Aktsiaselts Tallink Grupp - NASDAQ OMX Baltic

Aktsiaselts Tallink Grupp - NASDAQ OMX Baltic

Aktsiaselts Tallink Grupp - NASDAQ OMX Baltic

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FINANCIAL STATEMENTS FOR THE FINANCIAL YEAR ENDED AUGUST 31, 2005<br />

NOTES TO THE FINANCIAL STATEMENTS—(Continued)<br />

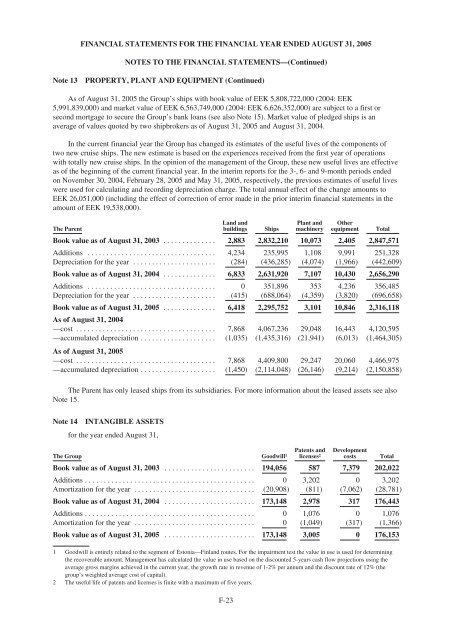

Note 13 PROPERTY, PLANT AND EQUIPMENT (Continued)<br />

As of August 31, 2005 the Group’s ships with book value of EEK 5,808,722,000 (2004: EEK<br />

5,991,839,000) and market value of EEK 6,563,749,000 (2004: EEK 6,626,352,000) are subject to a first or<br />

second mortgage to secure the Group’s bank loans (see also Note 15). Market value of pledged ships is an<br />

average of values quoted by two shipbrokers as of August 31, 2005 and August 31, 2004.<br />

In the current financial year the Group has changed its estimates of the useful lives of the components of<br />

two new cruise ships. The new estimate is based on the experiences received from the first year of operations<br />

with totally new cruise ships. In the opinion of the management of the Group, these new useful lives are effective<br />

as of the beginning of the current financial year. In the interim reports for the 3-, 6- and 9-month periods ended<br />

on November 30, 2004, February 28, 2005 and May 31, 2005, respectively, the previous estimates of useful lives<br />

were used for calculating and recording depreciation charge. The total annual effect of the change amounts to<br />

EEK 26,051,000 (including the effect of correction of error made in the prior interim financial statements in the<br />

amount of EEK 19,538,000).<br />

Land and<br />

Plant and Other<br />

The Parent<br />

buildings Ships machinery equipment Total<br />

Book value as of August 31, 2003 .............. 2,883 2,832,210 10,073 2,405 2,847,571<br />

Additions .................................. 4,234 235,995 1,108 9,991 251,328<br />

Depreciation for the year ...................... (284) (436,285) (4,074) (1,966) (442,609)<br />

Book value as of August 31, 2004 .............. 6,833 2,631,920 7,107 10,430 2,656,290<br />

Additions .................................. 0 351,896 353 4,236 356,485<br />

Depreciation for the year ...................... (415) (688,064) (4,359) (3,820) (696,658)<br />

Book value as of August 31, 2005 .............. 6,418 2,295,752 3,101 10,846 2,316,118<br />

As of August 31, 2004<br />

—cost ..................................... 7,868 4,067,236 29,048 16,443 4,120,595<br />

—accumulated depreciation ....................<br />

As of August 31, 2005<br />

(1,035) (1,435,316) (21,941) (6,013) (1,464,305)<br />

—cost ..................................... 7,868 4,409,800 29,247 20,060 4,466,975<br />

—accumulated depreciation .................... (1,450) (2,114,048) (26,146) (9,214) (2,150,858)<br />

The Parent has only leased ships from its subsidiaries. For more information about the leased assets see also<br />

Note 15.<br />

Note 14 INTANGIBLE ASSETS<br />

for the year ended August 31,<br />

The Group Goodwill1 Patents and<br />

licenses2 Development<br />

costs Total<br />

Book value as of August 31, 2003 ........................ 194,056 587 7,379 202,022<br />

Additions............................................. 0 3,202 0 3,202<br />

Amortization for the year ................................ (20,908) (811) (7,062) (28,781)<br />

Book value as of August 31, 2004 ........................ 173,148 2,978 317 176,443<br />

Additions............................................. 0 1,076 0 1,076<br />

Amortization for the year ................................ 0 (1,049) (317) (1,366)<br />

Book value as of August 31, 2005 ........................ 173,148 3,005 0 176,153<br />

1 Goodwill is entirely related to the segment of Estonia—Finland routes. For the impairment test the value in use is used for determining<br />

the recoverable amount. Management has calculated the value in use based on the discounted 5-years cash flow projections using the<br />

average gross margins achieved in the current year, the growth rate in revenue of 1-2% per annum and the discount rate of 12% (the<br />

group’s weighted average cost of capital).<br />

2 The useful life of patents and licenses is finite with a maximum of five years.<br />

F-23