Comprehensive Annual Financial Report Ending June 2011

Comprehensive Annual Financial Report Ending June 2011

Comprehensive Annual Financial Report Ending June 2011

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

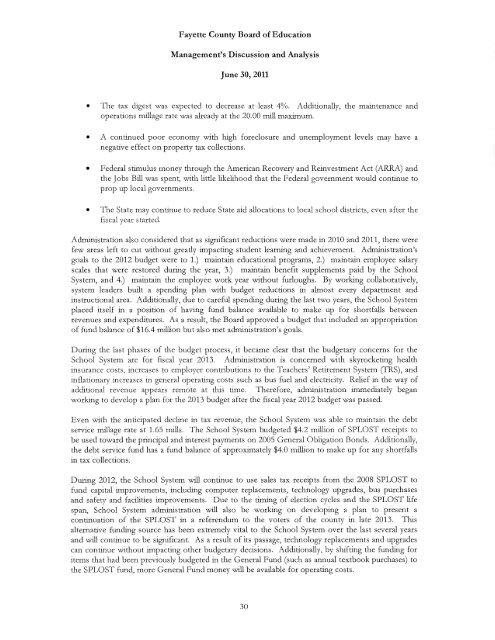

Fayette County Board of Education<br />

Management's Discussion and Analysis<br />

<strong>June</strong> 30, <strong>2011</strong><br />

• The tax digest was expected to decrease at least 4%. Additionally, the maintenance and<br />

operations millage rate was already at the 20.00 mill maximum.<br />

• A continued poor economy with high foreclosure and unemployment levels may have a<br />

negative effect on property tax collections.<br />

• Federal stimulus money through the American Recovery and Reinvestment Act (ARRA) and<br />

the Jobs Bill was spent, with little likelihood that the Federal government would continue to<br />

prop up local governments.<br />

• The State may continue to reduce State aid allocations to local school districts, even after the<br />

fiscal year started.<br />

Administration also considered that as significant reductions were made in 2010 and <strong>2011</strong>, there were<br />

few areas left to cut widwut greatly impacting student learning and achievement. Administration's<br />

goals to the 2012 budget were to 1.) maintain educational programs, 2.) maintain employee salary<br />

scales that were restored during the year, 3.) maintain benefit supplements paid by the School<br />

System, and 4.) maintain the employee work year without furloughs. By working collaboratively,<br />

system leaders built a spending plan with budget reductions in almost every department and<br />

instructional area. Additionally, due to careful spending during the last two years, the School System<br />

placed itself in a position of having fund balance available to make up for shortfalls between<br />

revenues and expenditures. As a result, the Board approved a budget that included an appropriation<br />

of fund balance of$16.4 million but also met administration's goals.<br />

During the last phases of the budget process, it became clear that the budgetary concerns for the<br />

School System are for fiscal year 2013. Administration is concerned with skyrocketing health<br />

insurance costs, increases to employer contributions to the Teachers' Retirement System (TRS), and<br />

inflationary increases in general operating costs such as bus fuel and electricity. Relief in the way of<br />

additional revenue appears remote at this time. Therefore, administration immediately began<br />

working to develop a plan for the 2013 budget after the fiscal year 2012 budget was passed.<br />

Even with tl1e anticipated decline in tax revenue, the School System was able to maintain the debt<br />

service millage rate at 1.65 mills. The School System budgeted $4.2 million of SPLOST receipts to<br />

be used toward the principal and interest payments on 2005 General Obligation Bonds. Additionally,<br />

the debt service fund has a fund balance of approximately $4.0 million to make up for any shortfalls<br />

in tax collections.<br />

During 2012, the School System will continue to use sales tax receipts from the 2008 SPLOST to<br />

fund capital improvements, including computer replacements, technology upgrades, bus purchases<br />

and safety and facilities improvements. Due to the timing of election cycles and the SPLOST life<br />

span, School System administration will also be working on developing a plan to present a<br />

continuation of the SPLOST in a referendum to the voters of the county in late 2013. This<br />

alternative funding source has been extremely vital to the School System over the last several years<br />

and will continue to be significant. As a result of its passage, technology replacements and upgrades<br />

can continue without impacting other budgetary decisions. Additionally, by shifting the funding for<br />

items that had been previously budgeted in the General Fund (such as annual textbook purchases) to<br />

the SPLOST fund, more General Fund money will be available for operating costs.<br />

30