AC Choksi Share Brokers Private Limited - Myiris.com

AC Choksi Share Brokers Private Limited - Myiris.com

AC Choksi Share Brokers Private Limited - Myiris.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

A C <strong>Choksi</strong><br />

<strong>Share</strong> <strong>Brokers</strong> <strong>Private</strong> <strong>Limited</strong><br />

INITIATION REPORT | BAJAJ CORP LTD. Sept 09, 2011<br />

Re<strong>com</strong>mendation: BUY<br />

Target Price (Rs.) 148.1<br />

Re<strong>com</strong>mendation Price (Rs.) 123.7<br />

Potential Return (%) 19.8%<br />

BSE Sensex 16866.97<br />

Key Financials<br />

<strong>Share</strong>s Outstanding (mn) 147.5<br />

Face Value (Rs.) 1<br />

Market Capital (Rs. bn) 18.57<br />

Free Float (Rs. bn) 3.68<br />

Dividend Yield (%) 1.5%<br />

Stock Data<br />

BSE Code 533299<br />

NSE Code BAJAJCORP<br />

Bloomberg BJCOR IN<br />

Reuters Code B<strong>AC</strong>O.BO<br />

52-Week Range (Rs.) 151.50/73.30<br />

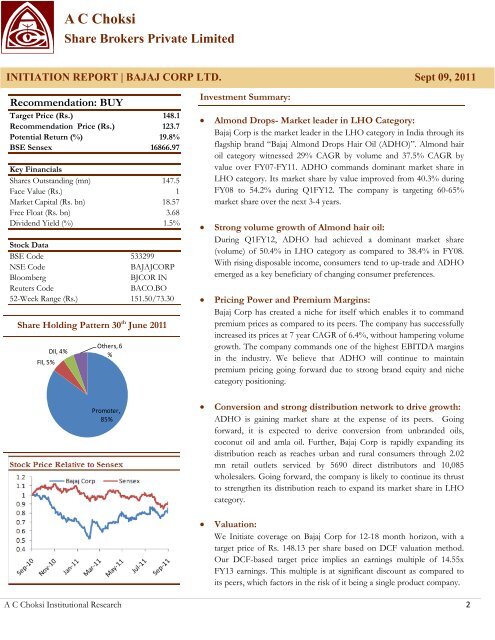

<strong>Share</strong> Holding Pattern 30 th June 2011<br />

FII, 5%<br />

DII, 4%<br />

Others, 6<br />

%<br />

Promoter,<br />

85%<br />

Investment Summary:<br />

• Almond Drops- Market leader in LHO Category:<br />

Bajaj Corp is the market leader in the LHO category in India through its<br />

flagship brand “Bajaj Almond Drops Hair Oil (ADHO)”. Almond hair<br />

oil category witnessed 29% CAGR by volume and 37.5% CAGR by<br />

value over FY07-FY11. ADHO <strong>com</strong>mands dominant market share in<br />

LHO category. Its market share by value improved from 40.3% during<br />

FY08 to 54.2% during Q1FY12. The <strong>com</strong>pany is targeting 60-65%<br />

market share over the next 3-4 years.<br />

• Strong volume growth of Almond hair oil:<br />

During Q1FY12, ADHO had achieved a dominant market share<br />

(volume) of 50.4% in LHO category as <strong>com</strong>pared to 38.4% in FY08.<br />

With rising disposable in<strong>com</strong>e, consumers tend to up-trade and ADHO<br />

emerged as a key beneficiary of changing consumer preferences.<br />

• Pricing Power and Premium Margins:<br />

Bajaj Corp has created a niche for itself which enables it to <strong>com</strong>mand<br />

premium prices as <strong>com</strong>pared to its peers. The <strong>com</strong>pany has successfully<br />

increased its prices at 7 year CAGR of 6.4%, without hampering volume<br />

growth. The <strong>com</strong>pany <strong>com</strong>mands one of the highest EBITDA margins<br />

in the industry. We believe that ADHO will continue to maintain<br />

premium pricing going forward due to strong brand equity and niche<br />

category positioning.<br />

• Conversion and strong distribution network to drive growth:<br />

ADHO is gaining market share at the expense of its peers. Going<br />

forward, it is expected to derive conversion from unbranded oils,<br />

coconut oil and amla oil. Further, Bajaj Corp is rapidly expanding its<br />

distribution reach as reaches urban and rural consumers through 2.02<br />

mn retail outlets serviced by 5690 direct distributors and 10,085<br />

wholesalers. Going forward, the <strong>com</strong>pany is likely to continue its thrust<br />

to strengthen its distribution reach to expand its market share in LHO<br />

category.<br />

• Valuation:<br />

We Initiate coverage on Bajaj Corp for 12-18 month horizon, with a<br />

target price of Rs. 148.13 per share based on DCF valuation method.<br />

Our DCF-based target price implies an earnings multiple of 14.55x<br />

FY13 earnings. This multiple is at significant discount as <strong>com</strong>pared to<br />

its peers, which factors in the risk of it being a single product <strong>com</strong>pany.<br />

A C <strong>Choksi</strong> Institutional Research 2