Quarterly Report 1/2009 - Munich Re Group

Quarterly Report 1/2009 - Munich Re Group

Quarterly Report 1/2009 - Munich Re Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Interim management report Business experience<br />

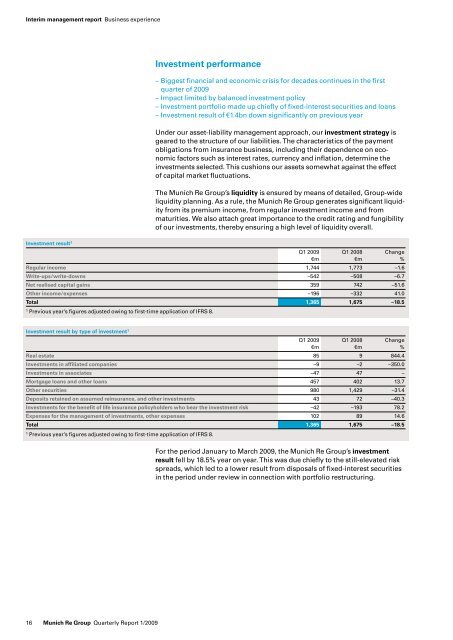

Investment result 1<br />

16 <strong>Munich</strong> <strong>Re</strong> <strong>Group</strong> <strong>Quarterly</strong> <strong><strong>Re</strong>port</strong> 1/<strong>2009</strong><br />

Investment performance<br />

1 Previous year’s figures adjusted owing to first-time application of IFRS 8.<br />

1 Previous year’s figures adjusted owing to first-time application of IFRS 8.<br />

– Biggest financial and economic crisis for decades continues in the first<br />

quarter of <strong>2009</strong><br />

– Impact limited by balanced investment policy<br />

– Investment portfolio made up chiefly of fixed-interest securities and loans<br />

– Investment result of €1.4bn down significantly on previous year<br />

Under our asset-liability management approach, our investment strategy is<br />

geared to the structure of our liabilities. The characteristics of the payment<br />

obligations from insurance business, including their dependence on economic<br />

factors such as interest rates, currency and inflation, determine the<br />

investments selected. This cushions our assets somewhat against the effect<br />

of capital market fluctuations.<br />

The <strong>Munich</strong> <strong>Re</strong> <strong>Group</strong>’s liquidity is ensured by means of detailed, <strong>Group</strong>-wide<br />

liquidity planning. As a rule, the <strong>Munich</strong> <strong>Re</strong> <strong>Group</strong> generates significant liquidity<br />

from its premium income, from regular investment income and from<br />

maturities. We also attach great importance to the credit rating and fungibility<br />

of our investments, thereby ensuring a high level of liquidity overall.<br />

Q1 <strong>2009</strong> Q1 2008 Change<br />

€m €m %<br />

<strong>Re</strong>gular income 1,744 1,773 –1.6<br />

Write-ups/write-downs –542 –508 –6.7<br />

Net realised capital gains 359 742 –51.6<br />

Other income/expenses –196 –332 41.0<br />

Total 1,365 1,675 –18.5<br />

Investment result by type of investment 1<br />

Q1 <strong>2009</strong> Q1 2008 Change<br />

€m €m %<br />

<strong>Re</strong>al estate 85 9 844.4<br />

Investments in affiliated companies –9 –2 –350.0<br />

Investments in associates –47 47 –<br />

Mortgage loans and other loans 457 402 13.7<br />

Other securities 980 1,429 –31.4<br />

Deposits retained on assumed reinsurance, and other investments 43 72 –40.3<br />

Investments for the benefit of life insurance policyholders who bear the investment risk –42 –193 78.2<br />

Expenses for the management of investments, other expenses 102 89 14.6<br />

Total 1,365 1,675 –18.5<br />

For the period January to March <strong>2009</strong>, the <strong>Munich</strong> <strong>Re</strong> <strong>Group</strong>’s investment<br />

result fell by 18.5% year on year. This was due chiefly to the still-elevated risk<br />

spreads, which led to a lower result from disposals of fixed-interest securities<br />

in the period under review in connection with portfolio restructuring.