HP·38E/38C - Slide Rule Museum

HP·38E/38C - Slide Rule Museum

HP·38E/38C - Slide Rule Museum

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

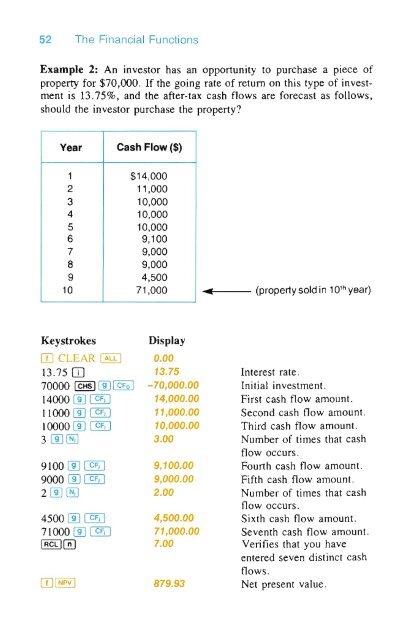

52 The Financial Functions<br />

Example 2: An investor has an opportunity to purchase a piece of<br />

property for $70,000. If the going rate of return on this type of investment<br />

is 13.75%, and the after-tax cash flows are forecast as fo llows,<br />

should the investor purchase the property?<br />

Year Cash Flow ($)<br />

1 $14,000<br />

2 11 ,000<br />

3 10,000<br />

4 10,000<br />

5 10,000<br />

6 9,100<br />

7 9,000<br />

8 9,000<br />

9 4,500<br />

10 71 ,000 • (property sold in 1 a th year)<br />

Keystrokes Display<br />

[]] CLEAR I ALL I 0.00<br />

13 .75 [IJ 13.75 Interest rate.<br />

70000 I cHsl 1]] I CFo I -70,000.00 Initial investment.<br />

14000 I]] @U 14,000.00 First cash flow amount.<br />

11 000 I]] @U 11,000.00 Second cash flow amount.<br />

10000 I]] @U 10,000.00 Third cash flow amount.<br />

3 1]]@ 3.00 Number of times that cash<br />

flow occurs.<br />

9 100 I]]@U 9,100.00 Fourth cash flow amount.<br />

9000 I]]@U 9,000.00 Fifth cash fl ow amount.<br />

2 1]]@ 2.00 Number of times that cash<br />

flow occurs .<br />

4500 I]] @U 4,500.00 Sixth cash fl ow amount.<br />

7 1000 I]]@U 71,000.00 Seventh cash flow amount.<br />

IRCl l0 7.00 Verifies that you have<br />

entered seven distinct cash<br />

flows.<br />

[]]I NPV I 879.93 Net present value.