Quarterly Report 1/2009 - Munich Re Group

Quarterly Report 1/2009 - Munich Re Group

Quarterly Report 1/2009 - Munich Re Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Interim management report Business experience<br />

14 <strong>Munich</strong> <strong>Re</strong> <strong>Group</strong> <strong>Quarterly</strong> <strong><strong>Re</strong>port</strong> 1/<strong>2009</strong><br />

Total premium income across all lines of business increased by 3.3% to €5.0bn<br />

(4.9bn). Growth was especially apparent in international business, in particular<br />

in life insurance. Although over 90% of our primary insurance volume<br />

stems from the eurozone, the strong declines in foreign exchange rates, especially<br />

the Polish zloty and Turkish lira, adversely affected growth by 1.6%.<br />

Gross premiums written rose to €4.7bn (4.6bn), a figure that does not include<br />

the savings premiums from unit-linked life insurance and capitalisation products<br />

such as “Riester” pensions in Germany.<br />

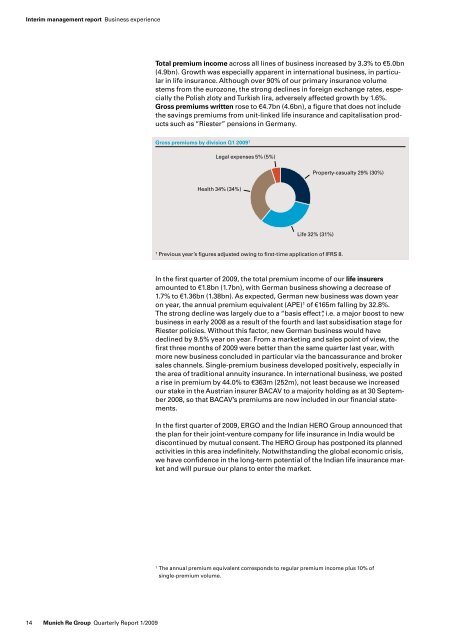

Gross premiums by division Q1 <strong>2009</strong> 1<br />

Legal expenses 5% (5%)<br />

Health 34% (34%)<br />

Property-casualty 29% (30%)<br />

Life 32% (31%)<br />

1 Previous year’s figures adjusted owing to first-time application of IFRS 8.<br />

In the first quarter of <strong>2009</strong>, the total premium income of our life insurers<br />

amounted to €1.8bn (1.7bn), with German business showing a decrease of<br />

1.7% to €1.36bn (1.38bn). As expected, German new business was down year<br />

on year, the annual premium equivalent (APE) 1 of €165m falling by 32.8%.<br />

The strong decline was largely due to a “basis effect“, i.e. a major boost to new<br />

business in early 2008 as a result of the fourth and last subsidisation stage for<br />

Riester policies. Without this factor, new German business would have<br />

declined by 9.5% year on year. From a marketing and sales point of view, the<br />

first three months of <strong>2009</strong> were better than the same quarter last year, with<br />

more new business concluded in particular via the bancassurance and broker<br />

sales channels. Single-premium business developed positively, especially in<br />

the area of traditional annuity insurance. In international business, we posted<br />

a rise in premium by 44.0% to €363m (252m), not least because we increased<br />

our stake in the Austrian insurer BACAV to a majority holding as at 30 September<br />

2008, so that BACAV’s premiums are now included in our financial statements.<br />

In the first quarter of <strong>2009</strong>, ERGO and the Indian HERO <strong>Group</strong> announced that<br />

the plan for their joint-venture company for life insurance in India would be<br />

discontinued by mutual consent. The HERO <strong>Group</strong> has postponed its planned<br />

activities in this area indefinitely. Notwithstanding the global economic crisis,<br />

we have confidence in the long-term potential of the Indian life insurance market<br />

and will pursue our plans to enter the market.<br />

¹ The annual premium equivalent corresponds to regular premium income plus 10% of<br />

single-premium volume.