Comprehensive Annual Financial Report Ending June 2011

Comprehensive Annual Financial Report Ending June 2011

Comprehensive Annual Financial Report Ending June 2011

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Fayette County Board of Education<br />

NOTES TO FINANCIAL STATEMENTS- CONTINUED<br />

<strong>June</strong> 30, <strong>2011</strong><br />

NOTE B- STEWARDSHIP, COMPLIANCE AND ACCOUNTABILITY- continued<br />

Additionally, the School System budgets purchases of buses and capital lease payments for buses under<br />

transportation services. In reporting actual expenditures budget basis, these items have be reclassified<br />

from capital outlay and debt service, respectively, to student transportation services.<br />

NOTE C- DEPOSTS AND INVESTMENTS<br />

Credit Risk. O.C.G.A. 36-83-4 authorizes the School System to invest its funds. In selecting among<br />

options for investment or among institutional bids for deposits, the highest rate of return shall be the<br />

objective, given equivalent conditions of safety and liquidity. The School System may invest its funds in<br />

obligations of the State of Georgia or other states, obligations issued by the United States government,<br />

obligations fully insured or guaranteed by the United States government or a United States government<br />

agency, obligations of any corporation of the United States government, prime banker's acceptances, the<br />

Georgia Fund 1 administered and regulated by the Georgia Office of Treasury and Fiscal Services,<br />

repurchase agreements, and obligations of political subdivisions of the State of Georgia. The School<br />

System does not have a policy for credit risk beyond the types of investments authorized by Georgia State<br />

law.<br />

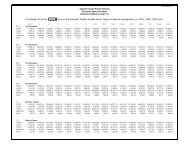

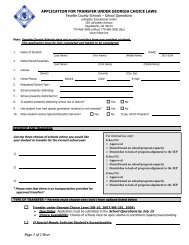

At <strong>June</strong> 30, <strong>2011</strong>, the School System had the following investments:<br />

Investment Type<br />

Georgia Fund 1<br />

Money market mutual funds<br />

Certificates of deposit<br />

Maturities<br />

59 day weighted average<br />

N/A<br />

11.0 montl1 weighted average<br />

Rating<br />

AAAm<br />

N/A<br />

N/A<br />

Fair Value<br />

$ 58,576,771<br />

9,283<br />

59,797<br />

$ 58,645,851<br />

Georgia Fund 1, created by O.C.G.A. 36-83-8, is a stable net asset value investment pool which follows<br />

Standard and Poor's criteria for AAAm rated money market funds. However, Georgia Fund 1 operates in<br />

a manner consistent with Rule 2a-7 of the Investment Company Act of 1940 and is considered to be a 2a-<br />

7 like pool. The pool is not registered with the Securities Exchange Commission as an irwestment<br />

company. The Office of Treasury and Fiscal Services is the regulatory oversight agency for Georgia Fund<br />

1. The pool's primary objectives are safety of capital, investment income, liquidity and diversification<br />

while maintaining principal ($1.00 per share value). Net asset value is calculated weekly to ensure stability.<br />

The pool distributes earnings (net of management fees) on a monthly basis and determines participant's<br />

shares sold and redeemed based on $1.00 per share. Pooled cash and cash equivalents and investments<br />

are reported at cost which approximates fair value. The pool does not issue any legally binding guarantees<br />

to support the value of the shares. Participation in the pool is voluntary and deposits consist of funds<br />

from local governments; operating and trust funds of Georgia's state agencies; colleges and universities;<br />

and current operating funds of the State of Georgia's General Fund. Investments in Georgia Fund 1 are<br />

directed toward short-term instl:uments such as U.S. Treasury obligations, securities issued or guaranteed<br />

as to principal and interest by the U.S. government or any of its agencies or instrumentalities, banker's<br />

acceptances and repurchase agreements.<br />

55