Quarterly Report 1/2009 - Munich Re Group

Quarterly Report 1/2009 - Munich Re Group

Quarterly Report 1/2009 - Munich Re Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Interim management report Business experience<br />

The carrying amount of our investments showed a slight increase of €2.1bn or<br />

1.2% since the beginning of the year. This increase was largely influenced by<br />

foreign currency gains of €1.5bn, which were chiefly due to rising exchange<br />

rates for our major investment portfolios held in US dollars, pounds sterling<br />

and Canadian dollars. Such gains are usually balanced by similar changes in<br />

the value of our liabilities in foreign currencies, meaning that exchange rate<br />

fluctuations lead only to minor changes in our asset position. In addition, we<br />

have increased our investments in fixed-interest securities and loans. By contrast,<br />

our equity portfolio has shrunk as a result of falling market values and a<br />

systematic reduction policy. Owing to the interest-rate trend, there was a<br />

slight fall in net unrealised gains on our fixed-interest securities available for<br />

sale and accounted for at market value.<br />

The downward trend on the stock exchanges continued in the <strong>2009</strong> financial<br />

year, especially at the start, with the most important indices showing substantial<br />

declines since January. The EURO STOXX 50 alone lost a further 376 points<br />

or 15.4% in the first three months. Alongside these price falls, we also continued<br />

to reduce the carrying amount of our equity portfolio (including investments<br />

in affiliated companies and associates) through disposals in the first<br />

quarter of the current financial year. Accordingly, at the reporting date, this<br />

amount totalled only €4.4bn (6.2bn). At market value, our equity portfolio<br />

(including investments in affiliated companies and associates) represents<br />

2.6% of our overall investment portfolio – down a further 1.0 percentage points<br />

on the start of the year. Because we have hedged this portfolio to a large<br />

extent using derivatives, our economic exposure to equities at the end of the<br />

quarter accounted for only 1.4% (1.7%) of our investments at market value.<br />

Expressed as a percentage of adjusted equity, the value of the equity portfolio<br />

– minus derivatives, policyholders’ bonuses and deferred taxes – is only 4%<br />

(“equity gearing”). At 5%, this ratio was already very low as at 31 December<br />

2008, but we were nonetheless able to reduce it still further in the first three<br />

months of <strong>2009</strong>. In the light of the volatile capital market environment, we<br />

thus lessened our dependence on the stock market significantly, also in relation<br />

to our capital base.<br />

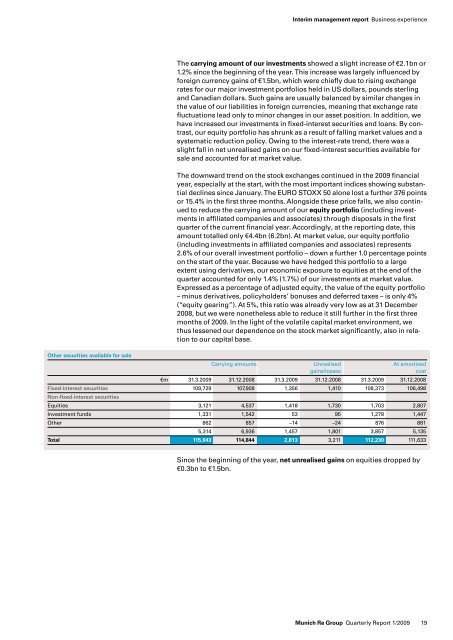

Other securities available for sale<br />

Carrying amounts Unrealised At amortised<br />

gains/losses cost<br />

€m 31.3.<strong>2009</strong> 31.12.2008 31.3.<strong>2009</strong> 31.12.2008 31.3.<strong>2009</strong> 31.12.2008<br />

Fixed-interest securities<br />

Non-fixed-interest securities<br />

109,729 107,908 1,356 1,410 108,373 106,498<br />

Equities 3,121 4,537 1,418 1,730 1,703 2,807<br />

Investment funds 1,331 1,542 53 95 1,278 1,447<br />

Other 862 857 –14 –24 876 881<br />

5,314 6,936 1,457 1,801 3,857 5,135<br />

Total 115,043 114,844 2,813 3,211 112,230 111,633<br />

Since the beginning of the year, net unrealised gains on equities dropped by<br />

€0.3bn to €1.5bn.<br />

<strong>Munich</strong> <strong>Re</strong> <strong>Group</strong> <strong>Quarterly</strong> <strong><strong>Re</strong>port</strong> 1/<strong>2009</strong><br />

19