Comprehensive Annual Financial Report Ending June 2011

Comprehensive Annual Financial Report Ending June 2011

Comprehensive Annual Financial Report Ending June 2011

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

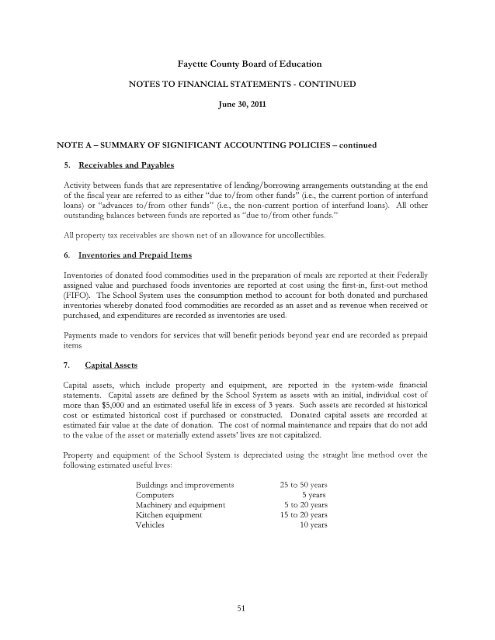

Fayette County Board of Education<br />

NO'TES 'TO FINANCIAL S'fA'fEMEN'fS- CONTINUED<br />

<strong>June</strong> 30, <strong>2011</strong><br />

NO'TE A- SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES- continued<br />

5. Receivables and Payables<br />

Activity between funds that are representative of lending/borrowing arrangements outstanding at the end<br />

of the fiscal year are referred to as either "due to/ from other funds" (i.e., the current portion of interfund<br />

loans) or "advances to/ from other funds" (i.e., the non-current portion of interfund loans). All other<br />

outstanding balances between f·unds are reported as "due to/ from other funds."<br />

All property tax receivables arc shown net of an allowance for uncollectibles.<br />

6. Inventories and Prepaid Items<br />

Inventories of donated food commodities used in the preparation of meals are reported at their Federally<br />

assigned value and purchased foods inventories are reported at cost using the first-in, first-out method<br />

(FIFO). The School System uses the consumption method to account for both donated and purchased<br />

inventories whereby donated food commodities are recorded as an asset and as revenue when received or<br />

purchased, and expenditures are recorded as inventories are used.<br />

Payments made to vendors for services that will benefit periods beyond year end are recorded as prepaid<br />

items<br />

7. Capital Assets<br />

Capital assets, which include property and equipment, are reported in the system-wide fmancial<br />

statements. Capital assets are defined by the School System as assets with an initial, individual cost of<br />

more than $5,000 and an estimated useful life in excess of 3 years. Such assets are recorded at historical<br />

cost or estimated historical cost if purchased or constructed. Donated capital assets are recorded at<br />

estimated fair value at the date of donation. The cost of normal maintenance and repairs that do not add<br />

to the value of the asset or materially extend assets' lives are not capitalized.<br />

Property and equipment of the School System is depreciated using the straight line method over the<br />

following estimated useful lives:<br />

Buildings and improvements<br />

Computers<br />

Machinery and equipment<br />

Kitchen equipment<br />

Vehicles<br />

51<br />

25 to 50 years<br />

5 years<br />

5 to 20 years<br />

15 to 20 years<br />

10 years