Annual Report 2012.pdf - Cherry

Annual Report 2012.pdf - Cherry

Annual Report 2012.pdf - Cherry

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Part 2 notes<br />

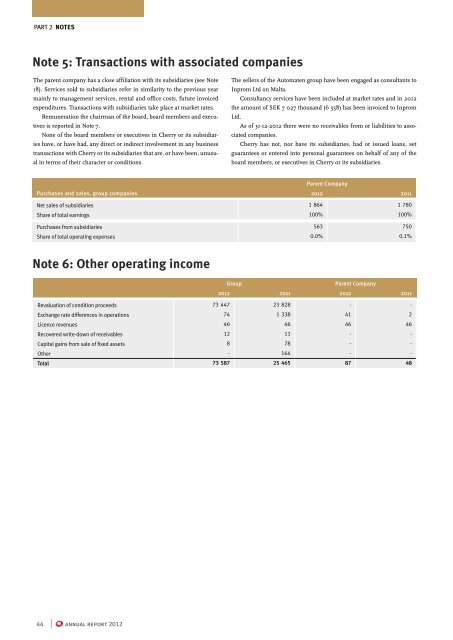

Note 5: Transactions with associated companies<br />

The parent company has a close affiliation with its subsidiaries (see Note<br />

18). Services sold to subsidiaries refer in similarity to the previous year<br />

mainly to management services, rental and office costs, future invoiced<br />

expenditures. Transactions with subsidiaries take place at market rates.<br />

Remuneration the chairman of the board, board members and executives<br />

is reported in Note 7.<br />

None of the board members or executives in <strong>Cherry</strong> or its subsidiaries<br />

have, or have had, any direct or indirect involvement in any business<br />

transactions with <strong>Cherry</strong> or its subsidiaries that are, or have been, unusual<br />

in terms of their character or conditions.<br />

Note 6: Other operating income<br />

44 | annual report 2012<br />

The sellers of the Automaten group have been engaged as consultants to<br />

Inprom Ltd on Malta.<br />

Consultancy services have been included at market rates and in 2012<br />

the amount of SEK 7 027 thousand (6 558) has been invoiced to Inprom<br />

Ltd.<br />

As of 31-12-2012 there were no receivables from or liabilities to associated<br />

companies.<br />

<strong>Cherry</strong> has not, nor have its subsidiaries, had or issued loans, set<br />

guarantees or entered into personal guarantees on behalf of any of the<br />

board members, or executives in <strong>Cherry</strong> or its subsidiaries.<br />

Parent Company<br />

Purchases and sales, group companies 2012 2011<br />

Net sales of subsidiaries 1 864 1 780<br />

Share of total earnings 100% 100%<br />

Purchases from subsidiaries 563 750<br />

Share of total operating expenses 0.0% 0.1%<br />

Group Parent Company<br />

2012 2011 2012 2011<br />

Revaluation of condition proceeds 73 447 23 828 - -<br />

Exchange rate differences in operations 74 1 338 41 2<br />

Licence revenues 46 46 46 46<br />

Recovered write-down of receivables 12 11 - -<br />

Capital gains from sale of fixed assets 8 78 - -<br />

Other - 164 - -<br />

Total 73 587 25 465 87 48