Annual Report 2012.pdf - Cherry

Annual Report 2012.pdf - Cherry

Annual Report 2012.pdf - Cherry

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Part 2 notes<br />

50 | annual report 2012<br />

Group Parent Company<br />

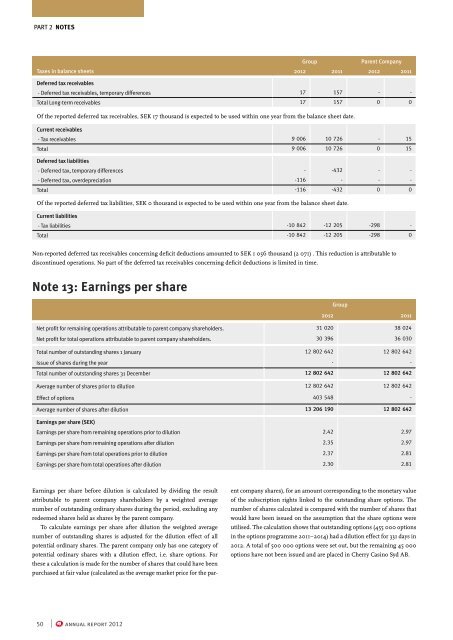

Taxes in balance sheets 2012 2011 2012 2011<br />

Deferred tax receivables<br />

- Deferred tax receivables, temporary differences 17 157 - -<br />

Total Long-term receivables 17 157 0 0<br />

Of the reported deferred tax receivables, SEK 17 thousand is expected to be used within one year from the balance sheet date.<br />

Current receivables<br />

- Tax receivables 9 006 10 726 - 15<br />

Total 9 006 10 726 0 15<br />

Deferred tax liabilities<br />

- Deferred tax, temporary differences - -432 - -<br />

- Deferred tax, overdepreciation -116 - - -<br />

Total -116 -432 0 0<br />

Of the reported deferred tax liabilities, SEK 0 thousand is expected to be used within one year from the balance sheet date.<br />

Current liabilities<br />

- Tax liabilities -10 842 -12 205 -298 -<br />

Total -10 842 -12 205 -298 0<br />

Non-reported deferred tax receivables concerning deficit deductions amounted to SEK 1 056 thousand (2 071) . This reduction is attributable to<br />

discontinued operations. No part of the deferred tax receivables concerning deficit deductions is limited in time.<br />

Note 13: Earnings per share<br />

Earnings per share before dilution is calculated by dividing the result<br />

attributable to parent company shareholders by a weighted average<br />

number of outstanding ordinary shares during the period, excluding any<br />

redeemed shares held as shares by the parent company.<br />

To calculate earnings per share after dilution the weighted average<br />

number of outstanding shares is adjusted for the dilution effect of all<br />

potential ordinary shares. The parent company only has one category of<br />

potential ordinary shares with a dilution effect, i.e. share options. For<br />

these a calculation is made for the number of shares that could have been<br />

purchased at fair value (calculated as the average market price for the par-<br />

Group<br />

2012 2011<br />

Net profit for remaining operations attributable to parent company shareholders. 31 020 38 024<br />

Net profit for total operations attributable to parent company shareholders. 30 396 36 030<br />

Total number of outstanding shares 1 January 12 802 642 12 802 642<br />

Issue of shares during the year - -<br />

Total number of outstanding shares 31 December 12 802 642 12 802 642<br />

Average number of shares prior to dilution 12 802 642 12 802 642<br />

Effect of options 403 548 -<br />

Average number of shares after dilution 13 206 190 12 802 642<br />

Earnings per share (SEK)<br />

Earnings per share from remaining operations prior to dilution 2.42 2.97<br />

Earnings per share from remaining operations after dilution 2.35 2.97<br />

Earnings per share from total operations prior to dilution 2.37 2.81<br />

Earnings per share from total operations after dilution 2.30 2.81<br />

ent company shares), for an amount corresponding to the monetary value<br />

of the subscription rights linked to the outstanding share options. The<br />

number of shares calculated is compared with the number of shares that<br />

would have been issued on the assumption that the share options were<br />

utilised. The calculation shows that outstanding options (455 000 options<br />

in the options programme 2011–2014) had a dilution effect for 331 days in<br />

2012. A total of 500 000 options were set out, but the remaining 45 000<br />

options have not been issued and are placed in <strong>Cherry</strong> Casino Syd AB.