Aktsiaselts Tallink Grupp - NASDAQ OMX Baltic

Aktsiaselts Tallink Grupp - NASDAQ OMX Baltic

Aktsiaselts Tallink Grupp - NASDAQ OMX Baltic

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FINANCIAL STATEMENTS FOR THE FINANCIAL YEAR ENDED AUGUST 31, 2005<br />

NOTES TO THE FINANCIAL STATEMENTS—(Continued)<br />

Note 12 OTHER FINANCIAL ASSETS AND PREPAYMENTS (Continued)<br />

As of August 31, 2005 the receivables from subsidiaries consists of the following loans granted to<br />

subsidiaries:<br />

(1) to <strong>Tallink</strong> Ltd in the amount of EEK 120,997,000 (2004: EEK 120,997,000) with 2014 as the maturity<br />

date and interest rate of 6%;<br />

(2) to Victory Line Ltd in the amount of EEK 347,000,000 (2004: EEK 496,630,000) with a non-agreed<br />

maturity date and an interest rate of 0%. In the opinion of the Parent’s management there is not a<br />

material impact on the financial statements from not using the effective interest rate, as<br />

Victory Line Ltd is a fully-owned subsidiary of the Parent. Therefore, the specified loan carrying<br />

amount has not been adjusted with the effective interest rate in either company’s financial statements.<br />

The split between current and non-current assets has been made based on the estimate of the Parent’s<br />

management of the actual payments in the next financial year.<br />

The short-term portion of the loans specified above in the total amount of EEK 158,685,000 (2004:<br />

EEK 147,821,000) has been recorded under current receivables (see Note 8).<br />

As of August 31,2005 and 2004 other receivables and prepaid expenses of the Group included long-term<br />

prepayment (term-less).<br />

As of August 31,2005 the balance of other receivables and prepaid expenses of the Parent includes the<br />

additional prepayments made for the new ships of <strong>Tallink</strong> Sea Line Ltd and <strong>Tallink</strong> Hansaway Ltd (subsidiaries).<br />

The specified prepayments have been recorded as a prepayment for property, plant and equipment in the balance<br />

sheet of the Group—see also Note 13.<br />

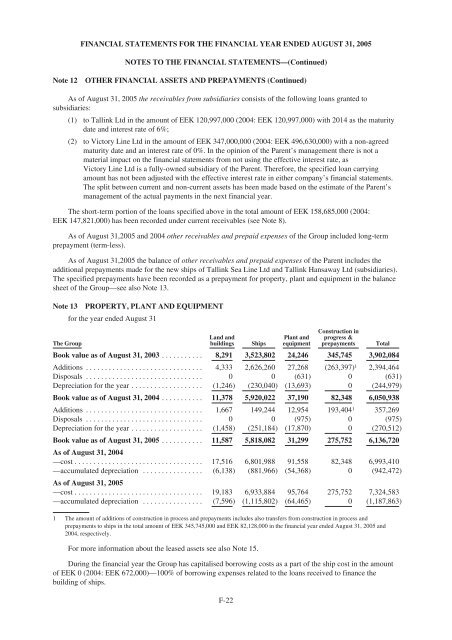

Note 13 PROPERTY, PLANT AND EQUIPMENT<br />

for the year ended August 31<br />

Land and<br />

Plant and<br />

Construction in<br />

progress &<br />

The Group<br />

buildings Ships equipment prepayments Total<br />

Book value as of August 31, 2003 ........... 8,291 3,523,802 24,246 345,745 3,902,084<br />

Additions ............................... 4,333 2,626,260 27,268 (263,397) 1 2,394,464<br />

Disposals ............................... 0 0 (631) 0 (631)<br />

Depreciation for the year ................... (1,246) (230,040) (13,693) 0 (244,979)<br />

Book value as of August 31, 2004 ........... 11,378 5,920,022 37,190 82,348 6,050,938<br />

Additions ............................... 1,667 149,244 12,954 193,404 1 357,269<br />

Disposals ............................... 0 0 (975) 0 (975)<br />

Depreciation for the year ................... (1,458) (251,184) (17,870) 0 (270,512)<br />

Book value as of August 31, 2005 ........... 11,587 5,818,082 31,299 275,752 6,136,720<br />

As of August 31, 2004<br />

—cost .................................. 17,516 6,801,988 91,558 82,348 6,993,410<br />

—accumulated depreciation ................<br />

As of August 31, 2005<br />

(6,138) (881,966) (54,368) 0 (942,472)<br />

—cost .................................. 19,183 6,933,884 95,764 275,752 7,324,583<br />

—accumulated depreciation ................ (7,596) (1,115,802) (64,465) 0 (1,187,863)<br />

1 The amount of additions of construction in process and prepayments includes also transfers from construction in process and<br />

prepayments to ships in the total amount of EEK 345,745,000 and EEK 82,128,000 in the financial year ended August 31, 2005 and<br />

2004, respectively.<br />

For more information about the leased assets see also Note 15.<br />

During the financial year the Group has capitalised borrowing costs as a part of the ship cost in the amount<br />

of EEK 0 (2004: EEK 672,000)—100% of borrowing expenses related to the loans received to finance the<br />

building of ships.<br />

F-22