Download complete issue - IndexUniverse.com

Download complete issue - IndexUniverse.com

Download complete issue - IndexUniverse.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

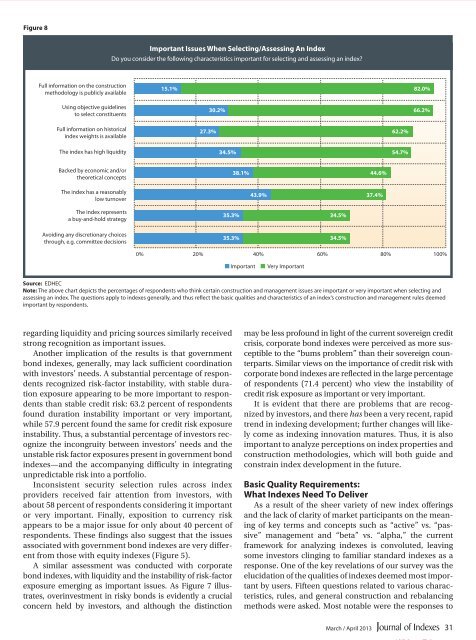

Figure 8<br />

Important Issues When Selecting/Assessing An Index<br />

Do you consider the following characteristics important for selecting and assessing an index?<br />

Full information on the construction<br />

methodology is publicly available<br />

Using objective guidelines<br />

to select constituents<br />

15.1%<br />

82.0%<br />

30.2% 66.2%<br />

Full information on historical<br />

index weights is available<br />

27.3% 62.2%<br />

The index has high liquidity<br />

34.5%<br />

54.7%<br />

Backed by economic and/or<br />

theoretical concepts<br />

The index has a reasonably<br />

low turnover<br />

The index represents<br />

a buy-and-hold strategy<br />

38.1% 44.6%<br />

43.9% 37.4%<br />

35.3% 34.5%<br />

Avoiding any discretionary choices<br />

through, e.g. <strong>com</strong>mittee decisions<br />

35.3% 34.5%<br />

0% 20%<br />

40% 60% 80% 100%<br />

Important<br />

Very Important<br />

Source: EDHEC<br />

Note: The above chart depicts the percentages of respondents who think certain construction and management <strong>issue</strong>s are important or very important when selecting and<br />

assessing an index. The questions apply to indexes generally, and thus reflect the basic qualities and characteristics of an index’s construction and management rules deemed<br />

important by respondents.<br />

regarding liquidity and pricing sources similarly received<br />

strong recognition as important <strong>issue</strong>s.<br />

Another implication of the results is that government<br />

bond indexes, generally, may lack sufficient coordination<br />

with investors’ needs. A substantial percentage of respondents<br />

recognized risk-factor instability, with stable duration<br />

exposure appearing to be more important to respondents<br />

than stable credit risk: 63.2 percent of respondents<br />

found duration instability important or very important,<br />

while 57.9 percent found the same for credit risk exposure<br />

instability. Thus, a substantial percentage of investors recognize<br />

the incongruity between investors’ needs and the<br />

unstable risk factor exposures present in government bond<br />

indexes—and the ac<strong>com</strong>panying difficulty in integrating<br />

unpredictable risk into a portfolio.<br />

Inconsistent security selection rules across index<br />

providers received fair attention from investors, with<br />

about 58 percent of respondents considering it important<br />

or very important. Finally, exposition to currency risk<br />

appears to be a major <strong>issue</strong> for only about 40 percent of<br />

respondents. These findings also suggest that the <strong>issue</strong>s<br />

associated with government bond indexes are very different<br />

from those with equity indexes (Figure 5).<br />

A similar assessment was conducted with corporate<br />

bond indexes, with liquidity and the instability of risk-factor<br />

exposure emerging as important <strong>issue</strong>s. As Figure 7 illustrates,<br />

overinvestment in risky bonds is evidently a crucial<br />

concern held by investors, and although the distinction<br />

may be less profound in light of the current sovereign credit<br />

crisis, corporate bond indexes were perceived as more susceptible<br />

to the “bums problem” than their sovereign counterparts.<br />

Similar views on the importance of credit risk with<br />

corporate bond indexes are reflected in the large percentage<br />

of respondents (71.4 percent) who view the instability of<br />

credit risk exposure as important or very important.<br />

It is evident that there are problems that are recognized<br />

by investors, and there has been a very recent, rapid<br />

trend in indexing development; further changes will likely<br />

<strong>com</strong>e as indexing innovation matures. Thus, it is also<br />

important to analyze perceptions on index properties and<br />

construction methodologies, which will both guide and<br />

constrain index development in the future.<br />

Basic Quality Requirements:<br />

What Indexes Need To Deliver<br />

As a result of the sheer variety of new index offerings<br />

and the lack of clarity of market participants on the meaning<br />

of key terms and concepts such as “active” vs. “passive”<br />

management and “beta” vs. “alpha,” the current<br />

framework for analyzing indexes is convoluted, leaving<br />

some investors clinging to familiar standard indexes as a<br />

response. One of the key revelations of our survey was the<br />

elucidation of the qualities of indexes deemed most important<br />

by users. Fifteen questions related to various characteristics,<br />

rules, and general construction and rebalancing<br />

methods were asked. Most notable were the responses to<br />

March / April 2013<br />

31