Gender Diversity on the Board - BI Norwegian Business School

Gender Diversity on the Board - BI Norwegian Business School

Gender Diversity on the Board - BI Norwegian Business School

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

GRA 19001 Master Thesis<br />

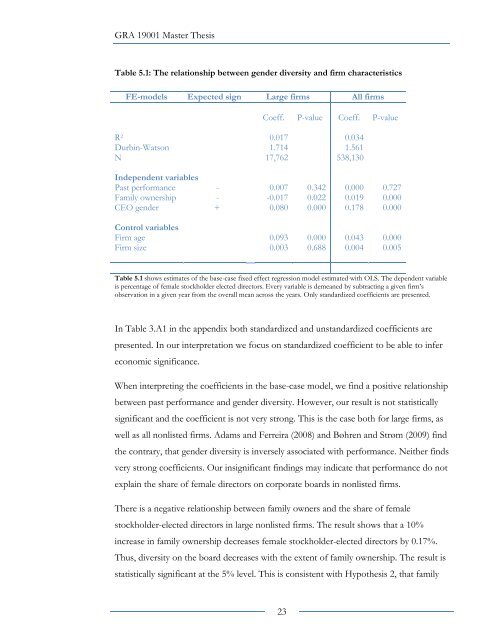

Table 5.1: The relati<strong>on</strong>ship between gender diversity and firm characteristics<br />

FE-models Expected sign Large firms All firms<br />

Coeff. P-value Coeff. P-value<br />

R 2 0.017 0.034<br />

Durbin-Wats<strong>on</strong> 1.714 1.561<br />

N 17,762 538,130<br />

Independent variables<br />

Past performance - 0.007 0.342 0.000 0.727<br />

Family ownership - -0.017 0.022 0.019 0.000<br />

CEO gender + 0.080 0.000 0.178 0.000<br />

C<strong>on</strong>trol variables<br />

Firm age 0.093 0.000 0.043 0.000<br />

Firm size 0.003 0.688 0.004 0.005<br />

Table 5.1 shows estimates of <strong>the</strong> base-case fixed effect regressi<strong>on</strong> model estimated with OLS. The dependent variable<br />

is percentage of female stockholder elected directors. Every variable is demeaned by subtracting a given firm’s<br />

observati<strong>on</strong> in a given year from <strong>the</strong> overall mean across <strong>the</strong> years. Only standardized coefficients are presented.<br />

In Table 3.A1 in <strong>the</strong> appendix both standardized and unstandardized coefficients are<br />

presented. In our interpretati<strong>on</strong> we focus <strong>on</strong> standardized coefficient to be able to infer<br />

ec<strong>on</strong>omic significance.<br />

When interpreting <strong>the</strong> coefficients in <strong>the</strong> base-case model, we find a positive relati<strong>on</strong>ship<br />

between past performance and gender diversity. However, our result is not statistically<br />

significant and <strong>the</strong> coefficient is not very str<strong>on</strong>g. This is <strong>the</strong> case both for large firms, as<br />

well as all n<strong>on</strong>listed firms. Adams and Ferreira (2008) and Bøhren and Strøm (2009) find<br />

<strong>the</strong> c<strong>on</strong>trary, that gender diversity is inversely associated with performance. Nei<strong>the</strong>r finds<br />

very str<strong>on</strong>g coefficients. Our insignificant findings may indicate that performance do not<br />

explain <strong>the</strong> share of female directors <strong>on</strong> corporate boards in n<strong>on</strong>listed firms.<br />

There is a negative relati<strong>on</strong>ship between family owners and <strong>the</strong> share of female<br />

stockholder-elected directors in large n<strong>on</strong>listed firms. The result shows that a 10%<br />

increase in family ownership decreases female stockholder-elected directors by 0.17%.<br />

Thus, diversity <strong>on</strong> <strong>the</strong> board decreases with <strong>the</strong> extent of family ownership. The result is<br />

statistically significant at <strong>the</strong> 5% level. This is c<strong>on</strong>sistent with Hypo<strong>the</strong>sis 2, that family<br />

23