Comprehensive Annual Financial Report Ending June 2011

Comprehensive Annual Financial Report Ending June 2011

Comprehensive Annual Financial Report Ending June 2011

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

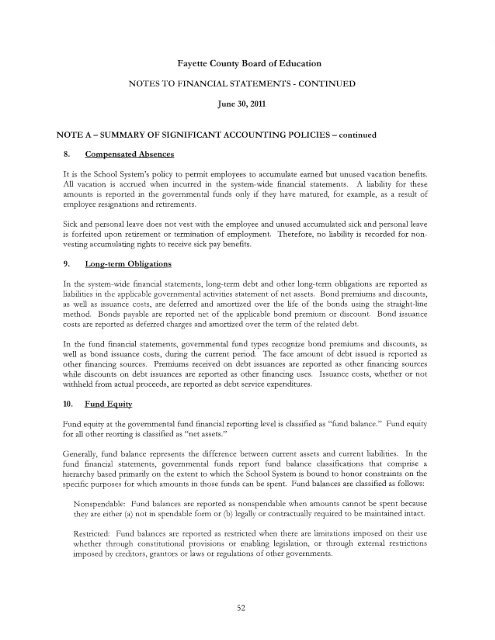

Fayette County Board of Education<br />

NOTES TO FINANCIAL STATEMENTS- CONTINUED<br />

<strong>June</strong> 30, <strong>2011</strong><br />

NOTE A- SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES -continued<br />

8. Compensated Absences<br />

It is the School System's policy to permit employees to accumulate earned but unused vacation benefits.<br />

All vacation is accrued when incurred in the system-wide financial statements. A liability for these<br />

amounts is reported in the governmental funds only if they have matured, for example, as a result of<br />

employee resignations and retirements.<br />

Sick and personal leave does not vest with the employee and unused accumulated sick and personal leave<br />

is forfeited upon retirement or termination of employment. Therefore, no liability is recorded for nonvesting<br />

accumulating rights to receive sick pay benefits.<br />

9. Long-term Obligations<br />

In the system-wide financial statements, long-term debt and other long-term obligations are reported as<br />

liabilities in the applicable governmental activities statement of net assets. Bond premiums and discounts,<br />

as well as issuance costs, are deferred and amortized over the life of the bonds using the straight-line<br />

method. Bonds payable are reported net of the applicable bond premium or discount. Bond issuance<br />

costs are reported as deferred charges and amortized over the term of the related debt.<br />

In the fund financial statements, governmental fund types recognize bond premiums and discounts, as<br />

well as bond issuance costs, during the current period. The face amount of debt issued is reported as<br />

other financing sources. Premiums received on debt issuances are reported as other fmancing sources<br />

while discounts on debt issuances are reported as other financing uses. Issuance costs, whether or not<br />

withheld from actual proceeds, are reported as debt service expenditures.<br />

10. Fund Equity<br />

Fund equity at the governmental fund financial reporting level is classified as "fund balance." Fund equity<br />

for all other reorting is classified as "net assets."<br />

Generally, fund balance represents the difference between current assets and current liabilities. In the<br />

fund financial statements, governmental funds report fund balance classifications that comprise a<br />

hierarchy based primarily on the extent to which the School System is bound to honor constraints on the<br />

specific purposes for which amounts in those funds can be spent. Fund balances are classified as follows:<br />

N onspendable: Fund balances are reported as nonspendable when amounts cannot be spent because<br />

they are either (a) not in spendable form or (b) legally or contractually required to be maintained intact.<br />

Restricted: Fund balances are reported as restricted when there are limitations imposed on their use<br />

whether through constitutional provisions or enabling legislation, or through external restrictions<br />

imposed by creditors, grantors or laws or regulations of other governments.<br />

52