ANYTIMEkANYPLACEkANYWHERE - Heinz

ANYTIMEkANYPLACEkANYWHERE - Heinz

ANYTIMEkANYPLACEkANYWHERE - Heinz

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

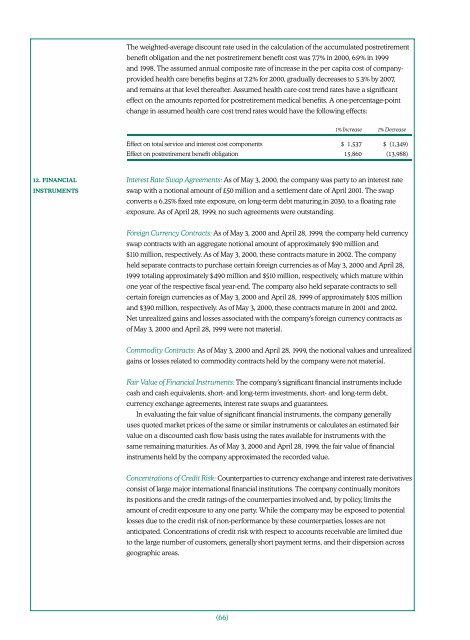

The weighted-average discount rate used in the calculation of the accumulated postretirement<br />

benefit obligation and the net postretirement benefit cost was 7.7% in 2000, 6.9% in 1999<br />

and 1998. The assumed annual composite rate of increase in the per capita cost of companyprovided<br />

health care benefits begins at 7.2% for 2000, gradually decreases to 5.3% by 2007,<br />

and remains at that level thereafter. Assumed health care cost trend rates have a significant<br />

effect on the amounts reported for postretirement medical benefits. A one-percentage-point<br />

change in assumed health care cost trend rates would have the following effects:<br />

1% Increase 1% Decrease<br />

Effect on total service and interest cost components $ 1,537 $ (1,349)<br />

Effect on postretirement benefit obligation 15,860 (13,988)<br />

12. FINANCIAL<br />

INSTRUMENTS<br />

Interest Rate Swap Agreements: As of May 3, 2000, the company was party to an interest rate<br />

swap with a notional amount of £50 million and a settlement date of April 2001. The swap<br />

converts a 6.25% fixed rate exposure, on long-term debt maturing in 2030, to a floating rate<br />

exposure. As of April 28, 1999, no such agreements were outstanding.<br />

Foreign Currency Contracts: As of May 3, 2000 and April 28, 1999, the company held currency<br />

swap contracts with an aggregate notional amount of approximately $90 million and<br />

$110 million, respectively. As of May 3, 2000, these contracts mature in 2002. The company<br />

held separate contracts to purchase certain foreign currencies as of May 3, 2000 and April 28,<br />

1999 totaling approximately $490 million and $510 million, respectively, which mature within<br />

one year of the respective fiscal year-end. The company also held separate contracts to sell<br />

certain foreign currencies as of May 3, 2000 and April 28, 1999 of approximately $105 million<br />

and $390 million, respectively. As of May 3, 2000, these contracts mature in 2001 and 2002.<br />

Net unrealized gains and losses associated with the company’s foreign currency contracts as<br />

of May 3, 2000 and April 28, 1999 were not material.<br />

Commodity Contracts: As of May 3, 2000 and April 28, 1999, the notional values and unrealized<br />

gains or losses related to commodity contracts held by the company were not material.<br />

Fair Value of Financial Instruments: The company’s significant financial instruments include<br />

cash and cash equivalents, short- and long-term investments, short- and long-term debt,<br />

currency exchange agreements, interest rate swaps and guarantees.<br />

In evaluating the fair value of significant financial instruments, the company generally<br />

uses quoted market prices of the same or similar instruments or calculates an estimated fair<br />

value on a discounted cash flow basis using the rates available for instruments with the<br />

same remaining maturities. As of May 3, 2000 and April 28, 1999, the fair value of financial<br />

instruments held by the company approximated the recorded value.<br />

Concentrations of Credit Risk: Counterparties to currency exchange and interest rate derivatives<br />

consist of large major international financial institutions. The company continually monitors<br />

its positions and the credit ratings of the counterparties involved and, by policy, limits the<br />

amount of credit exposure to any one party. While the company may be exposed to potential<br />

losses due to the credit risk of non-performance by these counterparties, losses are not<br />

anticipated. Concentrations of credit risk with respect to accounts receivable are limited due<br />

to the large number of customers, generally short payment terms, and their dispersion across<br />

geographic areas.<br />

(66)