September - FTSE

September - FTSE

September - FTSE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

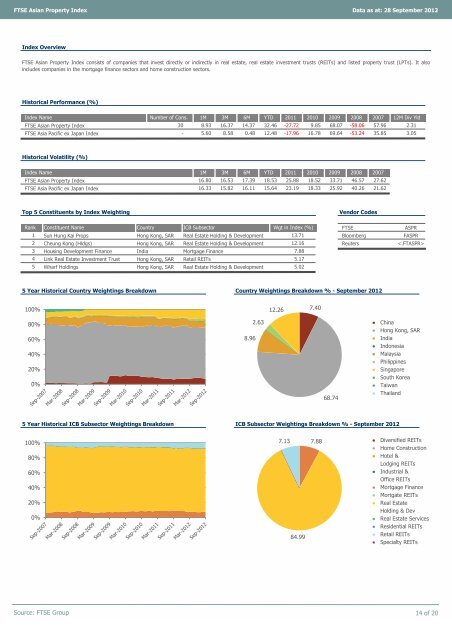

<strong>FTSE</strong> Asian Property Index Data as at: 28 <strong>September</strong> 2012<br />

Index Overview<br />

<strong>FTSE</strong> Asian Property Index consists of companies that invest directly or indirectly in real estate, real estate investment trusts (REITs) and listed property trust (LPTs). It also<br />

includes companies in the mortgage finance sectors and home construction sectors.<br />

Historical Performance (%)<br />

Index Name Number of Cons. 1M 3M 6M YTD 2011 2010 2009 2008 2007 12M Div Yld<br />

<strong>FTSE</strong> Asian Property Index<br />

<strong>FTSE</strong> Asia Pacific ex Japan Index<br />

Historical Volatility (%)<br />

Index Name 1M 3M 6M YTD 2011 2010 2009 2008<br />

<strong>FTSE</strong> Asian Property Index<br />

<strong>FTSE</strong> Asia Pacific ex Japan Index<br />

16.33 15.82 16.11 15.64 23.19 18.33 25.92 40.26 21.62<br />

Top 5 Constituents by Index Weighting Vendor Codes<br />

Rank Constituent Name Country ICB Subsector Wgt in Index (%)<br />

<strong>FTSE</strong> ASPR<br />

1 Sun Hung Kai Props Hong Kong, SAR Real Estate Holding & Development 13.71<br />

Bloomberg FASPR<br />

2 Cheung Kong (Hldgs) Hong Kong, SAR Real Estate Holding & Development 12.16<br />

Reuters <br />

3 Housing Development Finance India Mortgage Finance<br />

7.88<br />

4 Link Real Estate Investment Trust Hong Kong, SAR Retail REITs<br />

5.17<br />

5 Wharf Holdings Hong Kong, SAR Real Estate Holding & Development<br />

5.02<br />

5 Year Historical Country Weightings Breakdown Country Weightings Breakdown % - <strong>September</strong> 2012<br />

100%<br />

80%<br />

60%<br />

40%<br />

20%<br />

0%<br />

30 8.93 16.37 14.37 32.46 -27.72 9.85 68.07 -58.06<br />

● China<br />

● Hong Kong, SAR<br />

● India<br />

● Indonesia<br />

● Malaysia<br />

● Philippines<br />

● Singapore<br />

● South Korea<br />

● Taiwan<br />

● Thailand<br />

5 Year Historical ICB Subsector Weightings Breakdown ICB Subsector Weightings Breakdown % - <strong>September</strong> 2012<br />

100%<br />

80%<br />

60%<br />

40%<br />

20%<br />

0%<br />

● Diversified REITs<br />

● Home Construction<br />

● Hotel &<br />

Lodging REITs<br />

● Industrial &<br />

Office REITs<br />

● Mortgage Finance<br />

● Mortgate REITs<br />

● Real Estate<br />

Holding & Dev<br />

● Real Estate Services<br />

● Residential REITs<br />

● Retail REITs<br />

● Specialty REITs<br />

Source: <strong>FTSE</strong> Group 14 of 20<br />

2007<br />

16.80 16.53 17.39 18.53 25.88 18.52 33.71 46.57 27.62<br />

57.96 2.31<br />

- 5.60 8.58 0.48 12.48 -17.96 16.78 69.64 -53.24 35.85 3.05<br />

8.96<br />

2.63<br />

12.26<br />

7.13<br />

84.99<br />

7.40<br />

7.88<br />

68.74