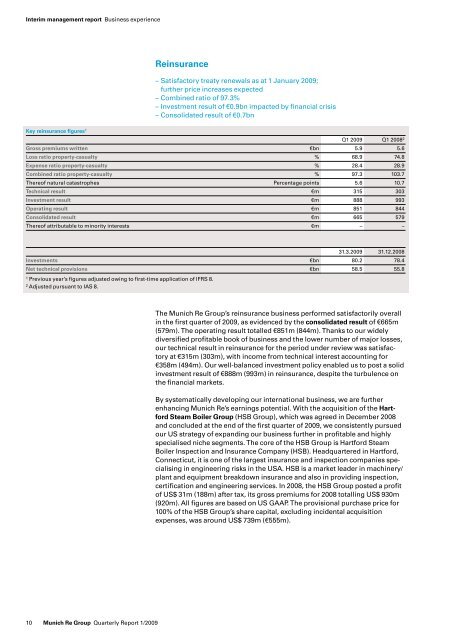

Key reinsurance figures 1<br />

10 <strong>Munich</strong> <strong>Re</strong> <strong>Group</strong> <strong>Quarterly</strong> <strong><strong>Re</strong>port</strong> 1/<strong>2009</strong><br />

<strong>Re</strong>insurance<br />

1 Previous year’s figures adjusted owing to first-time application of IFRS 8.<br />

2 Adjusted pursuant to IAS 8.<br />

– Satisfactory treaty renewals as at 1 January <strong>2009</strong>;<br />

further price increases expected<br />

– Combined ratio of 97.3%<br />

– Investment result of €0.9bn impacted by financial crisis<br />

– Consolidated result of €0.7bn<br />

Q1 <strong>2009</strong> Q1 2008 2<br />

Gross premiums written €bn 5.9 5.6<br />

Loss ratio property-casualty % 68.9 74.8<br />

Expense ratio property-casualty % 28.4 28.9<br />

Combined ratio property-casualty % 97.3 103.7<br />

Thereof natural catastrophes Percentage points 5.6 10.7<br />

Technical result €m 315 303<br />

Investment result €m 888 993<br />

Operating result €m 851 844<br />

Consolidated result €m 665 579<br />

Thereof attributable to minority interests €m – –<br />

31.3.<strong>2009</strong> 31.12.2008<br />

Investments €bn 80.2 78.4<br />

Net technical provisions €bn 58.5 55.8<br />

The <strong>Munich</strong> <strong>Re</strong> <strong>Group</strong>’s reinsurance business performed satisfactorily overall<br />

in the first quarter of <strong>2009</strong>, as evidenced by the consolidated result of €665m<br />

(579m). The operating result totalled €851m (844m). Thanks to our widely<br />

diversified profitable book of business and the lower number of major losses,<br />

our technical result in reinsurance for the period under review was satisfactory<br />

at €315m (303m), with income from technical interest accounting for<br />

€358m (494m). Our well-balanced investment policy enabled us to post a solid<br />

investment result of €888m (993m) in reinsurance, despite the turbulence on<br />

the financial markets.<br />

By systematically developing our international business, we are further<br />

enhancing <strong>Munich</strong> <strong>Re</strong>’s earnings potential. With the acquisition of the Hartford<br />

Steam Boiler <strong>Group</strong> (HSB <strong>Group</strong>), which was agreed in December 2008<br />

and concluded at the end of the first quarter of <strong>2009</strong>, we consistently pursued<br />

our US strategy of expanding our business further in profitable and highly<br />

specialised niche segments. The core of the HSB <strong>Group</strong> is Hartford Steam<br />

Boiler Inspection and Insurance Company (HSB). Headquartered in Hartford,<br />

Connecticut, it is one of the largest insurance and inspection companies specialising<br />

in engineering risks in the USA. HSB is a market leader in machinery/<br />

plant and equipment breakdown insurance and also in providing inspection,<br />

certification and engineering services. In 2008, the HSB <strong>Group</strong> posted a profit<br />

of US$ 31m (188m) after tax, its gross premiums for 2008 totalling US$ 930m<br />

(920m). All figures are based on US GAAP. The provisional purchase price for<br />

100% of the HSB <strong>Group</strong>’s share capital, excluding incidental acquisition<br />

expenses, was around US$ 739m (€555m).