Government of India Volume I: Analysis and Recommendations

Government of India Volume I: Analysis and Recommendations

Government of India Volume I: Analysis and Recommendations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

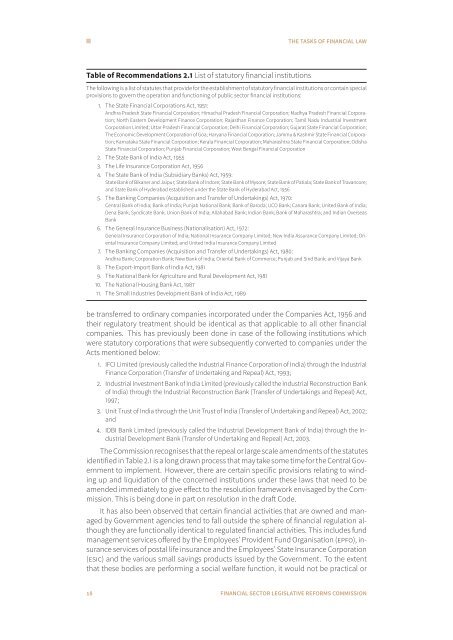

Table <strong>of</strong> <strong>Recommendations</strong> 2.1 List <strong>of</strong> statutory financial institutions<br />

THE TASKS OF FINANCIAL LAW<br />

The following is a list <strong>of</strong> statutes that provide for the establishment <strong>of</strong> statutory financial institutions or contain special<br />

provisions to govern the operation <strong>and</strong> functioning <strong>of</strong> public sector financial institutions:<br />

1. The State Financial Corporations Act, 1951:<br />

Andhra Pradesh State Financial Corporation; Himachal Pradesh Financial Corporation; Madhya Pradesh Financial Corporation;<br />

North Eastern Development Finance Corporation; Rajasthan Finance Corporation; Tamil Nadu Industrial Investment<br />

Corporation Limited; Uttar Pradesh Financial Corporation; Delhi Financial Corporation; Gujarat State Financial Corporation;<br />

The Economic Development Corporation <strong>of</strong> Goa; Haryana Financial Corporation; Jammu & Kashmir State Financial Corporation;<br />

Karnataka State Financial Corporation; Kerala Financial Corporation; Maharashtra State Financial Corporation; Odisha<br />

State Financial Corporation; Punjab Financial Corporation; West Bengal Financial Corporation<br />

2. The State Bank <strong>of</strong> <strong>India</strong> Act, 1955<br />

3. The Life Insurance Corporation Act, 1956<br />

4. The State Bank <strong>of</strong> <strong>India</strong> (Subsidiary Banks) Act, 1959:<br />

State Bank <strong>of</strong> Bikaner <strong>and</strong> Jaipur; State Bank <strong>of</strong> Indore; State Bank <strong>of</strong> Mysore; State Bank <strong>of</strong> Patiala; State Bank <strong>of</strong> Travancore;<br />

<strong>and</strong> State Bank <strong>of</strong> Hyderabad established under the State Bank <strong>of</strong> Hyderabad Act, 1956<br />

5. The Banking Companies (Acquisition <strong>and</strong> Transfer <strong>of</strong> Undertakings) Act, 1970:<br />

Central Bank <strong>of</strong> <strong>India</strong>; Bank <strong>of</strong> <strong>India</strong>; Punjab National Bank; Bank <strong>of</strong> Baroda; UCO Bank; Canara Bank; United Bank <strong>of</strong> <strong>India</strong>;<br />

Dena Bank; Syndicate Bank; Union Bank <strong>of</strong> <strong>India</strong>; Allahabad Bank; <strong>India</strong>n Bank; Bank <strong>of</strong> Maharashtra; <strong>and</strong> <strong>India</strong>n Overseas<br />

Bank<br />

6. The General Insurance Business (Nationalisation) Act, 1972:<br />

General Insurance Corporation <strong>of</strong> <strong>India</strong>; National Insurance Company Limited; New <strong>India</strong> Assurance Company Limited; Oriental<br />

Insurance Company Limited; <strong>and</strong> United <strong>India</strong> Insurance Company Limited<br />

7. The Banking Companies (Acquisition <strong>and</strong> Transfer <strong>of</strong> Undertakings) Act, 1980:<br />

Andhra Bank; Corporation Bank; New Bank <strong>of</strong> <strong>India</strong>; Oriental Bank <strong>of</strong> Commerce; Punjab <strong>and</strong> Sind Bank; <strong>and</strong> Vijaya Bank<br />

8. The Export-Import Bank <strong>of</strong> <strong>India</strong> Act, 1981<br />

9. The National Bank for Agriculture <strong>and</strong> Rural Development Act, 1981<br />

10. The National Housing Bank Act, 1987<br />

11. The Small Industries Development Bank <strong>of</strong> <strong>India</strong> Act, 1989<br />

be transferred to ordinary companies incorporated under the Companies Act, 1956 <strong>and</strong><br />

their regulatory treatment should be identical as that applicable to all other financial<br />

companies. This has previously been done in case <strong>of</strong> the following institutions which<br />

were statutory corporations that were subsequently converted to companies under the<br />

Acts mentioned below:<br />

1. IFCI Limited (previously called the Industrial Finance Corporation <strong>of</strong> <strong>India</strong>) through the Industrial<br />

Finance Corporation (Transfer <strong>of</strong> Undertaking <strong>and</strong> Repeal) Act, 1993;<br />

2. Industrial Investment Bank <strong>of</strong> <strong>India</strong> Limited (previously called the Industrial Reconstruction Bank<br />

<strong>of</strong> <strong>India</strong>) through the Industrial Reconstruction Bank (Transfer <strong>of</strong> Undertakings <strong>and</strong> Repeal) Act,<br />

1997;<br />

3. Unit Trust <strong>of</strong> <strong>India</strong> through the Unit Trust <strong>of</strong> <strong>India</strong> (Transfer <strong>of</strong> Undertaking <strong>and</strong> Repeal) Act, 2002;<br />

<strong>and</strong><br />

4. IDBI Bank Limited (previously called the Industrial Development Bank <strong>of</strong> <strong>India</strong>) through the Industrial<br />

Development Bank (Transfer <strong>of</strong> Undertaking <strong>and</strong> Repeal) Act, 2003.<br />

The Commission recognises that the repeal or large scale amendments <strong>of</strong> the statutes<br />

identified in Table 2.1 is a long drawn process that may take some time for the Central <strong>Government</strong><br />

to implement. However, there are certain specific provisions relating to winding<br />

up <strong>and</strong> liquidation <strong>of</strong> the concerned institutions under these laws that need to be<br />

amended immediately to give effect to the resolution framework envisaged by the Commission.<br />

This is being done in part on resolution in the draft Code.<br />

It has also been observed that certain financial activities that are owned <strong>and</strong> managed<br />

by <strong>Government</strong> agencies tend to fall outside the sphere <strong>of</strong> financial regulation although<br />

they are functionally identical to regulated financial activities. This includes fund<br />

management services <strong>of</strong>fered by the Employees’ Provident Fund Organisation (EPFO), insurance<br />

services <strong>of</strong> postal life insurance <strong>and</strong> the Employees’ State Insurance Corporation<br />

(ESIC) <strong>and</strong> the various small savings products issued by the <strong>Government</strong>. To the extent<br />

that these bodies are performing a social welfare function, it would not be practical or<br />

18 FINANCIAL SECTOR LEGISLATIVE REFORMS COMMISSION