Aktsiaselts Tallink Grupp - NASDAQ OMX Baltic

Aktsiaselts Tallink Grupp - NASDAQ OMX Baltic

Aktsiaselts Tallink Grupp - NASDAQ OMX Baltic

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FINANCIAL STATEMENTS FOR THE FINANCIAL YEAR ENDED AUGUST 31, 2005<br />

NOTES TO THE FINANCIAL STATEMENTS—(Continued)<br />

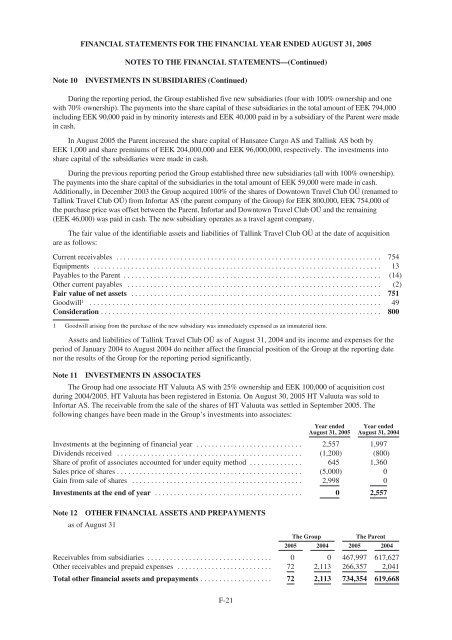

Note 10 INVESTMENTS IN SUBSIDIARIES (Continued)<br />

During the reporting period, the Group established five new subsidiaries (four with 100% ownership and one<br />

with 70% ownership). The payments into the share capital of these subsidiaries in the total amount of EEK 794,000<br />

including EEK 90,000 paid in by minority interests and EEK 40,000 paid in by a subsidiary of the Parent were made<br />

in cash.<br />

In August 2005 the Parent increased the share capital of Hansatee Cargo AS and <strong>Tallink</strong> AS both by<br />

EEK 1,000 and share premiums of EEK 204,000,000 and EEK 96,000,000, respectively. The investments into<br />

share capital of the subsidiaries were made in cash.<br />

During the previous reporting period the Group established three new subsidiaries (all with 100% ownership).<br />

The payments into the share capital of the subsidiaries in the total amount of EEK 59,000 were made in cash.<br />

Additionally, in December 2003 the Group acquired 100% of the shares of Downtown Travel Club OÜ (renamed to<br />

<strong>Tallink</strong> Travel Club OÜ) from Infortar AS (the parent company of the Group) for EEK 800,000, EEK 754,000 of<br />

the purchase price was offset between the Parent, Infortar and Downtown Travel Club OÜ and the remaining<br />

(EEK 46,000) was paid in cash. The new subsidiary operates as a travel agent company.<br />

The fair value of the identifiable assets and liabilities of <strong>Tallink</strong> Travel Club OÜ at the date of acquisition<br />

are as follows:<br />

Current receivables ...................................................................... 754<br />

Equipments ............................................................................ 13<br />

Payables to the Parent .................................................................... (14)<br />

Other current payables ................................................................... (2)<br />

Fair value of net assets .................................................................. 751<br />

Goodwill 1 ............................................................................. 49<br />

Consideration .......................................................................... 800<br />

1 Goodwill arising from the purchase of the new subsidiary was immediately expensed as an immaterial item.<br />

Assets and liabilities of <strong>Tallink</strong> Travel Club OÜ as of August 31, 2004 and its income and expenses for the<br />

period of January 2004 to August 2004 do neither affect the financial position of the Group at the reporting date<br />

nor the results of the Group for the reporting period significantly.<br />

Note 11 INVESTMENTS IN ASSOCIATES<br />

The Group had one associate HT Valuuta AS with 25% ownership and EEK 100,000 of acquisition cost<br />

during 2004/2005. HT Valuuta has been registered in Estonia. On August 30, 2005 HT Valuuta was sold to<br />

Infortar AS. The receivable from the sale of the shares of HT Valuuta was settled in September 2005. The<br />

following changes have been made in the Group’s investments into associates:<br />

Year ended<br />

August 31, 2005<br />

Year ended<br />

August 31, 2004<br />

Investments at the beginning of financial year ............................ 2,557 1,997<br />

Dividends received ................................................. (1,200) (800)<br />

Share of profit of associates accounted for under equity method .............. 645 1,360<br />

Salespriceofshares................................................. (5,000) 0<br />

Gainfromsaleofshares ............................................. 2,998 0<br />

Investments at the end of year ....................................... 0 2,557<br />

Note 12 OTHER FINANCIAL ASSETS AND PREPAYMENTS<br />

as of August 31<br />

The Group The Parent<br />

2005 2004 2005 2004<br />

Receivables from subsidiaries ................................. 0 0 467,997 617,627<br />

Other receivables and prepaid expenses ......................... 72 2,113 266,357 2,041<br />

Total other financial assets and prepayments ................... 72 2,113 734,354 619,668<br />

F-21