Improved Beta? - IndexUniverse.com

Improved Beta? - IndexUniverse.com

Improved Beta? - IndexUniverse.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

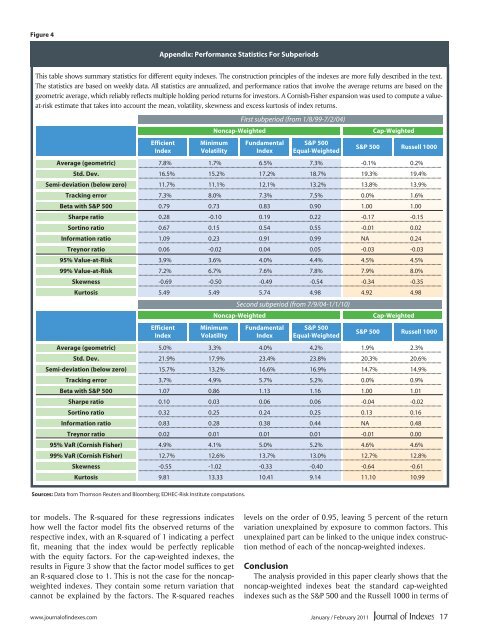

Figure 4<br />

Appendix: Performance Statistics For Subperiods<br />

This table shows summary statistics for different equity indexes. The construction principles of the indexes are more fully described in the text.<br />

The statistics are based on weekly data. All statistics are annualized, and performance ratios that involve the average returns are based on the<br />

geometric average, which reliably reflects multiple holding period returns for investors. A Cornish-Fisher expansion was used to <strong>com</strong>pute a valueat-risk<br />

estimate that takes into account the mean, volatility, skewness and excess kurtosis of index returns.<br />

Efficient<br />

Index<br />

Minimum<br />

Volatility<br />

Sources: Data from Thomson Reuters and Bloomberg; EDHEC-Risk Institute <strong>com</strong>putations.<br />

Fundamental<br />

Index<br />

S&P 500<br />

Equal-Weighted<br />

S&P 500 Russell 1000<br />

Average (geometric) 7.8% 1.7% 6.5% 7.3% -0.1% 0.2%<br />

Std. Dev. 16.5% 15.2% 17.2% 18.7% 19.3% 19.4%<br />

Semi-deviation (below zero) 11.7% 11.1% 12.1% 13.2% 13.8% 13.9%<br />

Tracking error 7.3% 8.0% 7.3% 7.5% 0.0% 1.6%<br />

<strong>Beta</strong> with S&P 500 0.79 0.73 0.83 0.90 1.00 1.00<br />

Sharpe ratio 0.28 -0.10 0.19 0.22 -0.17 -0.15<br />

Sortino ratio 0.67 0.15 0.54 0.55 -0.01 0.02<br />

Information ratio 1.09 0.23 0.91 0.99 NA 0.24<br />

Treynor ratio 0.06 -0.02 0.04 0.05 -0.03 -0.03<br />

95% Value-at-Risk 3.9% 3.6% 4.0% 4.4% 4.5% 4.5%<br />

99% Value-at-Risk 7.2% 6.7% 7.6% 7.8% 7.9% 8.0%<br />

Skewness -0.69 -0.50 -0.49 -0.54 -0.34 -0.35<br />

Kurtosis 5.49 5.49 5.74 4.98 4.92 4.98<br />

Efficient<br />

Index<br />

Noncap-Weighted<br />

Minimum<br />

Volatility<br />

First subperiod (from 1/8/99-7/2/04)<br />

Second subperiod (from 7/9/04-1/1/10)<br />

Noncap-Weighted<br />

Fundamental<br />

Index<br />

S&P 500<br />

Equal-Weighted<br />

Cap-Weighted<br />

Cap-Weighted<br />

S&P 500 Russell 1000<br />

Average (geometric) 5.0% 3.3% 4.0% 4.2% 1.9% 2.3%<br />

Std. Dev. 21.9% 17.9% 23.4% 23.8% 20.3% 20.6%<br />

Semi-deviation (below zero) 15.7% 13.2% 16.6% 16.9% 14.7% 14.9%<br />

Tracking error 3.7% 4.9% 5.7% 5.2% 0.0% 0.9%<br />

<strong>Beta</strong> with S&P 500 1.07 0.86 1.13 1.16 1.00 1.01<br />

Sharpe ratio 0.10 0.03 0.06 0.06 -0.04 -0.02<br />

Sortino ratio 0.32 0.25 0.24 0.25 0.13 0.16<br />

Information ratio 0.83 0.28 0.38 0.44 NA 0.48<br />

Treynor ratio 0.02 0.01 0.01 0.01 -0.01 0.00<br />

95% VaR (Cornish Fisher) 4.9% 4.1% 5.0% 5.2% 4.6% 4.6%<br />

99% VaR (Cornish Fisher) 12.7% 12.6% 13.7% 13.0% 12.7% 12.8%<br />

Skewness -0.55 -1.02 -0.33 -0.40 -0.64 -0.61<br />

Kurtosis 9.81 13.33 10.41 9.14 11.10 10.99<br />

tor models. The R-squared for these regressions indicates<br />

how well the factor model fits the observed returns of the<br />

respective index, with an R-squared of 1 indicating a perfect<br />

fit, meaning that the index would be perfectly replicable<br />

with the equity factors. For the cap-weighted indexes, the<br />

results in Figure 3 show that the factor model suffices to get<br />

an R-squared close to 1. This is not the case for the noncapweighted<br />

indexes. They contain some return variation that<br />

cannot be explained by the factors. The R-squared reaches<br />

levels on the order of 0.95, leaving 5 percent of the return<br />

variation unexplained by exposure to <strong>com</strong>mon factors. This<br />

unexplained part can be linked to the unique index construction<br />

method of each of the noncap-weighted indexes.<br />

Conclusion<br />

The analysis provided in this paper clearly shows that the<br />

noncap-weighted indexes beat the standard cap-weighted<br />

indexes such as the S&P 500 and the Russell 1000 in terms of<br />

www.journalofindexes.<strong>com</strong> January / February 2011<br />

17