ETHICS IN FINANCE: SURVIVING THE CRISIS ETHICS IN ...

ETHICS IN FINANCE: SURVIVING THE CRISIS ETHICS IN ...

ETHICS IN FINANCE: SURVIVING THE CRISIS ETHICS IN ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Finance & the Common Good / Bien Commun N° 33 - I / 2009<br />

<strong>ETHICS</strong> <strong>IN</strong> F<strong>IN</strong>ANCE<br />

ROB<strong>IN</strong> COSGROVE PRIZE<br />

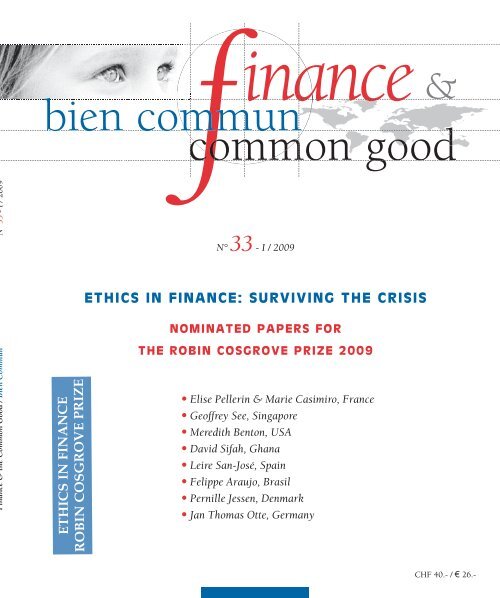

N° 33 - I / 2009<br />

<strong>ETHICS</strong> <strong>IN</strong> F<strong>IN</strong>ANCE: SURVIV<strong>IN</strong>G <strong>THE</strong> <strong>CRISIS</strong><br />

NOM<strong>IN</strong>ATED PAPERS FOR<br />

<strong>THE</strong> ROB<strong>IN</strong> COSGROVE PRIZE 2009<br />

• Elise Pellerin & Marie Casimiro, France<br />

• Geoffrey See, Singapore<br />

• Meredith Benton, USA<br />

• David Sifah, Ghana<br />

• Leire San-José, Spain<br />

• Felippe Araujo, Brasil<br />

• Pernille Jessen, Denmark<br />

• Jan Thomas Otte, Germany<br />

CHF 40.- / € 26.-

© Observatoire de la Finance - ISSN 1422-4658<br />

Finance & the Common Good / Bien Commun<br />

(Financial Ethics Review - Revue d’éthique financière)<br />

is a publication of the Observatoire de la Finance<br />

24, rue de l’Athénée, 1206 Geneva, Switzerland,<br />

Phone +41 (0)22 346 30 35, Fax +41 (0)22 789 14 60,<br />

Email office@obsfin.ch, Website: www.obsfin.ch<br />

Editorial officer and Layout : Sibilla La Spina<br />

Printer: Grafix, Gdansk (Poland)<br />

The Editors welcome contributions concerning the above mentioned topics<br />

provided they are coherent with the mission of Finance & the Common Good /<br />

Bien Commmun (see page 100).<br />

All texts (3’000 words - 18’000 characters including blank spaces) will be<br />

carefully reviewed.<br />

You are welcome to include illustrations, tables, or graphs and to indicate two or<br />

three interesting and recent publications regarding the issue in question. Please<br />

avoid footnotes.<br />

For suggestions of Book Reviews and News Monitor please contact<br />

Sibilla La Spina (office@obsfin.ch).

Finance & the Common Good/Bien Commun<br />

•<br />

•<br />

•<br />

•<br />

•<br />

•<br />

•<br />

•<br />

•<br />

•<br />

•<br />

•<br />

•<br />

•<br />

•<br />

•<br />

•<br />

Helen Alford O.P.<br />

Pontificia Università San Tommaso, Roma<br />

Jan Krzysztof Bielecki<br />

Bank Pekao SA, Warsaw<br />

Hans J. Blommestein<br />

OECD, Paris and Tilburg University<br />

S. J.Chang<br />

Illinois State University, Normal<br />

Marc Chesney<br />

University of Zurich<br />

Andrew Cornford<br />

Financial Markets Center<br />

Henri-Claude de Bettignies<br />

<strong>IN</strong>SEAD, Fontainebleau<br />

John Dobson<br />

California Polytechnic, San Luis Obispo<br />

Edouard Dommen<br />

Bellevue<br />

Andrew Hilton<br />

Centre for the Study of Financial Innovations,<br />

London<br />

Reinaldo Gonçalves<br />

Federal University of Rio de Janeiro<br />

Lubomir Mlcoch<br />

Charles University, Prague<br />

Business Ethics Center, Budapest<br />

Centre for Study of Financial Innovations,<br />

London<br />

Fédération Européenne des Finances et<br />

Banques Ethiques et Alternatives (FEBEA),<br />

Paris<br />

Finansol, Paris<br />

Institute of Business Ethics, London<br />

EDITORS<br />

Paul H. Dembinski and Jean-Michel Bonvin<br />

ADVISORY BOARD<br />

PARTNER <strong>IN</strong>STITUTIONS<br />

•<br />

•<br />

•<br />

•<br />

•<br />

•<br />

•<br />

•<br />

•<br />

•<br />

•<br />

•<br />

•<br />

•<br />

•<br />

•<br />

•<br />

•<br />

Maria Nowak<br />

Association pour le Droit à l’Initiative<br />

Economique, Paris<br />

Etienne Perrot<br />

Université Catholique de Paris<br />

Udo Reifner<br />

Institut für Finanzdienstleistungen e.V.,<br />

Hamburg<br />

Ahmed Abdel Karim Rifaat<br />

Islamic Financial Services Board,<br />

Kuala Lumpur<br />

Ernesto Rossi di Montelera<br />

Observatoire de la Finance, Genève<br />

Antoine de Salins<br />

Semaines Sociales de France, Bruxelles<br />

Jean-Michel Servet<br />

Institut universitaire d’études du développement<br />

(IUED), Genève<br />

Crocker Snow<br />

Money Matters Institute, Boston<br />

Justin Welby<br />

Church of England, Coventry<br />

Stefano Zamagni<br />

University of Bologna<br />

Laszlo Zsolnai<br />

Business Ethics Center, Budapest<br />

Instituto Empresa y Humanismo, Pamplona<br />

Microfinance Center, Warsaw<br />

Money Matters Institute, Boston<br />

Réseau de Financement Alternatif, Namur<br />

Réseau Européen de Microfinance, Paris<br />

SiRi Company Ltd, Fribourg<br />

UNIAPAC, Bruxelles<br />

1

Ethics in Finance<br />

n° 33 - I/2009<br />

Editorial / Éditorial<br />

Ethics in Finance: Surviving the Crisis /<br />

Ethique en finance : au-delà de la crise..............................................................<br />

Nominated Papers for the Robin Cosgrove Prize 2009<br />

Du bon usage de l’Ordre dans le désordre de la finance<br />

Elise Pellerin & Marie Casimiro..........................................................................<br />

Internationalism, Institutions and Individuals:<br />

Systemic Changes for a Systemic Ethical Crisis<br />

Geoffrey See...........................................................................................................<br />

Emotions, Personal Ethics and Professional Life: the Lost Link<br />

Meredith Benton....................................................................................................<br />

Ethics: an Essential Prerequisite of the Financial System<br />

David Sifah............................................................................................................<br />

Ethical Cash Management? A Possible Solution<br />

Leire San-José........................................................................................................<br />

Ethics: the Key to Credibility<br />

Felippe Araujo.......................................................................................................<br />

Investing as if People and Planet Mattered<br />

Pernille Jessen........................................................................................................<br />

Virtuous Enterprises: the Place of Christian Ethics<br />

Jan Thomas Otte....................................................................................................<br />

5<br />

16<br />

26<br />

38<br />

46<br />

58<br />

68<br />

78<br />

87<br />

3

Ethics in Finance:<br />

Surviving the Crisis<br />

In September 2007, when we<br />

awarded the first ‘Ethics of Finance<br />

Robin Cosgrove Prize’ the world<br />

was only just starting to evaluate<br />

the extent of the financial crisis<br />

that was to follow. It was only one<br />

year later, in October 2008, that things were to become clearer to everyone. The<br />

world was sitting on a financial bomb that public munitions experts tried to defuse<br />

as soon as the first signs of danger appeared. An explosion that would lead to<br />

a serious economic and social crisis had to be avoided at all costs.<br />

Even if the G20 Summit in Pittsburgh in September 2009 seems to be sending<br />

out a clear message that there is a return to economic growth, other less encouraging<br />

signs suggest that the page may not yet have been fully turned.<br />

As the financial crisis becomes more obvious, the ethical questions linked to<br />

both behaviour, to the mechanisms of and structures of finance are vying for top<br />

place on a list of priorities. Be it the question of confidence, methods of remuneration,<br />

conflicts of interest of governments defaulting, all these issues have an<br />

ethical dimension.<br />

Ethique en finance :<br />

au-delà de la crise<br />

En septembre 2007, au moment<br />

de la remise du premier<br />

« Ethique en finance, Prix Robin<br />

Cosgrove », le monde commençait<br />

seulement à prendre la mesure de<br />

la crise financière dans laquelle il<br />

allait s’engouffrer. Ce n’est qu’une année plus tard, en octobre 2008, que les choses<br />

allait devenir plus claires pour tous. Le monde était assis sur une bombe financière,<br />

que les artificiers publics se sont employés à désamorcer dès les premiers<br />

dangers. Il fallait en effet éviter à tout prix que l’explosion de la finance n’entraîne<br />

une grave crise économique et sociale.<br />

Même si le sommet du G20 de Pittsburgh en septembre 2009 semble délivrer<br />

un message clair de sortie de la crise, d’autres signaux moins réjouissants suggèrent<br />

que la page pourrait ne pas être encore tout à fait tournée.<br />

Au fur et à mesure que la crise financière devient plus évidente, les questions<br />

éthiques liées à la fois aux comportements, aux mécanismes et à la structure de<br />

la finance se frayent une place de choix sur la liste des priorités. Qu’il s’agisse de<br />

confiance, de modes de rémunération, de conflits d’intérêts, ou de défaillances de<br />

EDITORIAL / ÉDITORIAL<br />

5

6<br />

It was in early 2008 that the second ‘Ethics in Finance Robin Cosgrove Prize’<br />

was launched. The huge success of the first edition and the obvious actuality of the<br />

questions, the promoters - the Cosgrove family and the Observatoire de la Finance<br />

- decided to renew the award, in spite of the important effort that this entailed. It<br />

was also in early 2008 that MAPFRE decided to support an Ibero-American edi-<br />

tion of the Prize, which<br />

opened it to Spanish<br />

and Portuguese texts.<br />

The philosophy of<br />

the prize has remained<br />

unchanged: it is open<br />

to relatively short contributions that are written by practitioners, students and<br />

academics alike. They should be under 35 years old, and concern the broad field<br />

of finance and ethics. At the deadline, at the end of May 2009, over 150 potential<br />

candidates had applied, which led to about thirty acceptable texts. The texts and<br />

expression of interest came from all over the world: Algeria, Argentina, Australia,<br />

Austria, Belgium, Bolivia, Brazil, Cameroon, Canada, China, Columbia, Denmark,<br />

Equator, France, Germany, Great Britain, Iceland, Italy, Kenya, Kyrgyzstan, Mauritania,<br />

Mexico, Morocco, New Zealand, Nigeria, Pakistan, Peru, The Philippines,<br />

Poland, Portugal, Rumania, Singapore, Slovenia, Spain, South Korea, Switzerland,<br />

Turkey, Uganda, Ukraine, the United States, Vietnam and Zimbabwe. The authors<br />

range from doctoral students to people who hold MBAs, professionals in the field<br />

of finance, and are both men and women.<br />

The themes that were covered in this second edition of the Prize touched on<br />

financial education and literacy, the role of the emotions in decision-making, the<br />

systemic dimension of global finance, and the sociology of financial exclusion, as<br />

well as ethics and deontology of the financial professions, regulations and ethics<br />

and corporate social responsibility.<br />

This edition of Finance & the Common Good/Bien Commun includes the texts of<br />

the 8 nominees for the 2008-2009 Prize.<br />

The ‘Ethics of Finance Robin Cosgrove Prize’ has testified on a daily basis that<br />

it is possible to receive testimonials of good will and spontaneous help. Sibila La<br />

Spina successfully managed the different aspects of the project and made sure that<br />

it moved forward. Nelson Vera provided support, particularly in the launching of<br />

the Ibero-American edition. The two international juries also gave their help and<br />

support, and worked extremely hard reading about eight papers each.<br />

The promotional Committee, made up of Robin’s friends, family and ex-colleagues<br />

all did excellent work spreading the word. Last but not least, this could<br />

not have taken place without the help of our generous sponsors, particularly<br />

MAPFRE, Guardian Wealth Management, RAB Capital and Harvey McGrath in<br />

raising the prize money. Several bodies also helped ensure that the information<br />

on the Prize was publicised. These include New Europe, The IMF Institute, Bar-<br />

Be it the question of confidence, methods of<br />

remuneration, conflicts of interest of governments<br />

defaulting, all these issues have an ethical dimension.<br />

F<strong>IN</strong>ANCE & <strong>THE</strong> COMMON GOOD/BIEN COMMUN - N° 33 - I/2009

gouvernance, toutes ces préoccupations ont une dimension éthique.<br />

C’est au début de 2008 que la deuxième édition du « Ethique en finance, Prix<br />

Robin Cosgrove » a été lancée. En effet, fort de son succès de la première édition<br />

et de l’évidente actualité des problématiques, les promoteurs, la famille Cosgrove<br />

et l’Observatoire de la Finance, ont décidé de reconduire l’opération en dépit de<br />

l’effort important que cela supposait. C’est aussi en début de 2008 que MAPFRE<br />

a décidé de soutenir une édition ibéro-américaine du Prix, l’ouvrant ainsi aux<br />

textes hispaniques et lusophones.<br />

D’une édition à l’autre, le Prix n’a pas changé sa philosophie : il est ouvert aux<br />

contributions relativement brèves, provenant aussi bien des praticiens que d’universitaires<br />

de moins de 35 ans, portant sur la vaste thématique du rapport entre<br />

la finance et l’éthique. A la fin du délai d’inscription, à fin mai 2009, plus de 150<br />

candidats potentiels s’étaient annoncés, donnant lieu à près de trente contributions<br />

susceptibles d’être retenues. Les textes et expressions d’intérêt sont venus<br />

du monde entier, d’Algérie, Allemagne, Angleterre, Argentine, Australie, Autriche,<br />

Belgique, Bolivie, Brésil, Cameroun, Canada, Chine, Corée du Sud, Colombie,<br />

Equateur, Danemark, Espagne, Etats-Unis, France, Ghana, Grèce, Guatemala,<br />

Hongrie, Inde, Indoné-<br />

sie, Iran, Irlande, Islande,<br />

Italie, Kenya,<br />

Kirghizstan, Maroc,<br />

Mauritanie, Mexique,<br />

Nouvelle-Zélande, Nigeria,<br />

Pakistan, Pérou, Philippines, Pologne, Portugal, Roumanie, Singapour,<br />

Slovénie, Suisse, Turquie, Uganda, Ukraine, Vietnam et Zimbabwe. Les auteurs<br />

sont des doctorants, des détenteurs d’un MBA, des professionnels de la finance,<br />

hommes et femmes.<br />

Qu’il s’agisse de confiance, de modes de rémunération,<br />

de conflits d’intérêts, ou de défaillances de gouvernance,<br />

toutes ces préoccupations ont une dimension éthique.<br />

Les thèmes abordés lors de cette deuxième édition du Prix ont touché l’éducation<br />

à la finance, le rôle des émotions dans les décisions, la dimension systémique<br />

de la finance mondiale, et sociologique de l’exclusion financière, l’éthique et la<br />

déontologie des professions de la finance, la réglementation, ainsi que l’éthique et<br />

la responsabilité sociale des entreprises.<br />

Ce numéro de Finance & the Common Good/Bien Commun regroupe les textes<br />

des 8 nominés de l’édition 2008-2009 du Prix.<br />

L’« Ethique en finance, Prix Robin Cosgrove », nous a permis de faire quotidiennement<br />

l’expérience de témoignages de bonne volonté et d’aide spontanée.<br />

Sibilla La Spina est parvenue à gérer les différents aspects du projet et à faire en<br />

sorte que celui-ci aille de l’avant ; Nelson Vera l’a assistée, notamment dans le<br />

lancement de l’édition ibéro-américaine. De l’aide et de la bonne volonté ont été<br />

apportées par les deux Jurys internationaux, qui ont travaillé dur, avec une lecture<br />

de l’ordre de 8 papiers par personne.<br />

EDITORIAL / ÉDITORIAL<br />

7

8<br />

clays Bank plc, Fortis Bank, Wealth Briefing, EthicsWorld, EIRIS, The Carnegie<br />

Council for Policy Innovations, PriceWaterhouseCoopers and Netimpact.<br />

We wish to extend our warmest thanks all our partners, and we already look<br />

forward to announce a third edition of the ‘Ethics in Finance Robin Cosgrove<br />

Prize’ - including an Ibero-American chapter - that will be launched in early<br />

2010.<br />

The co-chairs of the Prize<br />

Dr Carol Cosgrove-Sacks<br />

Dr Paul H. Dembinski<br />

The nominated papers for the 2006/2007 edition of the ‘Ethics in Finance Robin<br />

Cosgrove Prize’ where published on Finance & the Common Good/Bien Commun,<br />

no27, II/2007, and on the website www.robincosgroveprize.org.<br />

F<strong>IN</strong>ANCE & <strong>THE</strong> COMMON GOOD/BIEN COMMUN - N° 33 - I/2009

Le Comité promotionnel, composé d’amis de Robin, de sa famille et d’anciens<br />

collègues, a fait un excellent travail de diffusion de l’information. Enfin, tout ceci<br />

n’aurait pas eu lieu sans l’apport de sponsors généreux, en particulier MAPFRE,<br />

Guardian Wealth Management, RAB Capital et Harvey Mc Grath au budget du<br />

Prix. Plusieurs collaborations - afin d’assurer la diffusion de l’information sur le<br />

Prix - ont aussi été mises sur pied avec New Europe, l’Institut du FMI, Barclays<br />

Bank plc, Fortis Bank, Wealth Briefing, EthicsWorld, EIRIS, le Carnegie Council<br />

for Policy Innovations, PricewaterhouseCoopers et NetImpact.<br />

Nous remercions chaleureusement tous nos partenaires et nous pouvons d’ores<br />

et déjà annoncer qu’une troisième édition du « Ethique en finance, Prix Robin<br />

Cosgrove » - avec un chapitre ibéro-américain - sera lancée en début 2010.<br />

Les coprésidents du Prix<br />

Dr Carol Cosgrove-Sacks<br />

Dr Paul H. Dembinski<br />

Les papiers nominés pour l’édition 2006/2007 de l’« Ethique en Finance Prix<br />

Robin Cosgrove »ont été publiés dans Finance & the Common Good/Bien Commun,<br />

no27, II/2007, est sur le site Internet www.robincosgroveprize.org.<br />

EDITORIAL / ÉDITORIAL<br />

9

10<br />

The Jury of the Robin Cosgrove Prize<br />

This Jury has been delegated by the organisers with the task of selecting the most meritorious contributions<br />

from the eligible candidates and of designating the prizewinners for the Robin Cosgrove Prize.<br />

The Jury is composed of eminent persons who sit in their private capacity on a pro bono basis.<br />

Prof. Marc Chesney is Professor of Finance at the University of Zurich. Previously<br />

in Paris, he was Professor and Associate Dean at HEC, President of the CEBC (Centre<br />

d’Etudes sur le Blanchiment et la Corruption) and an external expert with the World<br />

Bank. He has published articles and books in the areas of quantitative Finance and also of<br />

financial crime mechanisms. In addition, he focuses on the subject of Ethics and Finance.<br />

At the University of Zurich, he is member of the Board of the Graduate Programme for<br />

interdisciplinary Research in Ethics and co-organizer of the Ethical Finance Research Series.<br />

He is also member of the advisory Board of Finance & Common Good/Bien Commun.<br />

Marc Chesney holds a Ph.D. in Finance from the University of Geneva and obtained his<br />

Habilitation from the Sorbonne University.<br />

Robin’s mother, Dr Carol Cosgrove-Sacks, lives and works in Geneva. She<br />

was formerly Director of Trade in the United Nations in Geneva (1994-2005); since 2006<br />

she is a Professor at the College of Europe, Bruges; a Professor at the Europa Institute,<br />

University of Basel; and the Senior Advisor on International Standards Policy to OASIS,<br />

the global eBusiness standards organisation. She also maintains interest in some British<br />

academic centres, including the Institute of Development Studies (IDS), University of<br />

Sussex, and the Centre for Euro-Asian Studies (CEAS),University of Reading.<br />

Prof. Henri-Claude de Bettignies holds the AVIVA Chair in Leadership and<br />

Responsibility and is Emeritus Professor of Asian Business and Comparative Management<br />

at <strong>IN</strong>SEAD. He is also Distinguished Professor of Global Responsible Leadership at the<br />

China Europe International Business School (CEIBS), in Shanghai. He had been teaching<br />

ethics at Stanford Business School (for the last 16 years), and he started and led the development<br />

of the ethics initiative at <strong>IN</strong>SEAD before moving to China where currently he is<br />

creating, with CEIBS, the Euro-China Centre for Leadership and Responsibility. Professor<br />

de Bettignies is director of AVIRA, an <strong>IN</strong>SEAD programme pioneering a new approach to<br />

enlighten CEOs. Henri-Claude was the founder of the Euro-Asia Centre at <strong>IN</strong>SEAD, seeds<br />

of <strong>IN</strong>SEAD successful development in Asia. He is the Founder and Director of CEDRE<br />

(Centre for the Study of Development and Responsibility), Chairman of the LVMH Asia<br />

Scholarships, member of the Editorial Board of five academic journals and he is a member<br />

of the Board of Jones Lang LaSalle.<br />

F<strong>IN</strong>ANCE & <strong>THE</strong> COMMON GOOD/BIEN COMMUN - N° 33 - I/2009

Prof. Paul H. Dembinski is the initiator and Director of the Foundation of the<br />

Observatoire de la Finance. The mission of the Observatoire de la Finance is to promote<br />

awareness of ethical concerns in financial activities and the financial sector. Paul H. Dembinski<br />

is the founder and editor of the quarterly bilingual journal entitled Finance & the<br />

Common Good/Bien Commun. In parallel, he is partner and co-founder (with Alain Schoenenberger)<br />

of Eco’Diagnostic, an independent economic research institute working for<br />

both government and private clients in Switzerland and elsewhere. Paul H. Dembinski is<br />

also Professor at University of Fribourg where he teaches International Competition and<br />

Strategy.<br />

Dr Robert Alan Feldman is the Chief Economist and Co-Director of Japan Research<br />

at Morgan Stanley Japan Securities Co., Ltd. As part of Morgan Stanley’s global economics<br />

team, he is responsible for forecasting the Japanese economy and interest rates. He<br />

is a regular commentator on World Business Satellite, the nightly business program of TV<br />

Tokyo. Prior to joining Morgan Stanley in 1998, Robert Feldman was the chief economist<br />

for Japan for Salomon Brothers from 1990-97. He worked for the International Monetary<br />

Fund from 1983-89, in the Asian, European, and Research Departments. Robert Feldman<br />

has a Ph.D. in Economics from the Massachusetts Institute of Technology, where he concentrated<br />

on international finance and development. He did his undergraduate work at<br />

Yale University, where he took BAs in both Economics and in Japanese Studies, graduating<br />

phi beta kappa, summa cum laude. Before he entered graduate school, he worked at<br />

both the Federal Reserve Bank of New York and at the Chase Manhattan Bank.<br />

Dr Philippa Foster Back has over 25 years of business experience. She began her<br />

career at Citibank NA before joining Bowater in their Corporate Treasury Department in<br />

1979, leaving in 1988 as Group Treasurer. She was Group Finance Director at DG Gardner<br />

Group, a training organisation, prior to joining Thorn EMI in 1993 as Group Treasurer.<br />

She was appointed Institute of Business Ethics’ Director in August 2001. Philippa<br />

Foster Back has a number of external appointments, including at the Ministry of Defence,<br />

The Institute of Directors and the Association of Corporate Treasurers, where she was<br />

President from 1999 to 2000. In 2006 she was appointed Chairman of the UK Antarctic<br />

Heritage Trust.<br />

<strong>THE</strong> JURY<br />

11

12<br />

Dr Andrew Hilton is Director of the Centre for the Study of Financial Innovation,<br />

a non-profit think-tank, supported by 65 City institutions, that looks at the future of the<br />

global financial system. The CSFI was set up 13 years ago, and has since published three<br />

books and around 80 reports. More significantly, it has organized well over 750 roundtables<br />

on issues of pressing interest in the financial services sector including EMU, the<br />

single market, the Internet, small business finance, high-tech start-ups, microfinance and<br />

regulation. Andrew Hilton also runs a small economic and financial consultancy. He has<br />

worked for the World Bank in Washington and has run a financial advisory service for<br />

the Financial Times in New York. He is a board member of the Observatoire de la finance<br />

in Geneva. Andrew Hilton has a PhD from the University of Pennsylvania, an MBA from<br />

Wharton and an MA from New College, Oxford. He was appointed OBE in 2005.<br />

Mr Peter Gakunu is Alternate Executive Director at the International Monetary<br />

Fund in charge of Africa Group One constituency. Before joining the Fund, he served as<br />

Special Advisor to the Kenya Cabinet in charge of economic reforms from February 2003<br />

to October 2004. In September 2000, he joined the ‘Dream Team’, a team of high level<br />

personalities put together by the World Bank and UNDP to advise the Kenya Government<br />

on reforms. He worked as Economic Secretary and Director of Planning in the Ministry of<br />

Finance and Planning until December 2002. He coordinated the first Poverty Reduction<br />

Strategy Paper for Kenya. In 2003 he was appointed Permanent Secretary in the Ministry<br />

of Environment. Prior to returning to Kenya, he worked with the African Caribbean and<br />

Pacific Group in Brussels from 1986 to 2000 as Director of Trade, and from 1977 to 1986<br />

as Trade Expert in the ACP Secretariat. Peter Gakunu has known Robin for a long time.<br />

Mr Peter O’Connor is an experienced global and regional asset allocation and<br />

manager selection adviser for financial institutions, family offices and charities. He is<br />

Chairman/Lead Director of a number of publicly quoted investment/production companies<br />

with particular personal experience in Asia for the past 30 years. After boarding<br />

school in Ireland, Peter O’Connor read Economics and Law at Trinity College Dublin<br />

and King’s Inns Dublin respectively. He has lived and worked in London and Hong Kong,<br />

and he travelled frequently to most Asian countries, Canada and emerging economies in<br />

Europe.<br />

F<strong>IN</strong>ANCE & <strong>THE</strong> COMMON GOOD/BIEN COMMUN - N° 33 - I/2009

Mr Jean-Christophe Pernollet is the partner in charge of the Geneva office<br />

of PricewaterhouseCoopers. He is 40 years old, a graduate from IEP and EDHEC and has<br />

completed the Columbia Business School Senior Executive Program. As a Lead bank auditor<br />

recognized by the Federal Banking Commission, he is a financial services industry<br />

specialist and benefits from more than fifteen years of working experience, of which three<br />

in Paris and two in New York. PricewaterhouseCoopers, the global Assurance, Advisory<br />

and Tax and Legal Services leading firm, employs close to 300 people in Geneva in those<br />

three service lines.<br />

After taking his degree at Oxford University, Mr John Plender joined Deloitte,<br />

Plender, Griffiths & Co in the City of London in 1967, qualifying as a chartered accountant<br />

in 1970. He then moved into journalism and became financial editor of The Economist<br />

in 1974, where he remained until joining the UK Foreign Office policy planning staff in<br />

1980. On leaving the Foreign Office, he became a senior editorial writer and columnist<br />

at the Financial Times, an assignment he combined until recently with current affairs<br />

broadcasting for the BBC and Channel 4. A past chairman of Pensions and Investment<br />

Research Consultants (PIRC), John Plender has served on the London Stock Exchange’s<br />

quality of markets advisory committee and the UK government’s Company Law Review<br />

steering group. He is a non-executive director of Quintain PLC, a FTSE 250 company.<br />

His latest book, All You Need To Know About Ethics And Finance, is published by Longtail<br />

Publishing.<br />

Mr Domingo Sugranyes graduated from the University of Fribourg, Switzerland,<br />

in 1969. He was General Secretary of the International Christian Union of Business<br />

Executives (UNIAPAC), between 1973 and 1981. He joined MAPFRE, Spain’s leading<br />

insurance group in 1981. He was active in the international development of the group<br />

in Latin America and in Reinsurance worldwide. From 1989 to 2007 he was in charge of<br />

the group’s listed holding company and member of the group’s executive. After retiring<br />

from executive positions he remains on the Board of the MAPFRE Foundation and of several<br />

group companies. As complementary activities, Domingo Sugranyes was President<br />

of UNIAPAC from 1997/2000 and vice-chairman of the Board of Centesimus Annus Pro<br />

Pontifice Foundation, a Vatican Center for Christian Social Teaching.<br />

Canon Justin Welby was previously a senior executive in a UK oil company,<br />

before ordination in the Church of England. For many years, he was responsible for the<br />

reconciliation work of Coventry Cathedral, travelling widely in Africa and the Middle<br />

East. He is presently Dean of Liverpool Cathedral. Justin Welby has written extensively<br />

on ethics and finance.<br />

<strong>THE</strong> JURY<br />

13

14<br />

The Jury of the Ibero-American edition<br />

Juan José Almagro is PhD ‘cum laude’ in Labour Science, BA in Law (specializing<br />

in Public Law), attorney and also studied economics. He is honorary professor with the<br />

Complutense University of Madrid and professor and coordinator of its master’s degree<br />

programme in Social Responsibility. He spent his entire career at MAPFRE, having held<br />

several senior executive positions, including President of the Human Resources Unit.<br />

Presently Juan José Almagro is Group Director of Communication and Social Responsibility<br />

and Vice President of the MAPFRE Institute for Social Action. He is also Member of the<br />

board of MAPFRE FAMILIAR S.A.<br />

Roberto Delgado Gallart has been an active promoter, researcher and leader<br />

in the Non-Profit-Third Sector for over the past 26 years. He has developed and accomplished<br />

meaningful projects in the benefit of the poorest in México, as well as been an<br />

educator of many classes of new professionals in social work. In 2004 he received the<br />

National Altruism Award, given by the Association of Private Assistance Institutions. He<br />

is founder and chairman of CLARES (Latinamerican Center for Social Responsability)<br />

hosted by the Anáhuac University in México City, which offers the Diploma on Private<br />

Non Profit Management and the first and only Graduate Program in Latin America in<br />

Social Responsibility Studies.<br />

Paul H. Dembinski is the initiator and Director of the Foundation of the Observatoire<br />

de la Finance. The mission of the Observatoire de la Finance is to promote awareness<br />

of ethical concerns in financial activities and the financial sector. Paul H. Dembinski is<br />

the founder and editor of the quarterly bilingual journal entitled Finance & the Common<br />

Good/Bien Commun. In parallel, he is partner and co-founder (with Alain Schoenenberger)<br />

of Eco’Diagnostic, an independent economic research institute working for both government<br />

and private clients in Switzerland and elsewhere. Paul H. Dembinski is also Professor<br />

at University of Fribourg where he teaches International Competition and Strategy.<br />

Eduard Dommen is a specialist in economic ethics. He was a university professor<br />

at each end of his career, but he was mainly a researcher with the United Nations<br />

Conference on Trade and Development (UNCTAD). He has advised several governments<br />

on issues of money and taxation. For 17 years he was administrator of a philanthropic<br />

trust which managed its funds according to ethical principles. He was a founder member<br />

of the ethics council of the Swiss Alternative Bank; he is a member of the committee of<br />

the Swiss ethical shareholder association Actares. He has been a member of the board of<br />

micro credit institutions, municipal and international. He has published extensively on<br />

economic ethics in general and financial ethics in particular.<br />

F<strong>IN</strong>ANCE & <strong>THE</strong> COMMON GOOD/BIEN COMMUN - N° 33 - I/2009

Filomeno Mira Candel joined the MAPFRE Insurance Group at the end of 1970<br />

as an industrial risk prevention engineer, and since then has held several positions of high<br />

responsibility in the Group. Currently, he is Vice-Chairman of the board of Trustees of<br />

Fundación MAPFRE, the main stockholder of the new MAPFRE, S.A., and Chairman of<br />

its Executive Committee. After retiring from executive positions, he remains member of<br />

the Board of MAPFRE, S.A. and other MAPFRE Group companies.<br />

Paul-André Sanglard was Member of the Executive Board of the World Economic<br />

Forum and lecturer in Public Finance at the University of Geneva. Since 1989, he<br />

is consultant and independent non executive board member of various companies and<br />

foundations. Today he is Chairman of the Board of the Vaudoise Assurances Group, of the<br />

Banque Cantonale du Jura, of the Ophthalmologic Network Organization and of British<br />

American Tobacco (Switzerland).<br />

Simão Davi Silber is Professor of Economics at the University of Sao Paulo, Department<br />

of Economics, and also Researcher at Foundation of Economic Research (FIPE).<br />

He hold a PhD in Economics of the Yale University. His last publications are: ‘Políticas<br />

Comerciais Comparadas: Desempenho e Modelos Organizacionais’ (with Marcos Jank,<br />

Editora Saraiva, 2007), and ‘Gestão de Negócios Internacionais’ (with Marcos Vasconcelos<br />

and Miguel Ferreira, Editora Saraiva, 2006).<br />

Domingo Sugranyes graduated from the University of Fribourg, Switzerland, in<br />

1969. He was General Secretary of the International Christian Union of Business Executives<br />

(UNIAPAC), between 1973 and 1981. He joined MAPFRE, Spain’s leading insurance<br />

group in 1981. He was active in the international development of the group in Latin<br />

America and in Reinsurance worldwide. From 1989 to 2007 he was in charge of the<br />

group’s listed holding company and member of the group’s executive. After retiring from<br />

executive positions he remains on the Board of the MAPFRE Foundation and of several<br />

group companies.<br />

<strong>THE</strong> JURY<br />

15

16<br />

Elise Pellerin<br />

Analyste éthique<br />

&<br />

Marie Casimiro<br />

Assistante Gérant<br />

de Portefeuille,<br />

Ethiea Gestion, Paris<br />

Philosophers know<br />

that ethics and morals<br />

are quite distinct from<br />

one another.<br />

D<br />

u bon usage de l’Ordre<br />

dans le désordre de la finance<br />

Winner ex-aequo of the Robin Cosgrove Prize<br />

Lorsque la prospérité règne, et<br />

que les marchés financiers semblent<br />

vouloir monter au ciel, le monde de<br />

la finance se place volontiers dans<br />

une tour d’ivoire. Mais dans les moments<br />

de crise que nous traversons<br />

actuellement, le corps social, tout<br />

entier contaminé, revendique son<br />

droit de regard sur le comportement<br />

de ceux qui contrôlent les masses financières.<br />

Déclarations, accusations<br />

et interventions législatives se multiplient.<br />

On se souvient alors que la<br />

circulation de l’argent entraîne des<br />

conséquences politiques… et qu’elle<br />

devrait suivre une certaine éthique.<br />

Face à ce tribunal médiatique,<br />

populaire et politique, on constate<br />

que le discours sur l’« éthique »<br />

produit par le milieu financier se<br />

concentre depuis quelques années<br />

sur des questions de bilan carbone,<br />

d’énergies renouvelables ou encore<br />

sur des problématiques de recyclage<br />

- le plus souvent éloignées des cœurs<br />

de métier et des enjeux des entreprises.<br />

A commencer par les enjeux des<br />

entreprises œuvrant dans le secteur<br />

financier ! Si la communauté financière<br />

a fini par manipuler les questions<br />

de « responsabilité sociale » ou<br />

de « développement durable », elle<br />

l’a fait de façon à ne pas aborder les<br />

sujets qui fâchent ; le premier d’entre<br />

eux étant de mesurer sa propre responsabilité…<br />

ainsi que les exigences<br />

éthiques qui en découlent.<br />

Ethique ou morale ?<br />

Le souci de l’éthique devrait<br />

s’adresser en premier lieu aux acteurs<br />

des marchés financiers. Par acteurs<br />

nous entendons les individus, mais<br />

aussi les structures qui les emploient<br />

et au-delà, la structure plus globale<br />

du milieu financier, qui conditionne<br />

leur comportement. Pour proposer<br />

une solution qui favoriserait l’éthique<br />

dans la finance, nous voudrions<br />

d’abord décrypter cette formule et<br />

identifier les sources de sa perversion.<br />

Aujourd’hui, le terme « éthique<br />

» est indifféremment employé,<br />

dans le langage courant, comme un<br />

synonyme de « morale ». Et même,<br />

comme un doux palliatif évitant aux<br />

oreilles de s’écorcher avec ce mot<br />

qui sonne rigoriste, culpabilisant et<br />

« judéo-chrétien ». Les philosophes<br />

savent pourtant bien que la morale<br />

F<strong>IN</strong>ANCE & <strong>THE</strong> COMMON GOOD/BIEN COMMUN - N° 33 - I/2009

Moral designates an<br />

a priori normative<br />

system, based on the<br />

distinction between<br />

good and bad. It indicates<br />

what we should<br />

do and what we should<br />

think.<br />

Ethics refer to the rules<br />

we apply to behaviour<br />

in action (ethos) and<br />

are aimed at determining<br />

what we may do.<br />

Ethics therefore aim<br />

to order our action in<br />

such a way as to make<br />

it efficient.<br />

Ethics are effective and<br />

of interest, in the true<br />

sense of the term. They<br />

are productive and<br />

provide added value.<br />

Ethics tend towards<br />

order: they are never<br />

definitive, never ‘perfect’.<br />

We could say that for<br />

humankind, there is<br />

a constant tension<br />

between the order of<br />

virtue and the disorder<br />

of emotions: ethics<br />

provide precisely<br />

this attempt to order<br />

things.<br />

et l’éthique n’ont rien à voir. Là où la<br />

morale désigne un système normatif<br />

a priori, fondé sur une distinction<br />

entre ce qui est bien et ce qui est mal,<br />

l’éthique renvoie à la règle que l’on<br />

donne à son comportement (ethos)<br />

dans l’action. La morale indique ce<br />

que l’on doit faire et ce que l’on doit<br />

penser, quels que soient le moment<br />

et les conditions ; l’éthique visera à<br />

déterminer ce que l’on peut faire à<br />

partir d’un certain cocktail de liberté<br />

et de contraintes.<br />

Le champ de l’éthique n’est donc<br />

pas celui du discernement entre le<br />

Bien et le Mal, mais celui du comportement<br />

juste et prudent dans un<br />

contexte donné – ce qu’Aristote appelait<br />

vertu – aretè - (Ethique à Nicomaque,<br />

II, 6). La vertu n’ayant pas ici<br />

le sens de la pureté de la vierge effarouchée,<br />

mais bien celui de la force<br />

de l’homme qui maîtrise ses passions<br />

: c’est-à-dire qu’elle n’est pas une fin,<br />

mais bien un moyen.<br />

L’éthique, au contraire de la morale,<br />

ne vise donc pas à faire triompher<br />

le bien, et encore moins le bon<br />

sentiment, mais à ordonner l’action<br />

de façon à ce qu’elle soit efficace, par<br />

le biais d’une vertu entendue comme<br />

une force.<br />

L’éthique : un ordre<br />

pour l’action<br />

En ce sens, l’éthique concerne<br />

aussi bien la sphère de l’individu<br />

que celle du collectif. Une vie personnelle<br />

bien ordonnée est le gage<br />

du bonheur, une vie collective bien<br />

ordonnée celui de la justice. L’objet<br />

visé par l’éthique est la bonne action<br />

- celle qui s’inscrit dans l’ordre - et<br />

non le Bien. La première conclusion<br />

qui découle de cette définition est<br />

que l’éthique est performante, intéressante,<br />

au sens propre du terme.<br />

Elle est productive et apporte une<br />

valeur ajoutée. L’exigence d’éthique<br />

semble d’ores et déjà plus pertinente<br />

à faire valoir que celle de morale, qui<br />

lui est souvent rapportée, car selon la<br />

maxime libérale, mieux vaut compter<br />

sur l’intérêt des hommes que sur<br />

leur bienveillance.<br />

Le statut de médiation<br />

de la finance<br />

Le second point que nous voudrions<br />

relever est que l’éthique est<br />

une tension vers un ordre : elle n’est<br />

jamais définitive, jamais « parfaite ».<br />

Aussi pourrait-on répondre à la thèse<br />

de Mandeville - pour qui les vices<br />

individuels sont pourvoyeurs de<br />

prospérité collective (La Fable des<br />

Abeilles, 1713-1724, raconte la décadence<br />

d’une société-essaim : après<br />

avoir connu une forte prospérité sise<br />

sur la fourberie et le vice, les abeilles<br />

condamnent leur conduite et moralisent<br />

leur société, qui finit par s’affaiblir<br />

et disparaître) - que le monde<br />

humain est en constante tension entre<br />

l’ordre de la vertu et le désordre<br />

des passions : l’éthique est précisément<br />

cette recherche de l’ordre.<br />

Parler d’une « éthique de la finance<br />

» ou d’une « finance éthique » - ce<br />

qui revient peu ou prou au même -<br />

n’est donc pas rêver d’une finance au<br />

service du Bien, mais d’une finance<br />

bien ordonnée.<br />

DU BON USAGE DE L’ORDRE DANS LE DÉSORDRE DE LA F<strong>IN</strong>ANCE<br />

17

18<br />

To talk about the<br />

’ethics of finance’ or<br />

‘ethical finance’ is not<br />

a dream of finance<br />

that serves the greater<br />

Good, but rather of a<br />

well-ordered finance.<br />

As finance is the systemic<br />

organisation of<br />

the flow and exchange<br />

of goods and value<br />

between people, it has,<br />

by definition no moral<br />

connotations: it is the<br />

resources and projects<br />

that it supports that are<br />

connotated.<br />

But for the correct resources<br />

to feed into the<br />

most fruitful projects,<br />

finance needs to be<br />

well ordered.<br />

If finance in its role<br />

as mediator substitutes<br />

the ends for the<br />

means, and becomes<br />

its own idol, the ethical<br />

dimension obviously<br />

becomes compromised.<br />

Voici maintenant ce que nous entendons<br />

par « finance » ; il s’agit de<br />

l’organisation systémique des flux et<br />

des échanges des biens et de la valeur<br />

entre les hommes, par définition, un<br />

art de la médiation entre les ressources<br />

et les projets. On comprend que<br />

la finance n’a pas de couleur morale<br />

: ce sont ses ressources et ses<br />

projets qui en ont une. Mais elle est<br />

cependant directement concernée<br />

par l’éthique, car sa fin est d’apporter<br />

des ressources à des projets qui<br />

à leur tour, dégageront de nouvelles<br />

ressources. Pour que les bonnes ressources<br />

irriguent les projets les plus<br />

fructueux, la finance doit donc être<br />

bien ordonnée.<br />

D’autre part, l’abondance des<br />

ressources et leur répartition n’ont<br />

pas pour but leur accumulation stérile<br />

dans une cassette d’avare ; elles<br />

doivent être le vecteur du bien commun<br />

qui est, finalement, l’horizon de<br />

la finance. L’exigence d’éthique est<br />

d’autant plus grande que la finance<br />

a pour objet la régulation des échanges<br />

entre les individus, et qu’elle<br />

tend vers une fin collective qui s’apparente<br />

fort à un hédonisme - assurer<br />

le bonheur matériel en suscitant<br />

la création de richesses.<br />

Enfin, la finance concerne la notion<br />

d’échange, de laquelle découle<br />

celle de flux financier. L’échange est<br />

le fait de deux personnes motivées<br />

par deux besoins complémentaires,<br />

et qui s’entendent sur une certaine<br />

valeur : ce qui présuppose une relation<br />

de confiance et la reconnaissance<br />

de leur interdépendance dans<br />

l’horizon commun de la construc-<br />

tion d’un monde et du progrès de<br />

l’histoire humaine.<br />

Ce petit travail de définition est<br />

destiné à montrer que la finance n’a<br />

peut-être pas besoin d’être « moralisée<br />

», c’est-à-dire de recevoir de<br />

l’extérieur des règles de bonne conduite<br />

morale. Si l’on veut que la finance<br />

soit « éthique », la première<br />

exigence n’est-elle pas de respecter<br />

sa vocation propre et son statut de<br />

médiation ?<br />

La perversion des<br />

moyens et des fins<br />

Si la finance médiatrice se prend<br />

pour sa propre fin et fait d’elle-même<br />

sa propre idole, évidemment, son caractère<br />

éthique est remis en cause.<br />

Cet oubli de l’horizon plus large du<br />

bien commun, dans lequel doit s’inscrire<br />

l’activité financière, la conduit<br />

à se penser comme une mécanique<br />

produisant en elle-même de la richesse<br />

selon d’admirables constructions<br />

intellectuelles. La finance se détache<br />

du monde « réel » pour construire<br />

une sorte de monde parallèle, virtuel,<br />

qui finit par imploser - avant de<br />

renaître de ses cendres, mais c’est là<br />

une autre question.<br />

Une des causes de ce processus<br />

d’inversion de la fin et du moyen<br />

est probablement la massification<br />

des échanges, qui a fait évoluer au<br />

cours des dernières années l’activité<br />

financière dans le sens d’une industrialisation,<br />

fortement concentrée et<br />

centralisée, dans laquelle l’outil de<br />

production est l’intelligence des acteurs,<br />

et le produit l’argent.<br />

F<strong>IN</strong>ANCE & <strong>THE</strong> COMMON GOOD/BIEN COMMUN - N° 33 - I/2009

It shifts from being<br />

a force that serves a<br />

cause, to becoming a<br />

force that seeks to be<br />

an end unto itself, with<br />

money making money.<br />

Can this reversal in<br />

values not be explained<br />

by a failure to think<br />

things through?<br />

If intelligence is indeed<br />

the primary tool of<br />

finance, this is applied<br />

to the technical dimension<br />

and not used as a<br />

conscience.<br />

This intelligence is<br />

used without thought,<br />

without perspectives,<br />

without reflection,<br />

which poses an<br />

obvious problem of<br />

responsibility.<br />

The intelligence called<br />

upon by finance is<br />

required to work, and<br />

not to think.<br />

La finance perd alors son statut<br />

médiateur, la vertu que nous évoquions<br />

comme fondamentale dans<br />

l’éthique s’en trouve comme inversée<br />

: d’une force au service d’une cause,<br />

elle devient une force cherchant sa<br />

fin en elle-même, l’argent produisant<br />

de l’argent. La vertu n’est alors plus<br />

une force de l’action : ne visant plus<br />

à maîtriser les mécanismes passionnels,<br />

elle glorifie ces derniers. C’est<br />

le triomphe de l’orgueil (hubris) dont<br />

parle la tragédie grecque, qui conduit<br />

ceux qu’il possède à la démesure :<br />

toujours plus grand, toujours plus<br />

complexe, toujours plus.<br />

Déficit d’éthique,<br />

déficit de pensée<br />

Cette inversion des valeurs ne<br />

peut-elle pas s’expliquer par un déficit<br />

de pensée ? Si l’intelligence est<br />

effectivement l’outil premier de la finance,<br />

c’est dans sa dimension technique,<br />

non en tant que conscience.<br />

De la même façon que l’industrie,<br />

poussée par la concurrence à améliorer<br />

sans cesse sa productivité, annexe<br />

progressivement la force de travail<br />

de l’ouvrier à celle de la machine, et<br />

finit par faire de l’homme un appendice<br />

de celle-ci, la mécanique financière<br />

qui grossit au-delà des volumes<br />

d’échanges réels devient souveraine<br />

sur l’intelligence, qui devient alors<br />

un outil de production.<br />

Si la question de la pensée nous<br />

intéresse, c’est parce que notre réflexion<br />

vise à réinscrire la finance<br />

dans l’horizon d’une responsabilité<br />

humaine. Or, le recours massif à une<br />

intelligence qui s’exerce sans pen-<br />

sée, sans perspective, sans retour<br />

sur soi, pose un problème évident<br />

de responsabilité, une question éthique,<br />

portant sur le comportement<br />

des acteurs des marchés financiers.<br />

A l’intelligence que la finance sollicite,<br />

on ne demande pas de dominer<br />

les processus techniques développés,<br />

mais de les développer encore plus,<br />

de s’y plonger, d’en saisir les fils les<br />

plus fins pour en broder une inextricable,<br />

délicate, et si fragile dentelle<br />

de chiffres et d’algorithmes. On lui<br />

demande de travailler, mais on ne lui<br />

demande pas de penser.<br />

Ainsi l’extrême division des tâches,<br />

caractéristique de l’industrialisation<br />

des processus, conduit l’individu<br />

à perdre le sentiment de sa<br />

responsabilité au moment où il ne<br />

perçoit pas ce qu’il produit. Perception<br />

déjà délicate dans des domaines<br />

où la production de la finance est du<br />

ressort de l’immatériel.<br />

L’individu n’est alors plus partie<br />

prenante en tant que conscience :<br />

il est le rouage d’une industrie à laquelle<br />

son intelligence participe,<br />

mais non point sa pensée. L’exercice<br />

même d’une telle profession peut<br />

conduire l’individu à une division de<br />

son être, une sorte de divorce entre<br />

l’efficacité intellectuelle qui lui est<br />

demandée et le besoin qu’il éprouve<br />

de penser pour lui-même, qui est mis<br />

de côté - et pour lequel il n’a bien<br />

souvent plus de ressource physique<br />

et mentale, l’esprit étant possédé entièrement<br />

par des préoccupations à<br />

court terme d’une grande exigence,<br />

qui lui demandent une mobilisation<br />

permanente.<br />

DU BON USAGE DE L’ORDRE DANS LE DÉSORDRE DE LA F<strong>IN</strong>ANCE<br />

19

20<br />

This is how the extreme<br />

division of labour,<br />

which is characteristic<br />

of the industrialisation<br />

process, has led individuals<br />

to lose their<br />

sense of responsibility.<br />

It is necessary to find<br />

a solution to the status<br />

of the individual.<br />

This solution could<br />

involve the creation<br />

of a new structure,<br />

the Order of Financial<br />

Professions.<br />

In concrete terms, this<br />

Order would be a national<br />

body and consist<br />

of various chambers<br />

that represent the different<br />

professions of the<br />

sector. These would<br />

all be organised in a<br />

relatively independent<br />

way.<br />

The representatives of<br />

the various chambers<br />

would, however, have<br />

the right to oversee<br />

the activities of each<br />

branch.<br />

Le geste fondateur d’une démarche<br />

de promotion de l’éthique dans<br />

le milieu financier serait à nos yeux<br />

d’ordre structurel : trouver une solution<br />

au statut de l’individu, pris<br />

dans un mécanisme qui utilise ses<br />

compétences intellectuelles sans inscrire<br />

son travail dans l’horizon d’une<br />

responsabilité envers son milieu professionnel<br />

et envers le bien commun.<br />

La solution passerait à nos yeux par<br />

la création d’une nouvelle structure<br />

qui s’attacherait à défendre le souci<br />

de l’éthique, et à le rendre incontournable<br />

dans l’exercice des activités financières.<br />

Aussi proposons-nous d’imaginer<br />

« une sphère » qui serait partie<br />

prenante du monde de la finance et<br />

en même temps de la collectivité, qui<br />

défendrait les intérêts de chacune, et<br />

garantirait l’éthique financière : elle<br />

se traduirait par la création d’un Ordre<br />

des Professions Financières.<br />

Cette solution nous semble la<br />

plus à même d’imposer une éthique<br />

professionnelle, l’Ordre ayant pour<br />

charge de définir une charte déontologique,<br />

de veiller à son application,<br />

et de sanctionner les membres qui<br />

s’en écarteraient.<br />

L’intégration des cultures<br />

« non-financières »<br />

Concrètement, cet Ordre des<br />

Professions Financières aurait une<br />

dimension nationale ; il serait divisé<br />

en différentes chambres représentant<br />

la variété des métiers du secteur<br />

: gestionnaires de portefeuille,<br />

analystes financiers ou encore gé-<br />

rants de hedge funds, etc. Chacun<br />

ayant des contraintes, des objectifs,<br />

et des risques propres, parfois des<br />

intérêts divergents (les métiers du<br />

crédit et ceux de la gestion n’ont<br />

fondamentalement pas grand-chose<br />

en commun, par exemple), chaque<br />

chambre serait donc organisée de façon<br />

relativement autonome, avec ses<br />

propres représentants élus par ses<br />

membres. En revanche, pour éviter<br />

un lobbying trop fort de chaque métier,<br />

les représentants des différentes<br />

chambres disposeraient d’un droit de<br />

regard sur les prétentions de chaque<br />

branche.<br />

A la tête de cet Ordre, il y aurait<br />

un conseil représentatif composé<br />

d’élus des différentes chambres professionnelles.<br />

A ce conseil de spécialistes<br />

pourraient être associées des<br />

compétences plus inattendues. La<br />

nomination par les membres élus<br />

d’« indépendants » d’une culture<br />

non-financière, constituerait un second<br />

atout pour se préserver du<br />

lobbying. L’idée serait ici d’introduire<br />

dans les instances suprêmes de<br />

l’Ordre des chercheurs en sciences<br />

humaines, n’ayant pas de formation<br />

spécifique dans le domaine financier,<br />

mais reconnus dans la sphère de la<br />

recherche philosophique, sociologique,<br />

historique, juridique, etc. Cette<br />

diversification des référents à l’intérieur<br />

de l’Ordre favoriserait l’expression<br />

de points de vue critiques et du<br />

souci du bien commun. Par exemple,<br />

la compétence des philosophes, en<br />

matière de théorie de l’éthique, mais<br />

aussi de rhétorique et de dissection<br />

des discours, pourrait aider à analy-<br />

F<strong>IN</strong>ANCE & <strong>THE</strong> COMMON GOOD/BIEN COMMUN - N° 33 - I/2009

A representative<br />

council would sit at the<br />

head of the Order. It<br />

would be composed of<br />

elected members of the<br />

various professional<br />

chambers, and could<br />

also include elected<br />

members from a nonfinancial<br />

background,<br />

which would facilitate<br />

critical discussion and<br />

a preoccupation with<br />

the common good.<br />

Gaining admission to<br />

the profession would<br />

initially be based on<br />

the Order selecting<br />

candidates on the<br />

basis of a non-financial<br />

examination. This<br />

would guarantee that<br />

candidates have a basic<br />

grounding in the ethics<br />

of finance.<br />

There would be<br />

internal professional<br />

training, and a professional<br />

exam conferring<br />

the right to practice the<br />

profession.<br />

ser les systèmes de pensée qui soustendent<br />

les comportements. L’œil de<br />

l’historien, synthétisant les grands<br />

mouvements et les étapes du progrès<br />

historique, rompu à l’étude des crises<br />

du passé, verrait peut-être avec<br />

plus d’acuité se profiler de nouveaux<br />

bouleversements.<br />

En revanche, il ne semblerait pas<br />

opportun de proposer la nomination<br />

d’un représentant de l’Etat, l’Ordre<br />

se distinguant ainsi clairement des<br />

institutions étatiques, telle l’Autorité<br />

des Marchés Financiers (AMF), avec<br />

qui il devrait néanmoins dialoguer et<br />

collaborer.<br />

Modalités d’entrée<br />

dans l’Ordre<br />

L’accès à la profession serait régulé<br />

par deux étapes. Dans un premier<br />

temps, l’Ordre recruterait des<br />

candidats par le biais d’un examen<br />

non-financier, qui aurait pour but<br />

d’évaluer leur maturité intellectuelle,<br />

leur capacité d’adaptation, la<br />

qualité de leur réflexion personnelle.<br />

L’Ordre s’assurerait à ce moment de<br />

l’adhésion du candidat à la notion<br />

de fondement éthique de la finance.<br />

Cette méthode de sélection, volontairement<br />

non technique, permettrait<br />

d’ouvrir la profession à des profils<br />

diversifiés, tant sur le plan de la<br />

formation scolaire que sur celui du<br />

profil intellectuel des candidats. On<br />

pourrait ainsi éviter le biais d’un certain<br />

élitisme sectaire.<br />

La formation professionnalisante<br />

serait ensuite dispensée en interne,<br />

un examen professionnel subordon-<br />

nant l’obtention de l’habilitation à<br />

exercer le métier de la chambre que<br />

l’on souhaite rejoindre. Un peu sur<br />

le modèle de ce qui se fait pour les<br />

avocats et dans l’esprit de ce que<br />

cherche à mettre en place en France<br />

l’AMF. Le nouveau système de vérification<br />

des connaissances - qui vise<br />

les « fonctions clés » exercées au sein<br />

des prestataires de services d’investissements<br />

et concerne directement les<br />

sociétés de gestion - a été instauré par<br />

un arrêté du 30 janvier 2009 modifiant<br />

le Règlement Général de l’AMF<br />

et entrera en vigueur le 1er juillet<br />

2010. Pour se préparer à cet examen<br />

qui porterait sur des questions techniques<br />

et déontologiques (nous y reviendrons),<br />

les universités créeraient,<br />

en partenariat avec l’Ordre, des modules<br />

de formation adaptés.<br />

Le candidat reçu serait alors accueilli<br />

dans l’Ordre au cours d’une<br />

cérémonie symboliquement marquante,<br />

afin de lui faire prendre<br />

conscience de son appartenance à un<br />

groupe et des liens étroits qui lieront<br />

désormais sa vie professionnelle à<br />

celle de sa chambre. En effet, avec la<br />

création d’un ordre professionnel, les<br />

financiers ne seront plus considérés<br />

par leurs clients comme de simples<br />

individus, ou comme les salariés de<br />

telle entité, mais également comme<br />

membre d’une Chambre de métier<br />

dont la réputation pourrait entacher<br />

celle de tous ses membres.<br />

Ce phénomène de solidarité dont<br />

nous venons d’expliquer la source<br />

conduisit les agents de change, au<br />

XIXème siècle, à créer un fonds commun<br />

de garantie. Dans leur ouvrage<br />

DU BON USAGE DE L’ORDRE DANS LE DÉSORDRE DE LA F<strong>IN</strong>ANCE<br />

21

22<br />

This exam would<br />

address technical and<br />

deontological issues;<br />

preparation would be<br />

through universities<br />

that would develop<br />

modules and suitable<br />

training, in partnership<br />

with the Order.<br />

With the creation of<br />

a professional order,<br />

financiers would no<br />

longer be considered<br />

by their clients a mere<br />

individuals, but also as<br />

members of a professional<br />

chamber, whose<br />

reputation would affect<br />

all its members.<br />

All chambers would<br />

create their own guaranty<br />

fund by levying a<br />

tax on every transaction.<br />

This would improve<br />

the transparency of accounts,<br />

as all transactions<br />

(whether included<br />

in the accounts or<br />

not) would be declared<br />

to the Order.<br />

The first mission<br />

of this fund would<br />

obviously be to finance<br />

the Order.<br />

« Contribution à une étude sociologique<br />

des conduites économiques »,<br />

Gilles Lazuech et Pascale Moulévrier<br />

(Contribution à une étude sociologique<br />

des conduites économiques, Paris, Editions<br />

L’Harmattan, 2006) rapportent<br />

les modalités de sa création. La Bourse<br />

de Paris fut le théâtre, à l’automne<br />

1819, d’une spéculation malheureuse<br />

sur le cours de la rente. Pour éviter<br />

une crise systémique, la Compagnie<br />

des Agents de Change de la Bourse<br />

de Paris contracta collectivement<br />

une dette auprès d’un groupe de banquiers.<br />

Une caisse commune fut alors<br />

créée pour recevoir les versements<br />

que chaque agent de change fut tenu<br />

de faire pour rembourser le prêt.<br />

Solidarité et<br />

mutualisation des risques<br />

Trois ans après, lorsque les créances<br />

furent totalement éteintes, la<br />

Compagnie fut appelée à délibérer sur<br />

le maintien de ce fonds de garantie.<br />

Dans l’intervalle, l’expérience avait<br />

fait apprécier tous les avantages de<br />

cette institution : « elle assurait [notamment]<br />

à la Compagnie une puissance<br />

et une force réelles de nature à<br />

exercer une influence heureuse sur<br />

le crédit public lui-même» (Lazuech<br />

et Moulévrier, 2006). Aussi, la Compagnie<br />

décida-t-elle, à « l’unanimité »<br />

(souligné dans le texte), que la caisse<br />

commune serait maintenue.<br />

On pourrait aujourd’hui imaginer<br />

un système analogue : chaque<br />

chambre de métier créerait ainsi son<br />

propre fonds de garantie. Sur chaque<br />

opération réalisée par un membre de<br />

la chambre, une taxe serait prélevée<br />

qui servirait à nourrir la caisse commune.<br />

On pourrait même envisager<br />

que cette taxe soit proportionnelle au<br />

risque de la transaction. On pourrait,<br />

par exemple, appliquer les méthodes<br />

de calcul de fonds propres réglementaires<br />

prévues dans les accords Bâle 2.<br />

Ceux-ci s’appliquent à tous les produits<br />

financiers sans exception. Plus<br />

le produit est risqué, le risque étant<br />

évalué en accord avec les textes, plus<br />

la banque doit provisionner d’argent<br />

dans ses comptes. Le ratio total de<br />

fonds propres doit être supérieur à<br />

8%, c’est-à-dire que pour cent euros<br />

investis, la banque doit au moins en<br />

avoir huit dans ses comptes.<br />

De cette façon, la transparence des<br />

bilans comptables serait améliorée du<br />

fait même que toute opération (bilan<br />

ou hors bilan) serait déclarée à l’Ordre.<br />

L’information communiquée à<br />

l’Ordre ne porterait que sur le volume<br />

(en valeur) de la transaction, pour des<br />

raisons évidentes de concurrence et<br />

de confidentialité. De plus, le principe<br />

d’une commission variable prenant<br />

en compte la situation bilancielle de<br />

l’entité effectuant l’opération pourrait<br />

être un moyen d’éviter la prise excessive<br />

de risques par un établissement.<br />

Un tel système inciterait les membres<br />

à mieux s’autoréguler pour limiter le<br />

risque de faillite d’un établissement.<br />

Un fonds de garantie<br />

La première mission de ce fonds<br />

serait évidemment de financer le<br />

fonctionnement de l’Ordre : dépenses<br />

de structures et de ressources humaines,<br />

frais engagés par l’examen<br />

de recrutement, par la formation<br />

F<strong>IN</strong>ANCE & <strong>THE</strong> COMMON GOOD/BIEN COMMUN - N° 33 - I/2009

But the Order could<br />

also, inasmuch as the<br />

means would allow,<br />

contribute to compensation<br />

of victims<br />

should one of its members<br />

be found legally<br />

responsible for moral<br />

prejudice to clients.<br />

This would to some extent<br />

allow the honour<br />

of the profession to be<br />

preserved.<br />

Each chamber would<br />

define a corpus of rules<br />

that members would be<br />

obliged to respect.<br />

The representatives of<br />

the financiers themselves<br />

would write this<br />

deontological code.<br />

continue, etc. On peut même imaginer<br />

que l’Ordre favorise, par le biais<br />

du financement de thèses et de l’organisation<br />

de colloques, la recherche<br />

universitaire sur les questions d’éthique<br />

financière.<br />

Toutefois, ce fonds pourrait être<br />

utilisé dans des circonstances plus<br />

exceptionnelles. Nous pensons ici<br />

aux scandales qui émaillent l’actualité<br />

de la vie financière et qui font<br />

douter la collectivité tout entière de<br />

l’éthique des professionnels de la finance.<br />

Le fonds permettrait d’assurer<br />

l’ensemble des transactions - y compris<br />

les opérations de gré à gré - qui<br />

ne sont pas exemptes aujourd’hui de<br />

risque de contrepartie, ce qui généraliserait<br />

le concept de chambre de<br />

compensation existant sur les marchés<br />

organisés. Le fonds se substituerait<br />

à la contrepartie faisant défaut,<br />

ayant pour mission première<br />

de protéger les professionnels des<br />

agissements condamnables de leurs<br />

confrères.<br />

L’élaboration d’un<br />

code de déontologie<br />

En second lieu, si un de ses<br />

membres était reconnu pénalement<br />

responsable d’un préjudice<br />

auprès de ses clients, l’Ordre pourrait<br />

dans la mesure de ses moyens<br />

participer à l’indemnisation des<br />

victimes. On préserverait ainsi,<br />

en quelque sorte, l’honneur de la<br />

profession. Il faut préciser que la<br />

mise en cause de la responsabilité<br />

de l’Ordre ne se substituerait pas à<br />

celle du financier en cause, encourant<br />

selon son acte des sanctions<br />

d’ordre professionnel (au niveau<br />

de l’Ordre), voire pénales.<br />

Le fonds ayant vocation à intervenir<br />

dans le cas où l’Ordre aurait<br />

failli à sa mission de surveillance<br />

de l’éthique des professionnels, il<br />

conviendrait en conséquence que<br />

chaque chambre définisse un corps<br />

de règles qu’elle entendrait que ses<br />

membres s’obligent à respecter. Ces<br />

règles éthiques devraient être mises<br />

en forme afin qu’il puisse y être<br />

fait référence dans le prononcer des<br />

sanctions : cette formalisation passerait<br />

par l’élaboration d’un code de<br />

déontologie.<br />

Ce code serait élaboré par les financiers<br />

eux-mêmes par la voie représentative<br />

et nous pensons que ce<br />

procédé serait à même de renforcer<br />

l’efficacité de ces normes. En effet,<br />

pour les citoyens de nombreux<br />

pays occidentaux, aujourd’hui, la loi<br />

n’a plus la même valeur coercitive<br />

qu’auparavant. Nous assistons depuis<br />

quelques années au développement<br />

de ce que les juristes qualifient<br />

de droit mou, ou soft law. La multiplication<br />

des sources du droit, la<br />

complexité des termes dans lesquels<br />

les textes législatifs sont rédigés et<br />

enfin, le fait que les lois, autrefois<br />

générales (c’est-à-dire s’appliquant<br />

à tous), sont désormais très souvent<br />

spécifiques à une catégorie de personnes,<br />

concourent à ce que l’individu<br />

se sente moins lié par la force<br />

obligatoire de la norme.<br />

Dans ces conditions, nos sociétés<br />

ont de plus en plus recours à la<br />

notion de contrat pour organiser les<br />

rapports entre individus. Une rè-<br />

DU BON USAGE DE L’ORDRE DANS LE DÉSORDRE DE LA F<strong>IN</strong>ANCE<br />

23

24<br />

The rules of professional<br />

ethics, as<br />

defined by the various<br />

professional chambers<br />

would be submitted to<br />

the civil services, the<br />

Council of State and<br />

finally to the government.<br />

They would<br />

all be responsible for<br />

checking that they<br />

conform to existing<br />

regulatory norms, and<br />

where necessary would<br />

modify the text.<br />

Sanctions based on the<br />

code and pronounced<br />

by the Order could<br />

go as far as striking<br />

professionals off the<br />

register, or taking<br />

measures that would<br />

discredit the reputation<br />

of professionals found<br />

to be at fault.<br />

gle contractuellement acceptée aura<br />

ainsi plus de poids : curieusement,<br />

elle paraîtra plus légitime que la loi à<br />

celui qui doit s’y soumettre. Aussi, si<br />

nous voulons être efficaces dans l’organisation<br />

nouvelle de la finance que<br />

nous appelons de nos vœux, il sera<br />

plus adapté d’utiliser un moyen qui<br />

permette de donner ce sentiment de<br />

choix contractuel aux financiers.<br />

Contrôle et sanctions<br />

Cette dimension contractuelle<br />

est nécessaire mais toutefois insuffisante<br />

pour obtenir des professionnels,<br />

quels qu’ils soient, qu’ils respectent<br />

des normes contraignantes.<br />

Le code de déontologie élaboré par<br />

un Ordre Professionnel ayant reçu<br />

du gouvernement une délégation<br />

de puissance publique pour le faire<br />

appliquer, aurait une portée juridique<br />

autrement plus importante.<br />

C’est sur ce modèle que fonctionne<br />

le code de déontologie des médecins,<br />

par exemple. Reconnu par décret,<br />

désormais inséré au code sanitaire<br />

et social, il fait partie intégrante de<br />

notre système juridique. C’est la raison<br />

pour laquelle nous préconisons<br />

que la procédure d’élaboration du<br />

code déontologique des professions<br />

financières procède de la même logique<br />

que celle du code de déontologie<br />

médicale.<br />

Ainsi, une fois les règles d’éthique<br />

professionnelles définies par les<br />

différentes chambres de métier, le<br />

texte en découlant serait soumis à<br />

l’administration, au Conseil d’État et<br />

finalement au gouvernement, chacun<br />

ayant la charge de vérifier sa<br />

conformité avec les normes déjà en<br />

vigueur, et la possibilité d’y apporter<br />

des modifications. Enfin, le code serait<br />

publié au Journal Officiel sous la<br />

signature du Premier Ministre.<br />

Les sanctions prononcées par<br />

l’Ordre en fonction du code pourraient<br />

aller jusqu’à une interdiction<br />

d’exercice de la profession ou à des<br />

mesures entachant la réputation des<br />

professionnels mis en cause ; c’està-dire<br />

des sanctions efficaces mais<br />

parfois très lourdes, que seule peut<br />

prononcer une personne (morale,<br />

dans ce cas) qui se sent directement<br />

concernée par le respect des normes<br />

fixées.<br />

Du bon usage de l’Ordre<br />

Proposer un retour à une certaine<br />

forme de corporatisme pour aider<br />

la finance à retrouver son équilibre<br />

peut paraître audacieux, alors que le<br />

corporatisme a été largement utilisé<br />

et développé par les systèmes totalitaires<br />

et les gouvernements à tendance<br />

fasciste au XXème siècle. Ainsi, s’il<br />

peut apparaître plus simple de développer<br />

un tel modèle dans les pays<br />

où existaient traditionnellement des<br />