Quarterly Report 1/2009 - Munich Re Group

Quarterly Report 1/2009 - Munich Re Group

Quarterly Report 1/2009 - Munich Re Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Selected notes to the consolidated financial statements<br />

Premiums1, 2<br />

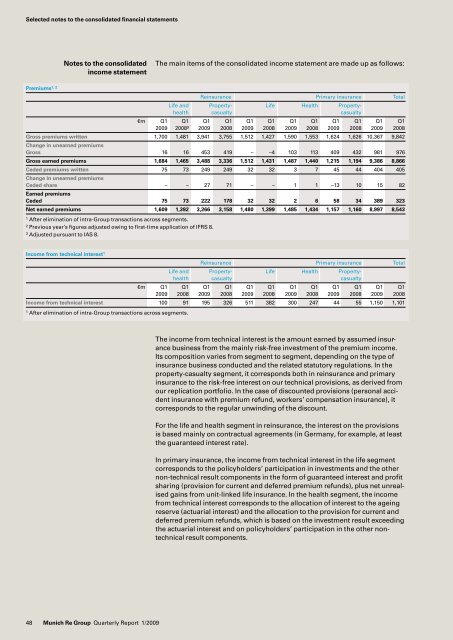

Notes to the consolidated The main items of the consolidated income statement are made up as follows:<br />

income statement<br />

1 After elimination of intra<strong>Group</strong> transactions across segments.<br />

2 Previous year’s figures adjusted owing to firsttime application of IFRS 8.<br />

3 Adjusted pursuant to IAS 8.<br />

1 After elimination of intra<strong>Group</strong> transactions across segments.<br />

48 <strong>Munich</strong> <strong>Re</strong> <strong>Group</strong> <strong>Quarterly</strong> <strong><strong>Re</strong>port</strong> 1/<strong>2009</strong><br />

<strong>Re</strong>insurance Primary insurance Total<br />

Life and Property Life Health Property<br />

health casualty casualty<br />

€m Q1 Q1 Q1 Q1 Q1 Q1 Q1 Q1 Q1 Q1 Q1 Q1<br />

<strong>2009</strong> 2008³ <strong>2009</strong> 2008 <strong>2009</strong> 2008 <strong>2009</strong> 2008 <strong>2009</strong> 2008 <strong>2009</strong> 2008<br />

Gross premiums written 1,700 1,481 3,941 3,755 1,512 1,427 1,590 1,553 1,624 1,626 10,367 9,842<br />

Change in unearned premiums<br />

Gross 16 16 453 419 – –4 103 113 409 432 981 976<br />

Gross earned premiums 1,684 1,465 3,488 3,336 1,512 1,431 1,487 1,440 1,215 1,194 9,386 8,866<br />

Ceded premiums written 75 73 249 249 32 32 3 7 45 44 404 405<br />

Change in unearned premiums<br />

Ceded share<br />

Earned premiums<br />

– – 27 71 – – 1 1 –13 10 15 82<br />

Ceded 75 73 222 178 32 32 2 6 58 34 389 323<br />

Net earned premiums 1,609 1,392 3,266 3,158 1,480 1,399 1,485 1,434 1,157 1,160 8,997 8,543<br />

Income from technical interest 1<br />

<strong>Re</strong>insurance Primary insurance Total<br />

Life and Property Life Health Property<br />

health casualty casualty<br />

€m Q1 Q1 Q1 Q1 Q1 Q1 Q1 Q1 Q1 Q1 Q1 Q1<br />

<strong>2009</strong> 2008 <strong>2009</strong> 2008 <strong>2009</strong> 2008 <strong>2009</strong> 2008 <strong>2009</strong> 2008 <strong>2009</strong> 2008<br />

Income from technical interest 100 91 195 326 511 382 300 247 44 55 1,150 1,101<br />

The income from technical interest is the amount earned by assumed insurance<br />

business from the mainly riskfree investment of the premium income.<br />

Its composition varies from segment to segment, depending on the type of<br />

insurance business conducted and the related statutory regulations. In the<br />

propertycasualty segment, it corresponds both in reinsurance and primary<br />

insurance to the riskfree interest on our technical provisions, as derived from<br />

our replication portfolio. In the case of discounted provisions (personal accident<br />

insurance with premium refund, workers’ compensation insurance), it<br />

corresponds to the regular unwinding of the discount.<br />

For the life and health segment in reinsurance, the interest on the provisions<br />

is based mainly on contractual agreements (in Germany, for example, at least<br />

the guaranteed interest rate).<br />

In primary insurance, the income from technical interest in the life segment<br />

corresponds to the policyholders’ participation in investments and the other<br />

nontechnical result components in the form of guaranteed interest and profit<br />

sharing (provision for current and deferred premium refunds), plus net unrealised<br />

gains from unitlinked life insurance. In the health segment, the income<br />

from technical interest corresponds to the allocation of interest to the ageing<br />

reserve (actuarial interest) and the allocation to the provision for current and<br />

deferred premium refunds, which is based on the investment result exceeding<br />

the actuarial interest and on policyholders’ participation in the other nontechnical<br />

result components.