össur annual report2009 - Euroland

össur annual report2009 - Euroland

össur annual report2009 - Euroland

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

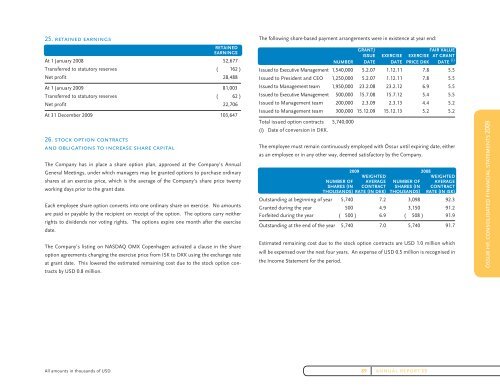

25. retained earnings<br />

RETAINED<br />

EARNINGS<br />

At 1 January 2008 52,677<br />

Transferred to statutory reserves ( 162 )<br />

Net profit 28,488<br />

At 1 January 2009 81,003<br />

Transferred to statutory reserves ( 62 )<br />

Net profit 22,706<br />

At 31 December 2009 103,647<br />

26. stock option contracts<br />

and obligations to increase share capital<br />

The Company has in place a share option plan, approved at the Company’s Annual<br />

General Meetings, under which managers may be granted options to purchase ordinary<br />

shares at an exercise price, which is the average of the Company’s share price twenty<br />

working days prior to the grant date.<br />

Each employee share option converts into one ordinary share on exercise. No amounts<br />

are paid or payable by the recipient on receipt of the option. The options carry neither<br />

rights to dividends nor voting rights. The options expire one month after the exercise<br />

date.<br />

The Company’s listing on NASDAQ OMX Copenhagen activated a clause in the share<br />

option agreements changing the exercise price from ISK to DKK using the exchange rate<br />

at grant date. This lowered the estimated remaining cost due to the stock option contracts<br />

by USD 0.8 million.<br />

The following share-based payment arrangements were in existence at year end:<br />

GRANT/ fAIR VALUE<br />

NUMBER<br />

ISSUE<br />

DATE<br />

ExERCISE ExERCISE AT GRANT<br />

DATE pRICE DKK DATE (i)<br />

Issued to Executive Management 1,540,000 5.2.07 1.12.11 7.8 5.5<br />

Issued to President and CEO 1,250,000 5.2.07 1.12.11 7.8 5.5<br />

Issued to Management team 1,950,000 23.2.08 23.2.12 6.9 5.5<br />

Issued to Executive Management 500,000 15.7.08 15.7.12 5.4 5.5<br />

Issued to Management team 200,000 2.3.09 2.3.13 4.4 5.2<br />

Issued to Management team 300,000 15.12.09 15.12.13 5.2 5.2<br />

Total issued option contracts 5,740,000<br />

(i) Date of conversion in DKK.<br />

The employee must remain continuously employed with Össur until expiring date, either<br />

as an employee or in any other way, deemed satisfactory by the Company.<br />

2009 2008<br />

WEIGHTED WEIGHTED<br />

NUMBER Of AVERAGE NUMBER Of AVERAGE<br />

SHARES (IN CONTRACT SHARES (IN CONTRACT<br />

THOUSANDS) RATE (IN DKK) THOUSANDS) RATE (IN ISK)<br />

Outstanding at beginning of year 5,740 7.2 3,098 92.3<br />

Granted during the year 500 4.9 3,150 91.2<br />

Forfeited during the year ( 500 ) 6.9 ( 508 ) 91.9<br />

Outstanding at the end of the year 5,740 7.0 5,740 91.7<br />

Estimated remaining cost due to the stock option contracts are USD 1.0 million which<br />

will be expensed over the next four years. An expense of USD 0.5 million is recognised in<br />

the Income Statement for the period.<br />

All amounts in thousands of USD 89 <strong>annual</strong> report 09<br />

Össur hf. consolidated financial stateMents 2009