QS Investors Diversification Based Investing Whitepaper - FTSE

QS Investors Diversification Based Investing Whitepaper - FTSE

QS Investors Diversification Based Investing Whitepaper - FTSE

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

1 | Rationale and philosophy<br />

DBI is based on three key beliefs:<br />

1. Geography and industry are the primary drivers of global<br />

equity risk<br />

2. Market sentiment generates momentum effects in<br />

capitalization-weighted indices, which leads to<br />

concentration risk that builds and collapses<br />

3. A diversified portfolio helps to avoid concentration risk<br />

and reduces downside market participation<br />

The rationale for the first two beliefs is given below. The third<br />

is explained in section three, “Performance analysis”.<br />

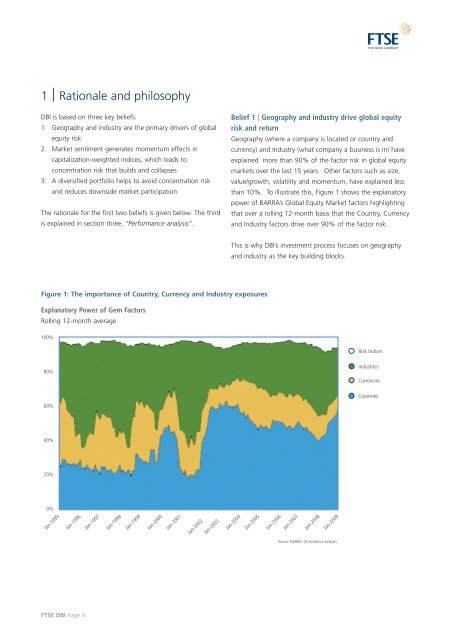

Figure 1: The importance of Country, Currency and Industry exposures<br />

Explanatory Power of Gem Factors<br />

Rolling 12-month average<br />

100%<br />

80%<br />

60%<br />

40%<br />

20%<br />

0%<br />

Jan-1995<br />

Jan-1996<br />

<strong>FTSE</strong> DBI Page 4<br />

Jan-1997<br />

Jan-1998<br />

Jan-1999<br />

Jan-2000<br />

Jan-2001<br />

Belief 1 | Geography and industry drive global equity<br />

risk and return<br />

Geography (where a company is located or country and<br />

currency) and Industry (what company a business is in) have<br />

explained more than 90% of the factor risk in global equity<br />

markets over the last 15 years. Other factors such as size,<br />

value/growth, volatility and momentum, have explained less<br />

than 10%. To illustrate this, Figure 1 shows the explanatory<br />

power of BARRA’s Global Equity Market factors highlighting<br />

that over a rolling 12-month basis that the Country, Currency<br />

and Industry factors drive over 90% of the factor risk.<br />

This is why DBI’s investment process focuses on geography<br />

and industry as the key building blocks.<br />

Jan-2002<br />

Jan-2003<br />

Jan-2004<br />

Jan-2005<br />

Jan-2006<br />

Jan-2007<br />

Jan-2008<br />

Jan-2009<br />

Source: BARRA, <strong>QS</strong> <strong>Investors</strong> analysis<br />

Risk Indices<br />

Industries<br />

Currencies<br />

Countries