Annual Report 2012.pdf - Cherry

Annual Report 2012.pdf - Cherry

Annual Report 2012.pdf - Cherry

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Part 2 notes<br />

Note 30: Acquisition of companies<br />

ADJUSTMENTS IN 2012 OF PREVIOUS ACQUISITIONS<br />

AUTOMATENGRUPPEN<br />

The terms and conditions required for payment of the conditional proceeds<br />

have not been met. The liability for these proceeds has therefore<br />

been valued to zero. Since the acquisition was implemented after IFRS 3<br />

began to be applied, the revaluation of SEK 73 446 thousand (23 828)<br />

has been reported in the income statement (included in Other operating<br />

income) in the consolidated financial statements.<br />

Note 32: Discontinued operations<br />

MARITIME OPERATIONS<br />

<strong>Cherry</strong> completed on 8 November 2012 the sale of all shares in <strong>Cherry</strong><br />

Maritime Gaming AB, Astral Maritime Services Ltd and <strong>Cherry</strong> Services<br />

Ltd to Bell Casino AB. The discontinued operations have previously comprised<br />

the Maritime segment, which has now been completely discon-<br />

58 | annual report 2012<br />

The goodwill attributable to the Automaten group has undergone an<br />

impairment test, whereby a write-down requirement of SEK 73 447<br />

thousand was identified. See also Note 15.<br />

During the year no payments concerning conditional proceeds have<br />

been made for the Automaten group.<br />

Note 31: Transactions with holdings without controlling influence<br />

TRANSACTIONS 2012<br />

On 23 February 2012 <strong>Cherry</strong> reached an agreement on the acquisition of<br />

additional shares in the partly-owned subsidiary <strong>Cherry</strong> Services Ltd and<br />

in Briseis Development Corporation. <strong>Cherry</strong> previously owned 55 percent<br />

of the shares and votes in the companies and the agreement concerns the<br />

remaining 45 percent. The proceeds amounted to SEK 1 382 thousand<br />

and were paid in cash on entry.<br />

Since <strong>Cherry</strong> already had a controlling influence in the company, the acquisition<br />

was reported as equity transactions in accordance with IAS 27.<br />

<strong>Cherry</strong> Services Ltd and Briseis Development Corporation were included<br />

in the Maritime business operations that were discontinued during the<br />

year.<br />

tinued as a result of the sale. <strong>Cherry</strong> received total proceeds of SEK 36.3<br />

million for shares, dividends from the sold companies and repayment of<br />

group loans that had been issued to the discontinued companies.<br />

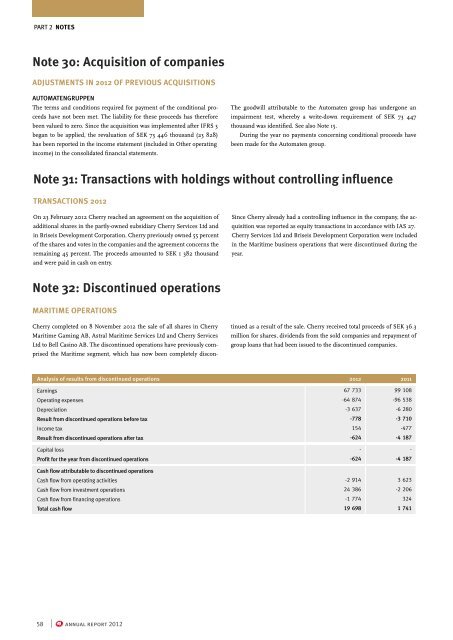

Analysis of results from discontinued operations 2012 2011<br />

Earnings 67 733 99 108<br />

Operating expenses -64 874 -96 538<br />

Depreciation -3 637 -6 280<br />

Result from discontinued operations before tax -778 -3 710<br />

Income tax 154 -477<br />

Result from discontinued operations after tax -624 -4 187<br />

Capital loss - -<br />

Profit for the year from discontinued operations -624 -4 187<br />

Cash flow attributable to discontinued operations<br />

Cash flow from operating activities -2 914 3 623<br />

Cash flow from investment operations 24 386 -2 206<br />

Cash flow from financing operations -1 774 324<br />

Total cash flow 19 698 1 741