Graduate diploma - The Chartered Institute of Purchasing and Supply

Graduate diploma - The Chartered Institute of Purchasing and Supply

Graduate diploma - The Chartered Institute of Purchasing and Supply

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

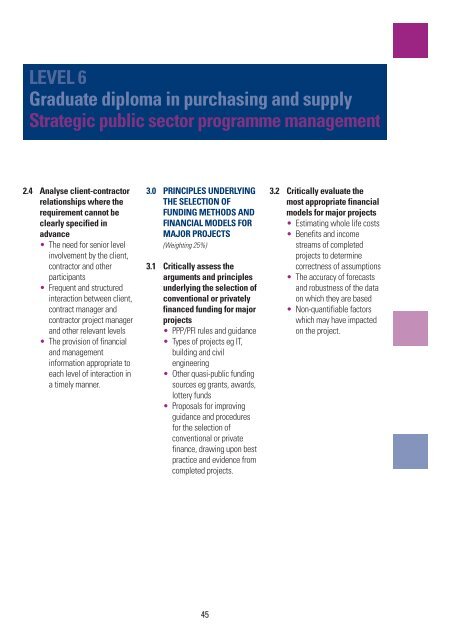

2.4 Analyse client-contractor<br />

relationships where the<br />

requirement cannot be<br />

clearly specified in<br />

advance<br />

• <strong>The</strong> need for senior level<br />

involvement by the client,<br />

contractor <strong>and</strong> other<br />

participants<br />

• Frequent <strong>and</strong> structured<br />

interaction between client,<br />

contract manager <strong>and</strong><br />

contractor project manager<br />

<strong>and</strong> other relevant levels<br />

• <strong>The</strong> provision <strong>of</strong> financial<br />

<strong>and</strong> management<br />

information appropriate to<br />

each level <strong>of</strong> interaction in<br />

a timely manner.<br />

3.0 PRINCIPLES UNDERLYING<br />

THE SELECTION OF<br />

FUNDING METHODS AND<br />

FINANCIAL MODELS FOR<br />

MAJOR PROJECTS<br />

(Weighting 25%)<br />

3.1 Critically assess the<br />

arguments <strong>and</strong> principles<br />

underlying the selection <strong>of</strong><br />

conventional or privately<br />

financed funding for major<br />

projects<br />

• PPP/PFI rules <strong>and</strong> guidance<br />

• Types <strong>of</strong> projects eg IT,<br />

building <strong>and</strong> civil<br />

engineering<br />

• Other quasi-public funding<br />

sources eg grants, awards,<br />

lottery funds<br />

• Proposals for improving<br />

guidance <strong>and</strong> procedures<br />

for the selection <strong>of</strong><br />

conventional or private<br />

finance, drawing upon best<br />

practice <strong>and</strong> evidence from<br />

completed projects.<br />

45<br />

3.2 Critically evaluate the<br />

most appropriate financial<br />

models for major projects<br />

• Estimating whole life costs<br />

• Benefits <strong>and</strong> income<br />

streams <strong>of</strong> completed<br />

projects to determine<br />

correctness <strong>of</strong> assumptions<br />

• <strong>The</strong> accuracy <strong>of</strong> forecasts<br />

<strong>and</strong> robustness <strong>of</strong> the data<br />

on which they are based<br />

• Non-quantifiable factors<br />

which may have impacted<br />

on the project.