ANYTIMEkANYPLACEkANYWHERE - Heinz

ANYTIMEkANYPLACEkANYWHERE - Heinz

ANYTIMEkANYPLACEkANYWHERE - Heinz

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

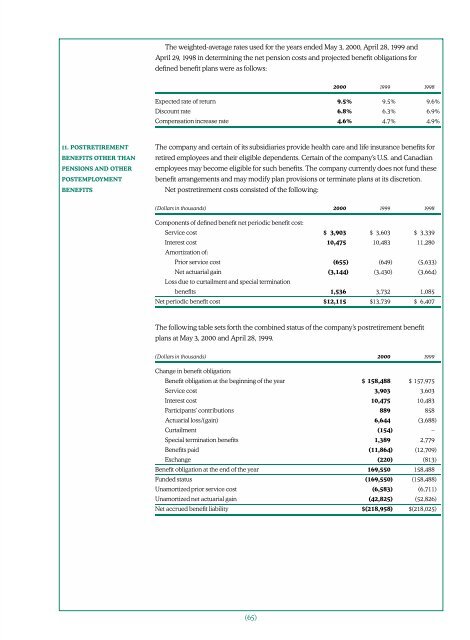

The weighted-average rates used for the years ended May 3, 2000, April 28, 1999 and<br />

April 29, 1998 in determining the net pension costs and projected benefit obligations for<br />

defined benefit plans were as follows:<br />

2000 1999 1998<br />

Expected rate of return 9.5% 9.5% 9.6%<br />

Discount rate 6.8% 6.3% 6.9%<br />

Compensation increase rate 4.6% 4.7% 4.9%<br />

11. POSTRETIREMENT<br />

BENEFITS OTHER THAN<br />

PENSIONS AND OTHER<br />

POSTEMPLOYMENT<br />

BENEFITS<br />

The company and certain of its subsidiaries provide health care and life insurance benefits for<br />

retired employees and their eligible dependents. Certain of the company’s U.S. and Canadian<br />

employees may become eligible for such benefits. The company currently does not fund these<br />

benefit arrangements and may modify plan provisions or terminate plans at its discretion.<br />

Net postretirement costs consisted of the following:<br />

(Dollars in thousands) 2000 1999 1998<br />

Components of defined benefit net periodic benefit cost:<br />

Service cost $ 3,903 $ 3,603 $ 3,339<br />

Interest cost 10,475 10,483 11,280<br />

Amortization of:<br />

Prior service cost (655) (649) (5,633)<br />

Net actuarial gain (3,144) (3,430) (3,664)<br />

Loss due to curtailment and special termination<br />

benefits 1,536 3,732 1,085<br />

Net periodic benefit cost $12,115 $13,739 $ 6,407<br />

The following table sets forth the combined status of the company’s postretirement benefit<br />

plans at May 3, 2000 and April 28, 1999.<br />

(Dollars in thousands) 2000 1999<br />

Change in benefit obligation:<br />

Benefit obligation at the beginning of the year $ 158,488 $ 157,975<br />

Service cost 3,903 3,603<br />

Interest cost 10,475 10,483<br />

Participants’ contributions 889 858<br />

Actuarial loss/(gain) 6,644 (3,688)<br />

Curtailment (154) –<br />

Special termination benefits 1,389 2,779<br />

Benefits paid (11,864) (12,709)<br />

Exchange (220) (813)<br />

Benefit obligation at the end of the year 169,550 158,488<br />

Funded status (169,550) (158,488)<br />

Unamortized prior service cost (6,583) (6,711)<br />

Unamortized net actuarial gain (42,825) (52,826)<br />

Net accrued benefit liability $(218,958) $(218,025)<br />

(65)