Government of India Volume I: Analysis and Recommendations

Government of India Volume I: Analysis and Recommendations

Government of India Volume I: Analysis and Recommendations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

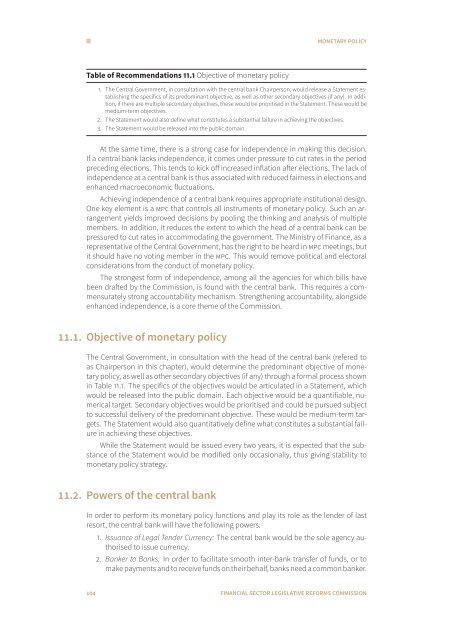

Table <strong>of</strong> <strong>Recommendations</strong> 11.1 Objective <strong>of</strong> monetary policy<br />

MONETARY POLICY<br />

1. The Central <strong>Government</strong>, in consultation with the central bank Chairperson, would release a Statement establishing<br />

the specifics <strong>of</strong> its predominant objective, as well as other secondary objectives (if any). In addition,<br />

if there are multiple secondary objectives, these would be prioritised in the Statement. These would be<br />

medium-term objectives.<br />

2. The Statement would also define what constitutes a substantial failure in achieving the objectives.<br />

3. The Statement would be released into the public domain.<br />

At the same time, there is a strong case for independence in making this decision.<br />

If a central bank lacks independence, it comes under pressure to cut rates in the period<br />

preceding elections. This tends to kick <strong>of</strong>f increased inflation after elections. The lack <strong>of</strong><br />

independence at a central bank is thus associated with reduced fairness in elections <strong>and</strong><br />

enhanced macroeconomic fluctuations.<br />

Achieving independence <strong>of</strong> a central bank requires appropriate institutional design.<br />

One key element is a MPC that controls all instruments <strong>of</strong> monetary policy. Such an arrangement<br />

yields improved decisions by pooling the thinking <strong>and</strong> analysis <strong>of</strong> multiple<br />

members. In addition, it reduces the extent to which the head <strong>of</strong> a central bank can be<br />

pressured to cut rates in accommodating the government. The Ministry <strong>of</strong> Finance, as a<br />

representative <strong>of</strong> the Central <strong>Government</strong>, has the right to be heard in MPC meetings, but<br />

it should have no voting member in the MPC. This would remove political <strong>and</strong> electoral<br />

considerations from the conduct <strong>of</strong> monetary policy.<br />

The strongest form <strong>of</strong> independence, among all the agencies for which bills have<br />

been drafted by the Commission, is found with the central bank. This requires a commensurately<br />

strong accountability mechanism. Strengthening accountability, alongside<br />

enhanced independence, is a core theme <strong>of</strong> the Commission.<br />

11.1. Objective <strong>of</strong> monetary policy<br />

The Central <strong>Government</strong>, in consultation with the head <strong>of</strong> the central bank (refered to<br />

as Chairperson in this chapter), would determine the predominant objective <strong>of</strong> monetary<br />

policy, as well as other secondary objectives (if any) through a formal process shown<br />

in Table 11.1. The specifics <strong>of</strong> the objectives would be articulated in a Statement, which<br />

would be released into the public domain. Each objective would be a quantifiable, numerical<br />

target. Secondary objectives would be prioritised <strong>and</strong> could be pursued subject<br />

to successful delivery <strong>of</strong> the predominant objective. These would be medium-term targets.<br />

The Statement would also quantitatively define what constitutes a substantial failure<br />

in achieving these objectives.<br />

While the Statement would be issued every two years, it is expected that the substance<br />

<strong>of</strong> the Statement would be modified only occasionally, thus giving stability to<br />

monetary policy strategy.<br />

11.2. Powers <strong>of</strong> the central bank<br />

In order to perform its monetary policy functions <strong>and</strong> play its role as the lender <strong>of</strong> last<br />

resort, the central bank will have the following powers:<br />

1. Issuance <strong>of</strong> Legal Tender Currency: The central bank would be the sole agency authorised<br />

to issue currency.<br />

2. Banker to Banks: In order to facilitate smooth inter-bank transfer <strong>of</strong> funds, or to<br />

make payments <strong>and</strong> to receive funds on their behalf, banks need a common banker.<br />

104 FINANCIAL SECTOR LEGISLATIVE REFORMS COMMISSION