Quarterly Report 1/2009 - Munich Re Group

Quarterly Report 1/2009 - Munich Re Group

Quarterly Report 1/2009 - Munich Re Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Interim management report Business experience<br />

1 Including owner-occupied property.<br />

20 <strong>Munich</strong> <strong>Re</strong> <strong>Group</strong> <strong>Quarterly</strong> <strong><strong>Re</strong>port</strong> 1/<strong>2009</strong><br />

At the end of the quarter, fixed-interest securities and loans totalled €154bn or<br />

approximately 87% of our total investment portfolio at carrying amounts, an<br />

increase of 1.3 percentage points compared with the beginning of the year,<br />

and 13 percentage points more than at 31 December 2007.<br />

We have placed the majority of this portfolio (47%) in government bonds or<br />

similarly secure instruments for which public institutions are liable; approximately<br />

56% relates to German and US issuers. Additionally, around 26% of<br />

our investments are in securities and debt instruments with top-quality collateralisation,<br />

mainly German pfandbriefs with good rating structures.<br />

In the first quarter, we again exercised restraint in the assumption of credit<br />

risks. We carried out selective restructuring within our portfolio of creditexposed<br />

fixed-interest securities, taking advantage of the considerable widening<br />

of risk spreads on corporate bonds to prudently improve our positions. As<br />

at the reporting date, these accounted for approximately 9% of our portfolio of<br />

fixed-interest investments. By contrast, we systematically trimmed back our<br />

portfolio of asset- and mortgage-backed securities to €5.2bn (6.1bn). Around<br />

70% of our portfolio of asset- and mortgage-backed securities were issued by<br />

state-supported agencies.<br />

At the reporting date, approximately 11% of our portfolio of fixed-interest<br />

securities and loans, which includes short-term items, was invested with<br />

banks. A small portion of our bank exposure, around 2%, is comprised of dormant<br />

holdings, participation certificates and other quasi-equity instruments.<br />

Another 8% is in subordinated bonds with limited maturities.<br />

As protection against the risks of future inflation and the associated rise in<br />

interest rates, we hold bonds worth approximately €7.2bn (6.5bn) for which<br />

the interest and redemption amounts are linked to inflation (inflation-indexed<br />

bonds). These account for 4.7% of our portfolio of fixed-interest securities and<br />

loans at market value.<br />

In the first three months up to the reporting date, we recorded a countervailing<br />

trend overall in risk-free interest rates. Whilst a steepening of the interestrate<br />

curve was apparent in Germany, risk-free interest rates in the USA rose<br />

continuously. Divergent effects both within and between individual asset<br />

classes were also apparent in risk spreads on fixed-interest securities. Overall,<br />

however, the developments in the area of fixed-interest securities were largely<br />

self-compensating. Net unrealised gains on our fixed-interest securities in the<br />

“available for sale” category thus declined only marginally by €54m to €1.4bn<br />

(see table on page 19) in the period under review.<br />

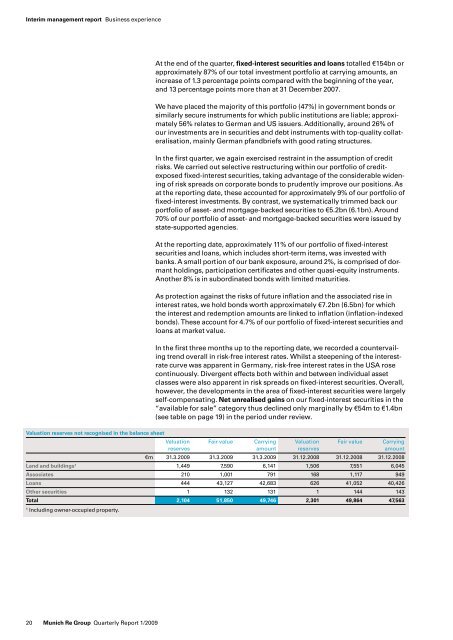

Valuation reserves not recognised in the balance sheet<br />

Valuation Fair value Carrying Valuation Fair value Carrying<br />

reserves amount reserves amount<br />

€m 31.3.<strong>2009</strong> 31.3.<strong>2009</strong> 31.3.<strong>2009</strong> 31.12.2008 31.12.2008 31.12.2008<br />

Land and buildings¹ 1,449 7,590 6,141 1,506 7,551 6,045<br />

Associates 210 1,001 791 168 1,117 949<br />

Loans 444 43,127 42,683 626 41,052 40,426<br />

Other securities 1 132 131 1 144 143<br />

Total 2,104 51,850 49,746 2,301 49,864 47,563