Revenues Fayette County Board of Education STATEMENT OF REVENUES, EXPENDITURES AND CHANGES IN FUND BALANCES GOVERNMENTAL FUNDS For the year ended <strong>June</strong> 30, <strong>2011</strong> Major Governmental Funds Debt Capital Projects Other Total Service SPLOST Governmental Governmental General Fund Fund Funds Funds State funds $ 84,841,972 $ $ $ 1,794,369 $ 86,636,341 Federal funds 4,350,060 10,165,836 14,515,896 Local and other funds 94,877,870 8,533,226 18,649,793 8,211,592 130,272,481 Total revenues 184,069,902 8,533,226 18,649,793 20,171,797 231,424,718 Expenditures Current Instruction 119,657,575 6,879,019 126,536,594 Support services Pupil services 8,072,843 1,232,381 9,305,224 Improvement of instructional services 3,164,069 968,701 4,132,770 Educational media services 3,448,879 91,865 3,540,744 General administration 966,773 188,881 1,155,654 School administration 12,404,590 367,459 12,772,049 Business administration 1,112,059 1,112,059 Maintenance and operation of facilities 13,691,705 98,948 13,790,653 Student transportation services 6,990,183 163,611 7,153,794 Central support services 3,181,093 3,18L093 Other support services 198,764 99,068 297,832 Community service 2,177,702 2,177,702 Food services 305,490 6,724,755 7,030,245 Capital outlay 457,752 9,945,370 2,511,677 12,914,799 Debt Service Principal retirement 1,080,848 8,942,432 1,039,224 11,062,504 Interest and fees 129,492 3,728,354 184,522 4,042,368 Total expenditures 174,862,115 12,670,786 11,169,116 21,504,067 220,206,084 Excess (deficiency) of revenues over (under) expenditures 9,207,787 (4,137,560) 7,480,677 (1 ,332,270) 11,218,634 Other financing sources (uses) Capital lease 3,311,428 3,311,428 Transfers in (out) (161,289) 5 000 000 (5,000,000) 161 289 Total other financing sources (uses) (161,289) 5 000 000 (1 688,572) 161,289 3,311,428 N ct change in fund balances 9,046,498 862,440 5,792,105 (1, 170,981) 14,530,062 Fund balances, beginning of year, as restated 17,290,956 3,120,910 14,819,897 11,223,077 46,454,840 Fund balances, end of year s 26,337,454 s; 3,983,350 s 20,612,002 $ 10,052,096 $ 60,984,902 The accompanying notes are an integral part of this statement. 38

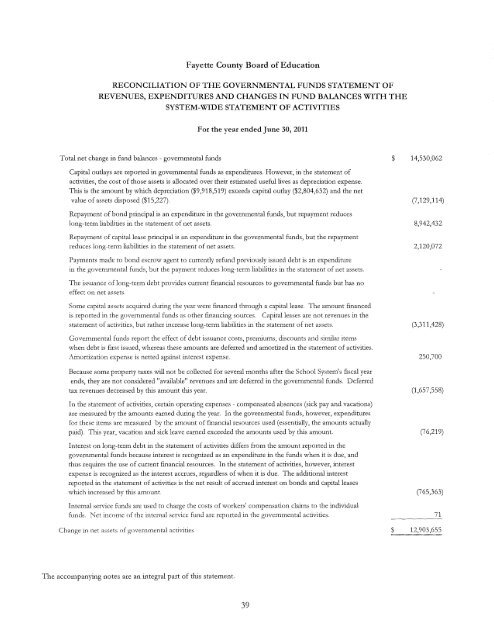

Fayette County Board of Education RECONCILIATION OF THE GOVERNMENTAL FUNDS STATEMENT OF REVENUES, EXPENDITURES AND CHANGES IN FUND BALANCES WITH THE SYSTEM-WIDE STATEMENT OF ACTIVITIES Total net change in fund balances- governmental funds For the year ended <strong>June</strong> 30, <strong>2011</strong> Capital oudays are reported in governmental funds as expenditures. However, in the statement of activities, the cost of those assets is allocated over their estimated useful lives as depreciation expense. This is the amount by which depreciation ($9 ,918,519) exceeds capital ouday ($2,804,632) and the net value of assets disposed ($15,227). Repayment of bond principal is an expenditure in the governmental funds, but repayment reduces long-term liabilities in the statement of net assets. Repayment of capital lease principal is an expenditure in rl1e governmental funds, but the repayment reduces long-term liabilities in the statement of net assets. Payments made to bond escrow agent to currendy refund previously issued debt is an expenditure in the governmental funds, but the payment reduces long-term liabilities in the statement of net assets. The issuance of long-term debt provides current financial resources to governmental funds but has no effect on net assets. Some capital assets acquired during the year were financed through a capital lease. The amount financed is reported in the governmental funds as other fmancing sources. Capital leases are not revenues in the statement of activities, but rather increase long-term liabilities in the statement of net assets. Governmental funds report the effect of debt issuance costs, premiums, discounts and similar items when debt is first issued, whereas these amounts are deferred and amortized in the statement of activities. Amortization expense is netted against interest expense. Because some property taxes will not be collected for several months after the School System's fiscal year ends, they are not considered "available" revenues and are deferred in the governmental funds. Deferred tax revenues decreased by this amount this year. In the statement of activities, certain operating expenses- compensated absences (sick pay and vacations) are measured by the amounts earned during the year. In the governmental funds, however, expenditures for these items are measured by the amount of financial resources used (essentially, the amounts actually paid). This year, vacation and sick leave earned exceeded the amounts used by this amount. Interest on long-term debt in the statement of activities differs from the amount reported in the governmental funds because interest is recognized as an expenditure in the funds when it is due, and thus requires the use of current financial resources. In the statement of activities, however, interest expense is recognized as the interest accrnes, regardless of when it is due. The additional interest reported in the statement of activities is the net result of accrned interest on bonds and capital leases which increased by this amount. Internal service funds are used to charge the costs of workers' compensation claims to the individual funds. Net income of the internal service fund are reported in the governmental activities. Change in net assets of governmental activities The accompanying notes are an integral part of dus statement. 39 $ $ 14,530,062 (7,129,114) 8,942,432 2,120,072 (3,311 ,428) 250,700 (1,657,558) (76,219) (765,363) 71 12,903,655

- Page 1 and 2: FAYETTE COUNTY BOARD OF EDUCATION F

- Page 3 and 4: Table of Contents INTRODUCTORY SECT

- Page 5 and 6: STATISTICAL SECTION (unaudited) Fay

- Page 7 and 8: INTRODUCTORY SECTION

- Page 9 and 10: Dr. Jeff Bearden Superintendent Dec

- Page 11 and 12: As with most of Georgia and the nat

- Page 14 and 15: (fhis page intentionally left blank

- Page 16 and 17: Purchasing Agent Co ordinator I nte

- Page 18 and 19: Fayette County Board of Education L

- Page 20 and 21: (fhis page intentionally left blank

- Page 22 and 23: Accounting principles generally acc

- Page 24 and 25: Fayette County Board of Education M

- Page 26 and 27: Fayette County Board of Education M

- Page 28: Fayette County Board of Education M

- Page 31 and 32: Fayette County Board of Education M

- Page 33 and 34: Fayette County Board of Education M

- Page 35 and 36: Fayette County Board of Education M

- Page 37 and 38: Requests for Information Fayette Co

- Page 39 and 40: Basic Financial Statements 33

- Page 42: Fayette County Board of Education B

- Page 48 and 49: Revenues Local and other funds Tota

- Page 50 and 51: ASSETS Cash Investments Total asset

- Page 52 and 53: (This page intentionally left blank

- Page 55 and 56: Fayette County Board of Education N

- Page 57 and 58: Fayette County Board of Education N

- Page 59: Fayette County Board of Education N

- Page 62 and 63: Fayette County Board of Education N

- Page 66: NOTE I- LONG-TERM DEBT General Obli

- Page 69 and 70: Fayette County Board of Education N

- Page 71 and 72: Fayette County Board of Education N

- Page 73 and 74: Fayette County Board of Education N

- Page 75 and 76: Fayette County Board of Education N

- Page 77 and 78: Fayette County Board of Education N

- Page 79 and 80: Combining Statements and Schedules

- Page 81 and 82: Fayette County Board of Education N

- Page 83: Revenues Fayette County Board of Ed

- Page 89: Drug Free Tide II $ - $ - 7,453 381

- Page 92 and 93: ASSETS Cash Investments Due from ot

- Page 95:

Fayette County Board of Education T

- Page 100:

Fayette County Board of Education T

- Page 108:

Revenues Local and other funds Tota

- Page 113 and 114:

Fayette County Board of Education A

- Page 115 and 116:

ADDITIONAL FINANCIAL INFORMATION 10

- Page 117 and 118:

Expenditures Operating costs Salari

- Page 119 and 120:

STATISTICAL SECTION This part of th

- Page 121 and 122:

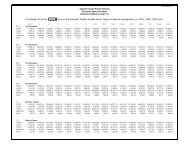

2007 2006 2005 2004 2003 $ 141,200,

- Page 123 and 124:

2007 2006 2005 2004 2003 (B) $ 139,

- Page 127 and 128:

Fiscal Year 2007 2006 2005 2004 200

- Page 131 and 132:

Overlapping Governments City of Cit

- Page 133 and 134:

Collections in Total Collections to

- Page 135 and 136:

Special Purpose Local Option Other

- Page 137 and 138:

2011 $ 2010 2009 2008 2007 2006 200

- Page 139 and 140:

Governmental Unit Debt repaid with

- Page 141 and 142:

2007 2006 2005 2004 2003 2002 $ 465

- Page 143 and 144:

Fayette County Board of Education T

- Page 145 and 146:

2006 70,860 675 519 52,725 450 358

- Page 147 and 148:

2006 94,179 800 469 94,179 800 732

- Page 149 and 150:

2006 2005 2004 2003 2002 139,581 13

- Page 151 and 152:

2006 2005 2004 2003 2002 2001 102 9

- Page 153 and 154:

2007 2006 2005 2004 2003 2002 337,3

- Page 155 and 156:

Sources: Note 1: Note 2: Fayette Co