ANYTIMEkANYPLACEkANYWHERE - Heinz

ANYTIMEkANYPLACEkANYWHERE - Heinz

ANYTIMEkANYPLACEkANYWHERE - Heinz

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

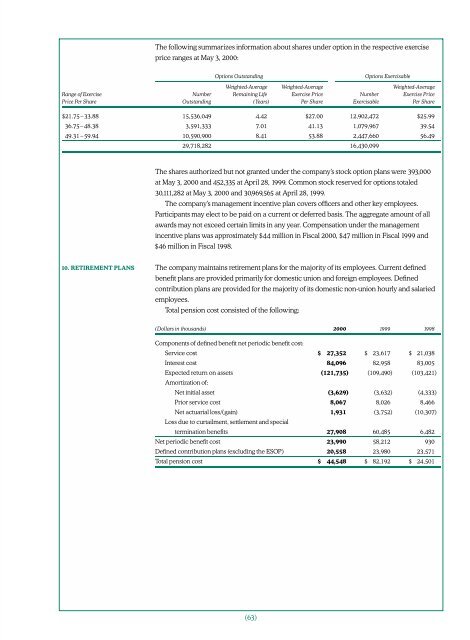

The following summarizes information about shares under option in the respective exercise<br />

price ranges at May 3, 2000:<br />

Options Outstanding<br />

Options Exercisable<br />

Range of Exercise<br />

Price Per Share<br />

Number<br />

Outstanding<br />

Weighted-Average<br />

Remaining Life<br />

(Years)<br />

Weighted-Average<br />

Exercise Price<br />

Per Share<br />

Number<br />

Exercisable<br />

Weighted-Average<br />

Exercise Price<br />

Per Share<br />

$21.75 – 33.88 15,536,049 4.42 $27.00 12,902,472 $25.99<br />

36.75 – 48.38 3,591,333 7.01 41.13 1,079,967 39.54<br />

49.31 – 59.94 10,590,900 8.41 53.88 2,447,660 56.49<br />

29,718,282 16,430,099<br />

The shares authorized but not granted under the company’s stock option plans were 393,000<br />

at May 3, 2000 and 452,335 at April 28, 1999. Common stock reserved for options totaled<br />

30,111,282 at May 3, 2000 and 30,969,565 at April 28, 1999.<br />

The company’s management incentive plan covers officers and other key employees.<br />

Participants may elect to be paid on a current or deferred basis. The aggregate amount of all<br />

awards may not exceed certain limits in any year. Compensation under the management<br />

incentive plans was approximately $44 million in Fiscal 2000, $47 million in Fiscal 1999 and<br />

$46 million in Fiscal 1998.<br />

10. RETIREMENT PLANS The company maintains retirement plans for the majority of its employees. Current defined<br />

benefit plans are provided primarily for domestic union and foreign employees. Defined<br />

contribution plans are provided for the majority of its domestic non-union hourly and salaried<br />

employees.<br />

Total pension cost consisted of the following:<br />

(Dollars in thousands) 2000 1999 1998<br />

Components of defined benefit net periodic benefit cost:<br />

Service cost $ 27,352 $ 23,617 $ 21,038<br />

Interest cost 84,096 82,958 83,005<br />

Expected return on assets (121,735) (109,490) (103,421)<br />

Amortization of:<br />

Net initial asset (3,629) (3,632) (4,333)<br />

Prior service cost 8,067 8,026 8,466<br />

Net actuarial loss/(gain) 1,931 (3,752) (10,307)<br />

Loss due to curtailment, settlement and special<br />

termination benefits 27,908 60,485 6,482<br />

Net periodic benefit cost 23,990 58,212 930<br />

Defined contribution plans (excluding the ESOP) 20,558 23,980 23,571<br />

Total pension cost $ 44,548 $ 82,192 $ 24,501<br />

(63)