QS Investors Diversification Based Investing Whitepaper - FTSE

QS Investors Diversification Based Investing Whitepaper - FTSE

QS Investors Diversification Based Investing Whitepaper - FTSE

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

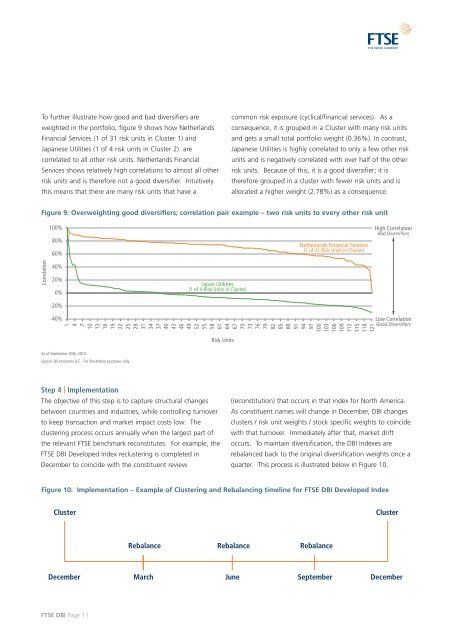

To further illustrate how good and bad diversifiers are<br />

weighted in the portfolio, figure 9 shows how Netherlands<br />

Financial Services (1 of 31 risk units in Cluster 1) and<br />

Japanese Utilities (1 of 4 risk units in Cluster 2) are<br />

correlated to all other risk units. Netherlands Financial<br />

Services shows relatively high correlations to almost all other<br />

risk units and is therefore not a good diversifier. Intuitively<br />

this means that there are many risk units that have a<br />

Correlation<br />

100%<br />

80%<br />

60%<br />

40%<br />

20%<br />

0%<br />

-20%<br />

-40%<br />

Step 4 | Implementation<br />

The objective of this step is to capture structural changes<br />

between countries and industries, while controlling turnover<br />

to keep transaction and market impact costs low. The<br />

clustering process occurs annually when the largest part of<br />

the relevant <strong>FTSE</strong> benchmark reconstitutes. For example, the<br />

<strong>FTSE</strong> DBI Developed Index reclustering is completed in<br />

December to coincide with the constituent review<br />

<strong>FTSE</strong> DBI Page 11<br />

Risk Units<br />

common risk exposure (cyclical/financial services). As a<br />

consequence, it is grouped in a Cluster with many risk units<br />

and gets a small total portfolio weight (0.36%). In contrast,<br />

Japanese Utilities is highly correlated to only a few other risk<br />

units and is negatively correlated with over half of the other<br />

risk units. Because of this, it is a good diversifier; it is<br />

therefore grouped in a cluster with fewer risk units and is<br />

allocated a higher weight (2.78%) as a consequence.<br />

Figure 9: Overweighting good diversifiers; correlation pair example – two risk units to every other risk unit<br />

Japan Utilities<br />

(1 of 4 Risk Units in Cluster)<br />

Netherlands Financial Services<br />

(1 of 31 Risk Units in Cluster)<br />

1<br />

4<br />

7<br />

10<br />

13<br />

16<br />

19<br />

22<br />

25<br />

28<br />

31<br />

34<br />

37<br />

40<br />

43<br />

46<br />

49<br />

52<br />

55<br />

58<br />

61<br />

64<br />

67<br />

70<br />

73<br />

76<br />

79<br />

82<br />

85<br />

88<br />

91<br />

94<br />

97<br />

100<br />

103<br />

106<br />

109<br />

112<br />

115<br />

118<br />

121<br />

As of September 30th, 2010.<br />

Source: <strong>QS</strong> <strong>Investors</strong> LLC. For illustration purposes only<br />

High Correlation<br />

Bad Diversifiers<br />

Low Correlation<br />

Good Diversifiers<br />

(reconstitution) that occurs in that index for North America.<br />

As constituent names will change in December, DBI changes<br />

clusters / risk unit weights / stock specific weights to coincide<br />

with that turnover. Immediately after that, market drift<br />

occurs. To maintain diversification, the DBI Indexes are<br />

rebalanced back to the original diversification weights once a<br />

quarter. This process is illustrated below in Figure 10.<br />

Figure 10: Implementation – Example of Clustering and Rebalancing timeline for <strong>FTSE</strong> DBI Developed Index<br />

Cluster<br />

Rebalance Rebalance Rebalance<br />

Cluster<br />

December March June September December