AC Choksi Share Brokers Private Limited - Myiris.com

AC Choksi Share Brokers Private Limited - Myiris.com

AC Choksi Share Brokers Private Limited - Myiris.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

A C <strong>Choksi</strong><br />

<strong>Share</strong> <strong>Brokers</strong> <strong>Private</strong> <strong>Limited</strong><br />

INITIATION REPORT | BAJAJ CORP LTD. Sept 09, 2011<br />

1600<br />

1400<br />

1200<br />

1000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

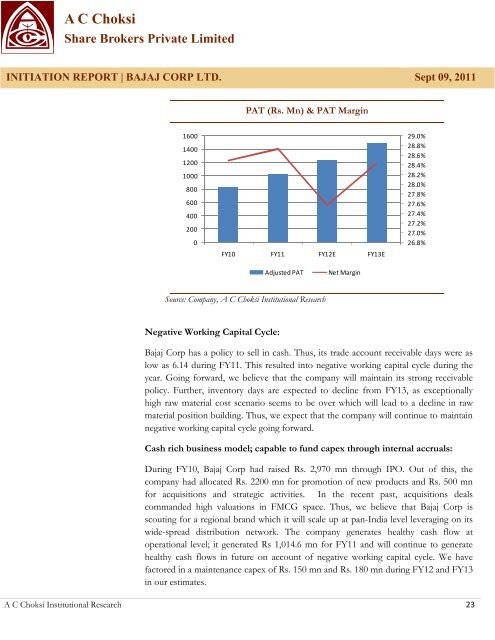

PAT (Rs. Mn) & PAT Margin<br />

FY10 FY11 FY12E FY13E<br />

Adjusted PAT Net Margin<br />

Source: Company, A C <strong>Choksi</strong> Institutional Research<br />

Negative Working Capital Cycle:<br />

A C <strong>Choksi</strong> Institutional Research 23<br />

29.0%<br />

28.8%<br />

28.6%<br />

28.4%<br />

28.2%<br />

28.0%<br />

27.8%<br />

27.6%<br />

27.4%<br />

27.2%<br />

27.0%<br />

26.8%<br />

Bajaj Corp has a policy to sell in cash. Thus, its trade account receivable days were as<br />

low as 6.14 during FY11. This resulted into negative working capital cycle during the<br />

year. Going forward, we believe that the <strong>com</strong>pany will maintain its strong receivable<br />

policy. Further, inventory days are expected to decline from FY13, as exceptionally<br />

high raw material cost scenario seems to be over which will lead to a decline in raw<br />

material position building. Thus, we expect that the <strong>com</strong>pany will continue to maintain<br />

negative working capital cycle going forward.<br />

Cash rich business model; capable to fund capex through internal accruals:<br />

During FY10, Bajaj Corp had raised Rs. 2,970 mn through IPO. Out of this, the<br />

<strong>com</strong>pany had allocated Rs. 2200 mn for promotion of new products and Rs. 500 mn<br />

for acquisitions and strategic activities. In the recent past, acquisitions deals<br />

<strong>com</strong>manded high valuations in FMCG space. Thus, we believe that Bajaj Corp is<br />

scouting for a regional brand which it will scale up at pan-India level leveraging on its<br />

wide-spread distribution network. The <strong>com</strong>pany generates healthy cash flow at<br />

operational level; it generated Rs 1,014.6 mn for FY11 and will continue to generate<br />

healthy cash flows in future on account of negative working capital cycle. We have<br />

factored in a maintenance capex of Rs. 150 mn and Rs. 180 mn during FY12 and FY13<br />

in our estimates.