ANYTIMEkANYPLACEkANYWHERE - Heinz

ANYTIMEkANYPLACEkANYWHERE - Heinz

ANYTIMEkANYPLACEkANYWHERE - Heinz

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

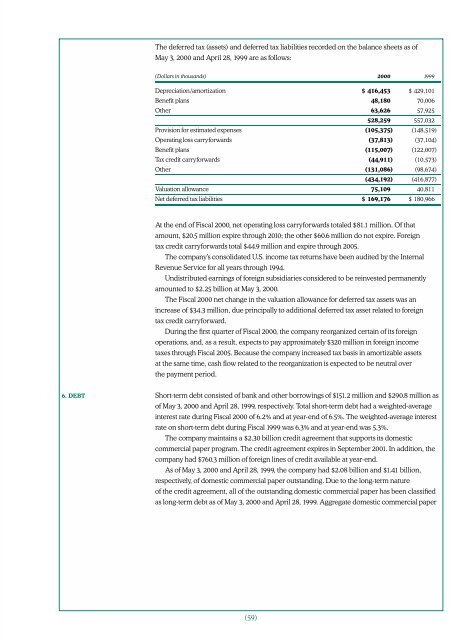

The deferred tax (assets) and deferred tax liabilities recorded on the balance sheets as of<br />

May 3, 2000 and April 28, 1999 are as follows:<br />

(Dollars in thousands) 2000 1999<br />

Depreciation/amortization $ 416,453 $ 429,101<br />

Benefit plans 48,180 70,006<br />

Other 63,626 57,925<br />

528,259 557,032<br />

Provision for estimated expenses (105,375) (148,519)<br />

Operating loss carryforwards (37,813) (37,104)<br />

Benefit plans (115,007) (122,007)<br />

Tax credit carryforwards (44,911) (10,573)<br />

Other (131,086) (98,674)<br />

(434,192) (416,877)<br />

Valuation allowance 75,109 40,811<br />

Net deferred tax liabilities $ 169,176 $ 180,966<br />

At the end of Fiscal 2000, net operating loss carryforwards totaled $81.1 million. Of that<br />

amount, $20.5 million expire through 2010; the other $60.6 million do not expire. Foreign<br />

tax credit carryforwards total $44.9 million and expire through 2005.<br />

The company’s consolidated U.S. income tax returns have been audited by the Internal<br />

Revenue Service for all years through 1994.<br />

Undistributed earnings of foreign subsidiaries considered to be reinvested permanently<br />

amounted to $2.25 billion at May 3, 2000.<br />

The Fiscal 2000 net change in the valuation allowance for deferred tax assets was an<br />

increase of $34.3 million, due principally to additional deferred tax asset related to foreign<br />

tax credit carryforward.<br />

During the first quarter of Fiscal 2000, the company reorganized certain of its foreign<br />

operations, and, as a result, expects to pay approximately $320 million in foreign income<br />

taxes through Fiscal 2005. Because the company increased tax basis in amortizable assets<br />

at the same time, cash flow related to the reorganization is expected to be neutral over<br />

the payment period.<br />

6. DEBT Short-term debt consisted of bank and other borrowings of $151.2 million and $290.8 million as<br />

of May 3, 2000 and April 28, 1999, respectively. Total short-term debt had a weighted-average<br />

interest rate during Fiscal 2000 of 6.2% and at year-end of 6.5%. The weighted-average interest<br />

rate on short-term debt during Fiscal 1999 was 6.3% and at year-end was 5.3%.<br />

The company maintains a $2.30 billion credit agreement that supports its domestic<br />

commercial paper program. The credit agreement expires in September 2001. In addition, the<br />

company had $760.3 million of foreign lines of credit available at year-end.<br />

As of May 3, 2000 and April 28, 1999, the company had $2.08 billion and $1.41 billion,<br />

respectively, of domestic commercial paper outstanding. Due to the long-term nature<br />

of the credit agreement, all of the outstanding domestic commercial paper has been classified<br />

as long-term debt as of May 3, 2000 and April 28, 1999. Aggregate domestic commercial paper<br />

(59)