össur annual report2009 - Euroland

össur annual report2009 - Euroland

össur annual report2009 - Euroland

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Össur hf. consolidated financial stateMents 2009<br />

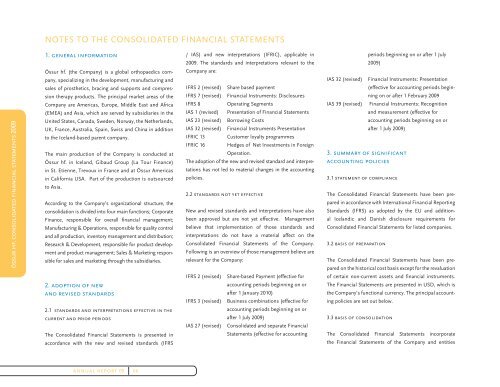

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

1. general inforMation<br />

Össur hf. (the Company) is a global orthopaedics company,<br />

specializing in the development, manufacturing and<br />

sales of prosthetics, bracing and supports and compression<br />

therapy products. The principal market areas of the<br />

Company are Americas, Europe, Middle East and Africa<br />

(EMEA) and Asia, which are served by subsidiaries in the<br />

United States, Canada, Sweden, Norway, the Netherlands,<br />

UK, France, Australia, Spain, Swiss and China in addition<br />

to the Iceland-based parent company.<br />

The main production of the Company is conducted at<br />

Össur hf. in Iceland, Gibaud Group (La Tour Finance)<br />

in St. Etienne, Trevoux in France and at Össur Americas<br />

in California USA. Part of the production is outsourced<br />

to Asia.<br />

According to the Company’s organizational structure, the<br />

consolidation is divided into four main functions; Corporate<br />

Finance, responsible for overall financial management;<br />

Manufacturing & Operations, responsible for quality control<br />

and all production, inventory management and distribution;<br />

Research & Development, responsible for product development<br />

and product management; Sales & Marketing responsible<br />

for sales and marketing through the subsidiaries.<br />

2. adoption of neW<br />

and revised standards<br />

2.1 standards and interpretations effective in the<br />

current and prior periods<br />

The Consolidated Financial Statements is presented in<br />

accordance with the new and revised standards (IFRS<br />

<strong>annual</strong> report 09<br />

66<br />

/ IAS) and new interpretations (IFRIC), applicable in<br />

2009. The standards and interpretations relevant to the<br />

Company are:<br />

IFRS 2 (revised) Share based payment<br />

IFRS 7 (revised) Financial Instruments: Disclosures<br />

IFRS 8 Operating Segments<br />

IAS 1 (revised) Presentation of Financial Statements<br />

IAS 23 (revised) Borrowing Costs<br />

IAS 32 (revised) Financial Instruments Presentation<br />

IFRIC 13 Customer loyalty programmes<br />

IFRIC 16 Hedges of Net Investments in Foreign<br />

Operation.<br />

The adoption of the new and revised standard and interpretations<br />

has not led to material changes in the accounting<br />

policies.<br />

2.2 standards not yet effective<br />

New and revised standards and interpretations have also<br />

been approved but are not yet effective. Management<br />

believe that implementation of those standards and<br />

interpretations do not have a material affect on the<br />

Consolidated Financial Statements of the Company.<br />

Following is an overview of those management believe are<br />

relevant for the Company:<br />

IFRS 2 (revised) Share-based Payment (effective for<br />

accounting periods beginning on or<br />

after 1 January 2010)<br />

IFRS 3 (revised) Business combinations (effective for<br />

accounting periods beginning on or<br />

after 1 July 2009)<br />

IAS 27 (revised) Consolidated and separate Financial<br />

Statements (effective for accounting<br />

periods beginning on or after 1 July<br />

2009)<br />

IAS 32 (revised) Financial Instruments: Presentation<br />

(effective for accounting periods beginning<br />

on or after 1 February 2009<br />

IAS 39 (revised) Financial Instruments: Recognition<br />

and measurement (effective for<br />

accounting periods beginning on or<br />

after 1 July 2009)<br />

3. suMMary of significant<br />

accounting policies<br />

3.1 stateMent of coMpliance<br />

The Consolidated Financial Statements have been prepared<br />

in accordance with International Financial Reporting<br />

Standards (IFRS) as adopted by the EU and additional<br />

Icelandic and Danish disclosure requirements for<br />

Consolidated Financial Statements for listed companies.<br />

3.2 basis of preparation<br />

The Consolidated Financial Statements have been prepared<br />

on the historical cost basis except for the revaluation<br />

of certain non-current assets and financial instruments.<br />

The Financial Statements are presented in USD, which is<br />

the Company’s functional currency. The principal accounting<br />

policies are set out below.<br />

3.3 basis of consolidation<br />

The Consolidated Financial Statements incorporate<br />

the Financial Statements of the Company and entities