Aktsiaselts Tallink Grupp - NASDAQ OMX Baltic

Aktsiaselts Tallink Grupp - NASDAQ OMX Baltic

Aktsiaselts Tallink Grupp - NASDAQ OMX Baltic

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FINANCIAL STATEMENTS FOR THE FINANCIAL YEAR ENDED AUGUST 31, 2005<br />

Note 17 SHARE CAPITAL (Continued)<br />

NOTES TO THE FINANCIAL STATEMENTS—(Continued)<br />

At AS <strong>Tallink</strong> <strong>Grupp</strong> Shareholders’ General Meeting on February 5, 2005 AS <strong>Tallink</strong> <strong>Grupp</strong> increased the share<br />

capital from EEK 275,000,000 to EEK 1,100,000,000 by issuing 82,500,000 new shares with a par value of EEK 10<br />

each. This increase was a bonus issue, i.e. new shares were issued on account of share premium in the amount of<br />

EEK 414,870,000 and retained earnings in the amount of EEK 410,130,000. Therefore, the Parent’s shareholders<br />

received three new shares for each share they owned before the issue.<br />

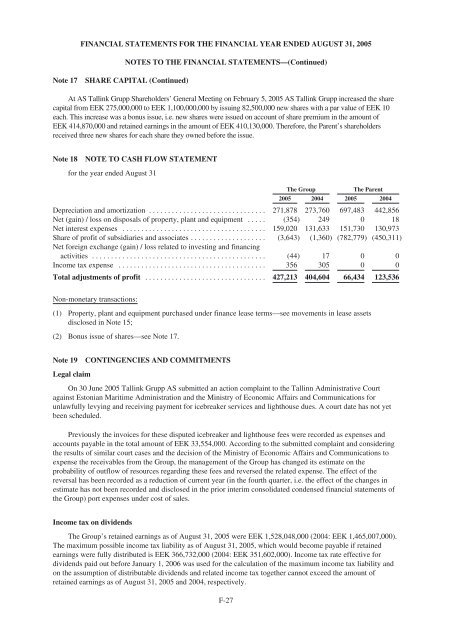

Note 18 NOTE TO CASH FLOW STATEMENT<br />

for the year ended August 31<br />

The Group The Parent<br />

2005 2004 2005 2004<br />

Depreciation and amortization ............................... 271,878 273,760 697,483 442,856<br />

Net (gain) / loss on disposals of property, plant and equipment ..... (354) 249 0 18<br />

Net interest expenses ...................................... 159,020 131,633 151,730 130,973<br />

Share of profit of subsidiaries and associates ....................<br />

Net foreign exchange (gain) / loss related to investing and financing<br />

(3,643) (1,360) (782,779) (450,311)<br />

activities .............................................. (44) 17 0 0<br />

Income tax expense ....................................... 356 305 0 0<br />

Total adjustments of profit ................................ 427,213 404,604 66,434 123,536<br />

Non-monetary transactions:<br />

(1) Property, plant and equipment purchased under finance lease terms—see movements in lease assets<br />

disclosed in Note 15;<br />

(2) Bonus issue of shares—see Note 17.<br />

Note 19 CONTINGENCIES AND COMMITMENTS<br />

Legal claim<br />

On 30 June 2005 <strong>Tallink</strong> <strong>Grupp</strong> AS submitted an action complaint to the Tallinn Administrative Court<br />

against Estonian Maritime Administration and the Ministry of Economic Affairs and Communications for<br />

unlawfully levying and receiving payment for icebreaker services and lighthouse dues. A court date has not yet<br />

been scheduled.<br />

Previously the invoices for these disputed icebreaker and lighthouse fees were recorded as expenses and<br />

accounts payable in the total amount of EEK 33,554,000. According to the submitted complaint and considering<br />

the results of similar court cases and the decision of the Ministry of Economic Affairs and Communications to<br />

expense the receivables from the Group, the management of the Group has changed its estimate on the<br />

probability of outflow of resources regarding these fees and reversed the related expense. The effect of the<br />

reversal has been recorded as a reduction of current year (in the fourth quarter, i.e. the effect of the changes in<br />

estimate has not been recorded and disclosed in the prior interim consolidated condensed financial statements of<br />

the Group) port expenses under cost of sales.<br />

Income tax on dividends<br />

The Group’s retained earnings as of August 31, 2005 were EEK 1,528,048,000 (2004: EEK 1,465,007,000).<br />

The maximum possible income tax liability as of August 31, 2005, which would become payable if retained<br />

earnings were fully distributed is EEK 366,732,000 (2004: EEK 351,602,000). Income tax rate effective for<br />

dividends paid out before January 1, 2006 was used for the calculation of the maximum income tax liability and<br />

on the assumption of distributable dividends and related income tax together cannot exceed the amount of<br />

retained earnings as of August 31, 2005 and 2004, respectively.<br />

F-27