Comprehensive Annual Financial Report Ending June 2011

Comprehensive Annual Financial Report Ending June 2011

Comprehensive Annual Financial Report Ending June 2011

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

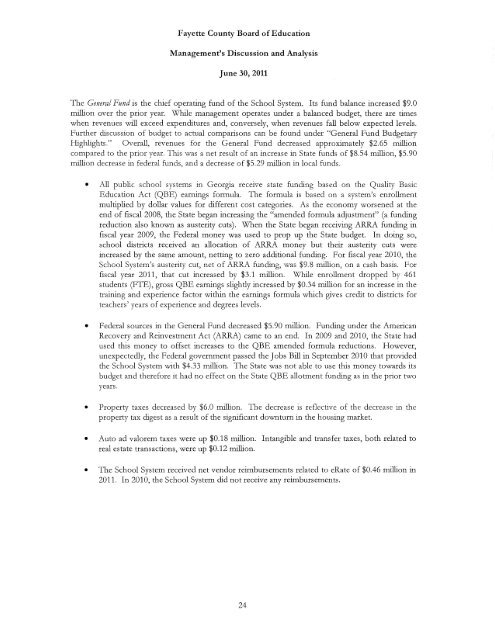

Fayette County Board of Education<br />

Management's Discussion and Analysis<br />

<strong>June</strong> 30, <strong>2011</strong><br />

The Genera/ Fund is the chief operating fund of the School System. Its fund balance increased $9.0<br />

million over the prior year. While management operates under a balanced budget, there are times<br />

when revenues will exceed expenditures and, conversely, when revenues fall below expected levels.<br />

Further discussion of budget to actual comparisons can be found under "General Fund Budgetary<br />

Highlights." Overall, revenues for the General Fund decreased approximately $2.65 million<br />

compared to the prior year. This was a net result of an increase in State funds of $8.54 million, $5.90<br />

million decrease in federal funds, and a decrease of $5.29 million in local funds.<br />

• All public school systems in Georgia receive state funding based on the Quality Basic<br />

Education Act (QBE) earnings formula. The formula is based on a system's enrollment<br />

multiplied by dollar values for different cost categories. As the economy worsened at the<br />

end of fiscal 2008, the State began increasing the "amended formula adjustment" (a funding<br />

reduction also known as austerity cuts). When the State began receiving ARRA funding in<br />

fiscal year 2009, the Federal money was used to prop up the State budget. In doing so,<br />

school districts received an allocation of ARRA money but their austerity cuts were<br />

increased by the same amount, netting to zero additional funding. For fiscal year 2010, the<br />

School System's austerity cut, net of ARRA funding, was $9.8 million, on a cash basis. For<br />

fiscal year <strong>2011</strong>, d1at cut increased by $3.1 million. While enrollment dropped by 461<br />

students (FTE), gross QBE earnings slighdy increased by $0.34 million for an increase in the<br />

training and experience factor within the earnings formula which gives credit to districts for<br />

teachers' years of experience and degrees levels.<br />

• Federal sources in the General Fund decreased $5.90 million. Funding under the American<br />

Recovery and Reinvestment Act (ARRA) came to an end. In 2009 and 2010, the State had<br />

used this money to offset increases to the QBE amended formula reductions. However,<br />

unexpectedly, the Federal government passed d1e Jobs Bill in September 2010 that provided<br />

the School System with $4.33 million. The State was not able to use this money towards its<br />

budget and therefore it had no effect on the State QBE allotment funding as in the prior two<br />

years.<br />

• Property taxes decreased by $6.0 million. The decrease is reflective of the decrease in the<br />

property tax digest as a result of d1e significant downturn in the housing market.<br />

• Auto ad valorem taxes were up $0.18 million. Intangible and transfer taxes, both related to<br />

real estate transactions, were up $0.12 million.<br />

• The School System received net vendor reimbursements related to cRate of $0.46 million in<br />

<strong>2011</strong>. In 2010, d1e School System did not receive any reimbursements.<br />

24