Building Lifelong Relationships - NUSS

Building Lifelong Relationships - NUSS

Building Lifelong Relationships - NUSS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

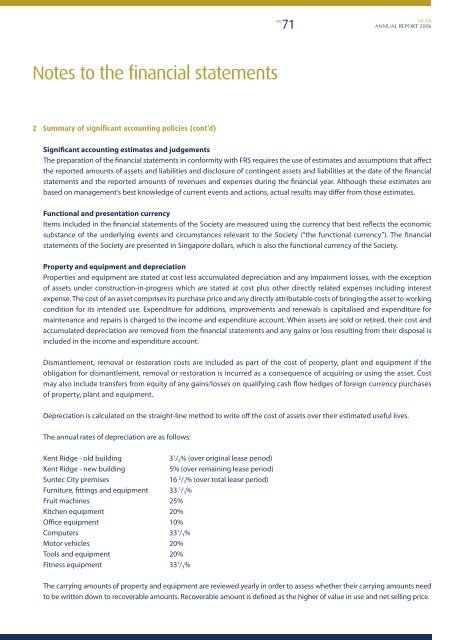

Notes to the financial statements<br />

2 Summary of significant accounting policies (cont’d)<br />

PG<br />

71<br />

<strong>NUSS</strong><br />

ANNUAl RepoRt 2006<br />

Significant accounting estimates and judgements<br />

The preparation of the financial statements in conformity with FRS requires the use of estimates and assumptions that affect<br />

the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial<br />

statements and the reported amounts of revenues and expenses during the financial year. Although these estimates are<br />

based on management’s best knowledge of current events and actions, actual results may differ from those estimates.<br />

Functional and presentation currency<br />

Items included in the financial statements of the Society are measured using the currency that best reflects the economic<br />

substance of the underlying events and circumstances relevant to the Society (“the functional currency”). The financial<br />

statements of the Society are presented in Singapore dollars, which is also the functional currency of the Society.<br />

Property and equipment and depreciation<br />

Properties and equipment are stated at cost less accumulated depreciation and any impairment losses, with the exception<br />

of assets under construction-in-progress which are stated at cost plus other directly related expenses including interest<br />

expense. The cost of an asset comprises its purchase price and any directly attributable costs of bringing the asset to working<br />

condition for its intended use. Expenditure for additions, improvements and renewals is capitalised and expenditure for<br />

maintenance and repairs is charged to the income and expenditure account. When assets are sold or retired, their cost and<br />

accumulated depreciation are removed from the financial statements and any gains or loss resulting from their disposal is<br />

included in the income and expenditure account.<br />

Dismantlement, removal or restoration costs are included as part of the cost of property, plant and equipment if the<br />

obligation for dismantlement, removal or restoration is incurred as a consequence of acquiring or using the asset. Cost<br />

may also include transfers from equity of any gains/losses on qualifying cash flow hedges of foreign currency purchases<br />

of property, plant and equipment.<br />

Depreciation is calculated on the straight-line method to write off the cost of assets over their estimated useful lives.<br />

The annual rates of depreciation are as follows:<br />

Kent Ridge - old building 3 1 /3% (over original lease period)<br />

Kent Ridge - new building 5% (over remaining lease period)<br />

Suntec City premises 16 2 /3% (over total lease period)<br />

Furniture, fittings and equipment 33 1 /3%<br />

Fruit machines 25%<br />

Kitchen equipment 20%<br />

Office equipment 10%<br />

Computers 33 1 /3%<br />

Motor vehicles 20%<br />

Tools and equipment 20%<br />

Fitness equipment 33 1 /3%<br />

The carrying amounts of property and equipment are reviewed yearly in order to assess whether their carrying amounts need<br />

to be written down to recoverable amounts. Recoverable amount is defined as the higher of value in use and net selling price.