QS Investors Diversification Based Investing Whitepaper - FTSE

QS Investors Diversification Based Investing Whitepaper - FTSE

QS Investors Diversification Based Investing Whitepaper - FTSE

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Step 2 | Cluster<br />

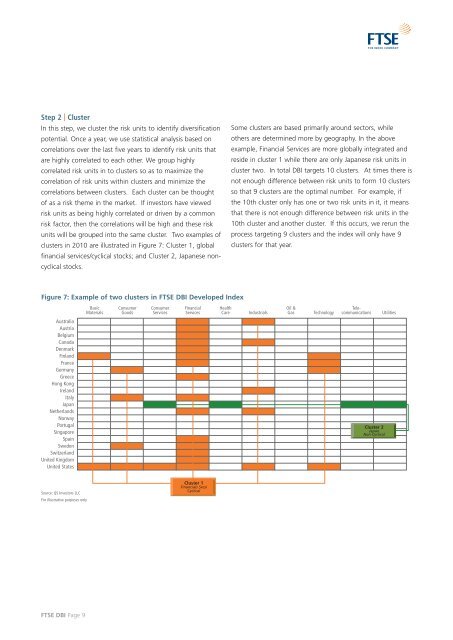

In this step, we cluster the risk units to identify diversification<br />

potential. Once a year, we use statistical analysis based on<br />

correlations over the last five years to identify risk units that<br />

are highly correlated to each other. We group highly<br />

correlated risk units in to clusters so as to maximize the<br />

correlation of risk units within clusters and minimize the<br />

correlations between clusters. Each cluster can be thought<br />

of as a risk theme in the market. If investors have viewed<br />

risk units as being highly correlated or driven by a common<br />

risk factor, then the correlations will be high and these risk<br />

units will be grouped into the same cluster. Two examples of<br />

clusters in 2010 are illustrated in Figure 7: Cluster 1, global<br />

financial services/cyclical stocks; and Cluster 2, Japanese noncyclical<br />

stocks.<br />

Figure 7: Example of two clusters in <strong>FTSE</strong> DBI Developed Index<br />

Australia<br />

Austria<br />

Belgium<br />

Canada<br />

Denmark<br />

Finland<br />

France<br />

Germany<br />

Greece<br />

Hong Kong<br />

Ireland<br />

Italy<br />

Japan<br />

Netherlands<br />

Norway<br />

Portugal<br />

Singapore<br />

Spain<br />

Sweden<br />

Switzerland<br />

United Kingdom<br />

United States<br />

Source: <strong>QS</strong> <strong>Investors</strong> LLC<br />

For illustrative purposes only<br />

<strong>FTSE</strong> DBI Page 9<br />

Basic<br />

Materials<br />

Consumer<br />

Goods<br />

Consumer<br />

Services<br />

Financial<br />

Services<br />

Cluster 1<br />

Financials Svcs/<br />

Cyclical<br />

Some clusters are based primarily around sectors, while<br />

others are determined more by geography. In the above<br />

example, Financial Services are more globally integrated and<br />

reside in cluster 1 while there are only Japanese risk units in<br />

cluster two. In total DBI targets 10 clusters. At times there is<br />

not enough difference between risk units to form 10 clusters<br />

so that 9 clusters are the optimal number. For example, if<br />

the 10th cluster only has one or two risk units in it, it means<br />

that there is not enough difference between risk units in the<br />

10th cluster and another cluster. If this occurs, we rerun the<br />

process targeting 9 clusters and the index will only have 9<br />

clusters for that year.<br />

Health<br />

Care Industrials<br />

Oil &<br />

Gas Technology<br />

Telecommunications<br />

Utilities<br />

Cluster 2<br />

Japan<br />

Non Cyclical