Comprehensive Annual Financial Report Ending June 2011

Comprehensive Annual Financial Report Ending June 2011

Comprehensive Annual Financial Report Ending June 2011

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

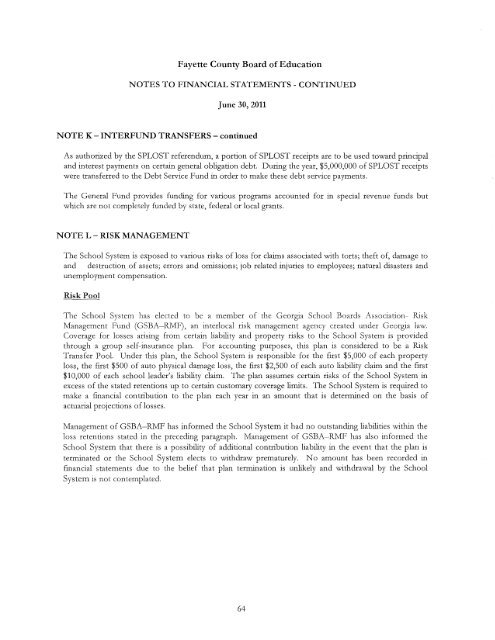

Fayette County Board of Education<br />

NOTES TO FINANCIAL STATEMENTS- CONTINUED<br />

<strong>June</strong> 30, <strong>2011</strong><br />

NOTE K- INTERFUND TRANSFERS- continued<br />

As authorized by the SPLOST referendum, a portion of SPLOST receipts are to be used toward principal<br />

and interest payments on certain general obligation debt. During the year, $5,000,000 of SPLOST receipts<br />

were transferred to the Debt Service Fund in order to make these debt service payments.<br />

The General Fund provides funding for various programs accounted for in special revenue funds but<br />

which are not completely funded by state, federal or local grants.<br />

NOTE L- RISK MANAGEMENT<br />

The School System is exposed to various risks of loss for claims associated with torts; theft of, damage to<br />

and destruction of assets; errors and omissions; job related injuries to employees; natural disasters and<br />

unemployment compensation.<br />

Risk Pool<br />

The School System has elected to be a member of the Georgia School Boards Association- Risk<br />

Management Fund (GSBA-RMF), an interlocal risk management agency created under Georgia law.<br />

Coverage for losses arising from certain liability and property risks to the School System is provided<br />

through a group self-insurance plan. For accounting purposes, this plan is considered to be a Risk<br />

Transfer Pool. Under this plan, the School System is responsible for the flrst $5,000 of each property<br />

loss, the first $500 of auto physical damage loss, the flrst $2,500 of each auto liability claim and the first<br />

$10,000 of each school leader's liability claim. The plan assumes certain risks of the School System in<br />

excess of the stated retentions up to certain customary coverage limits. The School System is required to<br />

make a financial contribution to the plan each year in an amount that is determined on the basis of<br />

actuarial projections of losses.<br />

Management of GSBA-RMF has informed the School System it had no outstanding liabilities within the<br />

loss retentions stated in the preceding paragraph. Management of GSBA-RMF has also informed the<br />

School System that there is a possibility of additional contribution liability in the event that the plan is<br />

terminated or the School System elects to withdraw prematurely. No amount has been recorded in<br />

financial statements due to the belief that plan termination is unlikely and withdrawal by the School<br />

System is not contemplated.<br />

64