Aktsiaselts Tallink Grupp - NASDAQ OMX Baltic

Aktsiaselts Tallink Grupp - NASDAQ OMX Baltic

Aktsiaselts Tallink Grupp - NASDAQ OMX Baltic

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FINANCIAL STATEMENTS FOR THE FINANCIAL YEAR ENDED AUGUST 31, 2004<br />

NOTES TO THE FINANCIAL STATEMENTS—(Continued)<br />

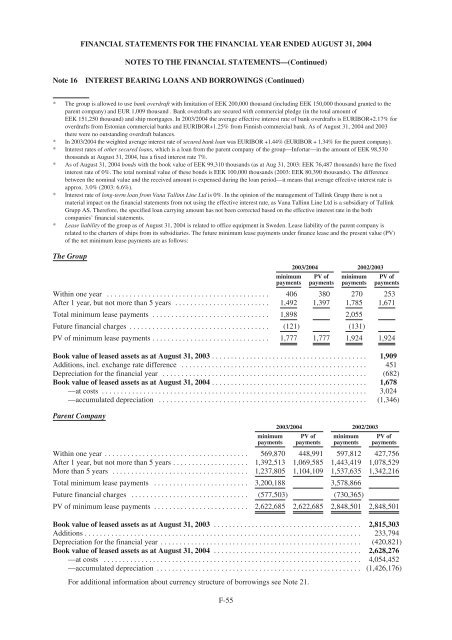

Note 16 INTEREST BEARING LOANS AND BORROWINGS (Continued)<br />

* The group is allowed to use bank overdraft with limitation of EEK 200,000 thousand (including EEK 150,000 thousand granted to the<br />

parent company) and EUR 1,009 thousand . Bank overdrafts are secured with commercial pledge (in the total amount of<br />

EEK 151,250 thousand) and ship mortgages. In 2003/2004 the average effective interest rate of bank overdrafts is EURIBOR+2.17% for<br />

overdrafts from Estonian commercial banks and EURIBOR+1.25% from Finnish commercial bank. As of August 31, 2004 and 2003<br />

there were no outstanding overdraft balances.<br />

* In 2003/2004 the weighted average interest rate of secured bank loan was EURIBOR +1.44% (EURIBOR + 1.34% for the parent company).<br />

* Interest rates of other secured loans, which is a loan from the parent company of the group—Infortar—in the amount of EEK 98,530<br />

thousands at August 31, 2004, has a fixed interest rate 7%.<br />

* As of August 31, 2004 bonds with the book value of EEK 99,310 thousands (as at Aug 31, 2003: EEK 76,487 thousands) have the fixed<br />

interest rate of 0%. The total nominal value of these bonds is EEK 100,000 thousands (2003: EEK 80,390 thousands). The difference<br />

between the nominal value and the received amount is expensed during the loan period—it means that average effective interest rate is<br />

approx. 3.0% (2003: 6.6%).<br />

* Interest rate of long-term loan from Vana Tallinn Line Ltd is 0%. In the opinion of the management of <strong>Tallink</strong> <strong>Grupp</strong> there is not a<br />

material impact on the financial statements from not using the effective interest rate, as Vana Tallinn Line Ltd is a subsidiary of <strong>Tallink</strong><br />

<strong>Grupp</strong> AS. Therefore, the specified loan carrying amount has not been corrected based on the effective interest rate in the both<br />

companies’ financial statements.<br />

* Lease liability of the group as of August 31, 2004 is related to office equipment in Sweden. Lease liability of the parent company is<br />

related to the charters of ships from its subsidiaries. The future minimum lease payments under finance lease and the present value (PV)<br />

of the net minimum lease payments are as follows:<br />

The Group<br />

minimum<br />

payments<br />

2003/2004 2002/2003<br />

PV of<br />

payments minimum<br />

payments<br />

PV of<br />

payments<br />

Within one year ........................................... 406 380 270 253<br />

After 1 year, but not more than 5 years ......................... 1,492 1,397 1,785 1,671<br />

Total minimum lease payments ............................... 1,898 2,055<br />

Future financial charges ..................................... (121) (131)<br />

PV of minimum lease payments ............................... 1,777 1,777 1,924 1,924<br />

Book value of leased assets as at August 31, 2003 ......................................... 1,909<br />

Additions, incl. exchange rate difference ................................................. 451<br />

Depreciation for the financial year ...................................................... (682)<br />

Book value of leased assets as at August 31, 2004 ......................................... 1,678<br />

—atcosts ...................................................................... 3,024<br />

—accumulated depreciation ....................................................... (1,346)<br />

Parent Company<br />

minimum<br />

payments<br />

2003/2004 2002/2003<br />

PV of<br />

payments<br />

minimum<br />

payments<br />

PV of<br />

payments<br />

Within one year ...................................... 569,870 448,991 597,812 427,756<br />

After 1 year, but not more than 5 years .................... 1,392,513 1,069,585 1,443,419 1,078,529<br />

More than 5 years .................................... 1,237,805 1,104,109 1,537,635 1,342,216<br />

Total minimum lease payments ......................... 3,200,188 3,578,866<br />

Future financial charges ............................... (577,503) (730,365)<br />

PV of minimum lease payments ......................... 2,622,685 2,622,685 2,848,501 2,848,501<br />

Book value of leased assets as at August 31, 2003 ....................................... 2,815,303<br />

Additions......................................................................... 233,794<br />

Depreciation for the financial year ..................................................... (420,821)<br />

Book value of leased assets as at August 31, 2004 ....................................... 2,628,276<br />

—atcosts .................................................................... 4,054,452<br />

—accumulated depreciation ...................................................... (1,426,176)<br />

For additional information about currency structure of borrowings see Note 21.<br />

F-55