QS Investors Diversification Based Investing Whitepaper - FTSE

QS Investors Diversification Based Investing Whitepaper - FTSE

QS Investors Diversification Based Investing Whitepaper - FTSE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2 | The DBI investment process<br />

DBI takes into account the observed characteristics of<br />

markets and indices described earlier, and uses them to<br />

create a more diversified index. The strategy’s investment<br />

process has four steps:<br />

1 | Assign all stocks to risk units defined by the key drivers<br />

of risk: country and industry<br />

2 | Identify highly correlated risk units, and group them in a<br />

single “cluster”<br />

3 | Weight the clusters and the risk units in them equally.<br />

The objective of equal weighting is to achieve a high<br />

level of diversification<br />

4 | Rebalance the index to capture changes in market<br />

dynamics<br />

These four steps are described in more detail.<br />

<strong>FTSE</strong> DBI Page 8<br />

Step 1 | Partition<br />

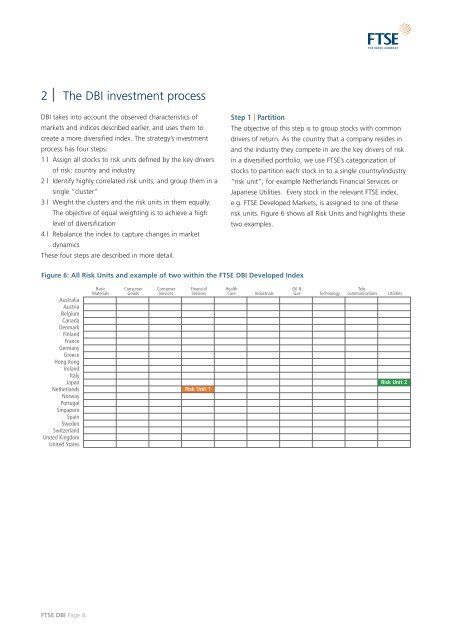

Figure 6: All Risk Units and example of two within the <strong>FTSE</strong> DBI Developed Index<br />

Australia<br />

Austria<br />

Belgium<br />

Canada<br />

Denmark<br />

Finland<br />

France<br />

Germany<br />

Greece<br />

Hong Kong<br />

Ireland<br />

Italy<br />

Japan<br />

Netherlands<br />

Norway<br />

Portugal<br />

Singapore<br />

Spain<br />

Sweden<br />

Switzerland<br />

United Kingdom<br />

United States<br />

Basic<br />

Materials<br />

Consumer<br />

Goods<br />

Consumer<br />

Services<br />

Financial<br />

Services<br />

Risk Unit 1<br />

The objective of this step is to group stocks with common<br />

drivers of return. As the country that a company resides in<br />

and the industry they compete in are the key drivers of risk<br />

in a diversified portfolio, we use <strong>FTSE</strong>’s categorization of<br />

stocks to partition each stock in to a single country/industry<br />

“risk unit”, for example Netherlands Financial Services or<br />

Japanese Utilities. Every stock in the relevant <strong>FTSE</strong> index,<br />

e.g. <strong>FTSE</strong> Developed Markets, is assigned to one of these<br />

risk units. Figure 6 shows all Risk Units and highlights these<br />

two examples.<br />

Health<br />

Care Industrials<br />

Oil &<br />

Gas Technology<br />

Telecommunications<br />

Utilities<br />

Risk Unit 2