Quarterly Report 1/2009 - Munich Re Group

Quarterly Report 1/2009 - Munich Re Group

Quarterly Report 1/2009 - Munich Re Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Selected notes to the consolidated financial statements<br />

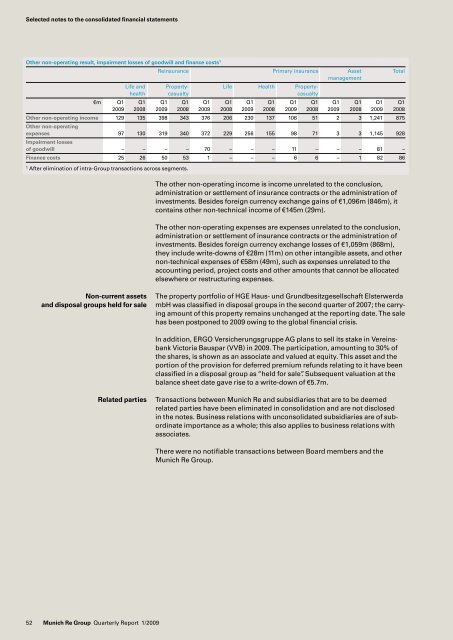

Other non-operating result, impairment losses of goodwill and finance costs 1<br />

1 After elimination of intra<strong>Group</strong> transactions across segments.<br />

52 <strong>Munich</strong> <strong>Re</strong> <strong>Group</strong> <strong>Quarterly</strong> <strong><strong>Re</strong>port</strong> 1/<strong>2009</strong><br />

<strong>Re</strong>insurance Primary insurance Asset Total<br />

management<br />

Life and Property Life Health Property<br />

health casualty casualty<br />

€m Q1 Q1 Q1 Q1 Q1 Q1 Q1 Q1 Q1 Q1 Q1 Q1 Q1 Q1<br />

<strong>2009</strong> 2008 <strong>2009</strong> 2008 <strong>2009</strong> 2008 <strong>2009</strong> 2008 <strong>2009</strong> 2008 <strong>2009</strong> 2008 <strong>2009</strong> 2008<br />

Other non-operating income 129 135 398 343 376 206 230 137 106 51 2 3 1,241 875<br />

Other non-operating<br />

expenses<br />

Impairment losses<br />

97 130 319 340 372 229 256 155 98 71 3 3 1,145 928<br />

of goodwill – – – – 70 – – – 11 – – – 81 –<br />

Finance costs 25 26 50 53 1 – – – 6 6 – 1 82 86<br />

The other nonoperating income is income unrelated to the conclusion,<br />

administration or settlement of insurance contracts or the administration of<br />

investments. Besides foreign currency exchange gains of €1,096m (846m), it<br />

contains other nontechnical income of €145m (29m).<br />

The other nonoperating expenses are expenses unrelated to the conclusion,<br />

administration or settlement of insurance contracts or the administration of<br />

investments. Besides foreign currency exchange losses of €1,059m (868m),<br />

they include writedowns of €28m (11m) on other intan gible assets, and other<br />

nontechnical expenses of €58m (49m), such as expenses unrelated to the<br />

accounting period, project costs and other amounts that cannot be allocated<br />

elsewhere or restructuring expenses.<br />

Non-current assets The property portfolio of HGE Haus und Grundbesitzgesellschaft Elsterwerda<br />

and disposal groups held for sale mbH was classified in disposal groups in the second quarter of 2007; the carrying<br />

amount of this property remains unchanged at the reporting date. The sale<br />

has been postponed to <strong>2009</strong> owing to the global financial crisis.<br />

In addition, ERGO Versicherungsgruppe AG plans to sell its stake in Vereinsbank<br />

Victoria Bauspar (VVB) in <strong>2009</strong>. The participation, amounting to 30% of<br />

the shares, is shown as an associate and valued at equity. This asset and the<br />

portion of the provision for deferred premium refunds relating to it have been<br />

classified in a disposal group as “held for sale”. Subsequent valuation at the<br />

balance sheet date gave rise to a writedown of €5.7m.<br />

<strong>Re</strong>lated parties Transactions between <strong>Munich</strong> <strong>Re</strong> and subsidiaries that are to be deemed<br />

related parties have been eliminated in consolidation and are not disclosed<br />

in the notes. Business relations with unconsolidated subsidiaries are of subordinate<br />

importance as a whole; this also applies to business relations with<br />

associates.<br />

There were no notifiable transactions between Board members and the<br />

<strong>Munich</strong> <strong>Re</strong> <strong>Group</strong>.