Government of India Volume I: Analysis and Recommendations

Government of India Volume I: Analysis and Recommendations

Government of India Volume I: Analysis and Recommendations

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CONSUMER PROTECTION<br />

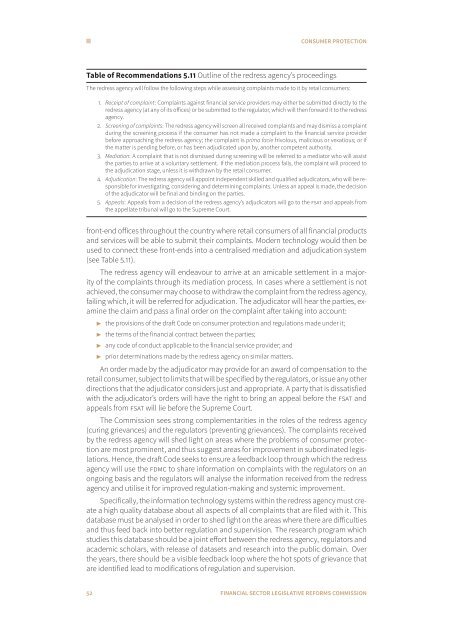

Table <strong>of</strong> <strong>Recommendations</strong> 5.11 Outline <strong>of</strong> the redress agency’s proceedings<br />

The redress agency will follow the following steps while assessing complaints made to it by retail consumers:<br />

1. Receipt <strong>of</strong> complaint: Complaints against financial service providers may either be submitted directly to the<br />

redress agency (at any <strong>of</strong> its <strong>of</strong>fices) or be submitted to the regulator, which will then forward it to the redress<br />

agency.<br />

2. Screening <strong>of</strong> complaints: The redress agency will screen all received complaints <strong>and</strong> may dismiss a complaint<br />

during the screening process if the consumer has not made a complaint to the financial service provider<br />

before approaching the redress agency; the complaint is prima facie frivolous, malicious or vexatious; or if<br />

the matter is pending before, or has been adjudicated upon by, another competent authority.<br />

3. Mediation: A complaint that is not dismissed during screening will be referred to a mediator who will assist<br />

the parties to arrive at a voluntary settlement. If the mediation process fails, the complaint will proceed to<br />

the adjudication stage, unless it is withdrawn by the retail consumer.<br />

4. Adjudication: The redress agency will appoint independent skilled <strong>and</strong> qualified adjudicators, who will be responsible<br />

for investigating, considering <strong>and</strong> determining complaints. Unless an appeal is made, the decision<br />

<strong>of</strong> the adjudicator will be final <strong>and</strong> binding on the parties.<br />

5. Appeals: Appeals from a decision <strong>of</strong> the redress agency’s adjudicators will go to the FSAT <strong>and</strong> appeals from<br />

the appellate tribunal will go to the Supreme Court.<br />

front-end <strong>of</strong>fices throughout the country where retail consumers <strong>of</strong> all financial products<br />

<strong>and</strong> services will be able to submit their complaints. Modern technology would then be<br />

used to connect these front-ends into a centralised mediation <strong>and</strong> adjudication system<br />

(see Table 5.11).<br />

The redress agency will endeavour to arrive at an amicable settlement in a majority<br />

<strong>of</strong> the complaints through its mediation process. In cases where a settlement is not<br />

achieved, the consumer may choose to withdraw the complaint from the redress agency,<br />

failing which, it will be referred for adjudication. The adjudicator will hear the parties, examine<br />

the claim <strong>and</strong> pass a final order on the complaint after taking into account:<br />

◮ the provisions <strong>of</strong> the draft Code on consumer protection <strong>and</strong> regulations made under it;<br />

◮ the terms <strong>of</strong> the financial contract between the parties;<br />

◮ any code <strong>of</strong> conduct applicable to the financial service provider; <strong>and</strong><br />

◮ prior determinations made by the redress agency on similar matters.<br />

An order made by the adjudicator may provide for an award <strong>of</strong> compensation to the<br />

retail consumer, subject to limits that will be specified by the regulators, or issue any other<br />

directions that the adjudicator considers just <strong>and</strong> appropriate. A party that is dissatisfied<br />

with the adjudicator’s orders will have the right to bring an appeal before the FSAT <strong>and</strong><br />

appeals from FSAT will lie before the Supreme Court.<br />

The Commission sees strong complementarities in the roles <strong>of</strong> the redress agency<br />

(curing grievances) <strong>and</strong> the regulators (preventing grievances). The complaints received<br />

by the redress agency will shed light on areas where the problems <strong>of</strong> consumer protection<br />

are most prominent, <strong>and</strong> thus suggest areas for improvement in subordinated legislations.<br />

Hence, the draft Code seeks to ensure a feedback loop through which the redress<br />

agency will use the FDMC to share information on complaints with the regulators on an<br />

ongoing basis <strong>and</strong> the regulators will analyse the information received from the redress<br />

agency <strong>and</strong> utilise it for improved regulation-making <strong>and</strong> systemic improvement.<br />

Specifically, the information technology systems within the redress agency must create<br />

a high quality database about all aspects <strong>of</strong> all complaints that are filed with it. This<br />

database must be analysed in order to shed light on the areas where there are difficulties<br />

<strong>and</strong> thus feed back into better regulation <strong>and</strong> supervision. The research program which<br />

studies this database should be a joint effort between the redress agency, regulators <strong>and</strong><br />

academic scholars, with release <strong>of</strong> datasets <strong>and</strong> research into the public domain. Over<br />

the years, there should be a visible feedback loop where the hot spots <strong>of</strong> grievance that<br />

are identified lead to modifications <strong>of</strong> regulation <strong>and</strong> supervision.<br />

52 FINANCIAL SECTOR LEGISLATIVE REFORMS COMMISSION