Download complete issue - IndexUniverse.com

Download complete issue - IndexUniverse.com

Download complete issue - IndexUniverse.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

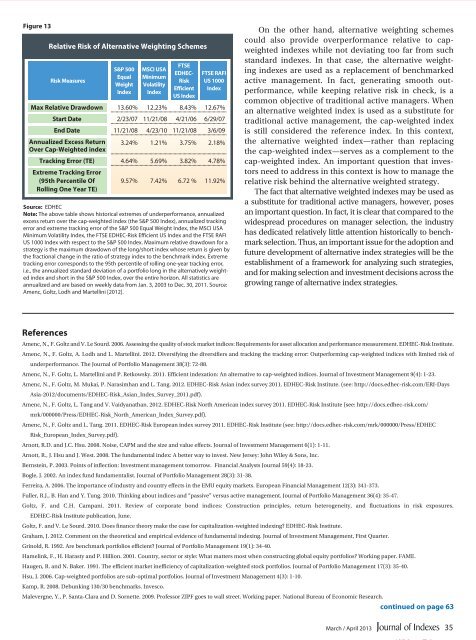

Figure 13<br />

Relative Risk of Alternative Weighting Schemes<br />

Risk Measures<br />

S&P 500<br />

Equal<br />

Weight<br />

Index<br />

MSCI USA<br />

Minimum<br />

Volatility<br />

Index<br />

FTSE<br />

EDHEC-<br />

Risk<br />

Efficient<br />

US Index<br />

FTSE RAFI<br />

US 1000<br />

Index<br />

Max Relative Drawdown 13.60% 12.23% 8.43% 12.67%<br />

Start Date 2/23/07 11/21/08 4/21/06 6/29/07<br />

End Date 11/21/08 4/23/10 11/21/08 3/6/09<br />

Annualized Excess Return<br />

Over Cap-Weighted index<br />

3.24% 1.21% 3.75% 2.18%<br />

Tracking Error (TE) 4.64% 5.69% 3.82% 4.78%<br />

Extreme Tracking Error<br />

(95th Percentile Of 9.57% 7.42% 6.72 % 11.92%<br />

Rolling One Year TE)<br />

Source: EDHEC<br />

Note: The above table shows historical extremes of underperformance, annualized<br />

excess return over the cap-weighted index (the S&P 500 Index), annualized tracking<br />

error and extreme tracking error of the S&P 500 Equal Weight Index, the MSCI USA<br />

Minimum Volatility Index, the FTSE EDHEC-Risk Efficient US Index and the FTSE RAFI<br />

US 1000 Index with respect to the S&P 500 Index. Maximum relative drawdown for a<br />

strategy is the maximum drawdown of the long/short index whose return is given by<br />

the fractional change in the ratio of strategy index to the benchmark index. Extreme<br />

tracking error corresponds to the 95th percentile of rolling one-year tracking error,<br />

i.e., the annualized standard deviation of a portfolio long in the alternatively weighted<br />

index and short in the S&P 500 Index, over the entire horizon. All statistics are<br />

annualized and are based on weekly data from Jan. 3, 2003 to Dec. 30, 2011. Source:<br />

Amenc, Goltz, Lodh and Martellini [2012].<br />

On the other hand, alternative weighting schemes<br />

could also provide overperformance relative to capweighted<br />

indexes while not deviating too far from such<br />

standard indexes. In that case, the alternative weighting<br />

indexes are used as a replacement of benchmarked<br />

active management. In fact, generating smooth outperformance,<br />

while keeping relative risk in check, is a<br />

<strong>com</strong>mon objective of traditional active managers. When<br />

an alternative weighted index is used as a substitute for<br />

traditional active management, the cap-weighted index<br />

is still considered the reference index. In this context,<br />

the alternative weighted index—rather than replacing<br />

the cap-weighted index—serves as a <strong>com</strong>plement to the<br />

cap-weighted index. An important question that investors<br />

need to address in this context is how to manage the<br />

relative risk behind the alternative weighted strategy.<br />

The fact that alternative weighted indexes may be used as<br />

a substitute for traditional active managers, however, poses<br />

an important question. In fact, it is clear that <strong>com</strong>pared to the<br />

widespread procedures on manager selection, the industry<br />

has dedicated relatively little attention historically to benchmark<br />

selection. Thus, an important <strong>issue</strong> for the adoption and<br />

future development of alternative index strategies will be the<br />

establishment of a framework for analyzing such strategies,<br />

and for making selection and investment decisions across the<br />

growing range of alternative index strategies.<br />

References<br />

Amenc, N., F. Goltz and V. Le Sourd. 2006. Assessing the quality of stock market indices: Requirements for asset allocation and performance measurement. EDHEC-Risk Institute.<br />

Amenc, N., F. Goltz, A. Lodh and L. Martellini. 2012. Diversifying the diversifiers and tracking the tracking error: Outperforming cap-weighted indices with limited risk of<br />

underperformance. The Journal of Portfolio Management 38(3): 72-88.<br />

Amenc, N., F. Goltz, L. Martellini and P. Retkowsky. 2011. Efficient indexation: An alternative to cap-weighted indices. Journal of Investment Management 9(4): 1-23.<br />

Amenc, N., F. Goltz, M. Mukai, P. Narasimhan and L. Tang. 2012. EDHEC-Risk Asian index survey 2011. EDHEC-Risk Institute. (see: http://docs.edhec-risk.<strong>com</strong>/ERI-Days<br />

Asia-2012/documents/EDHEC-Risk_Asian_Index_Survey_2011.pdf).<br />

Amenc, N., F. Goltz, L. Tang and V. Vaidyanathan. 2012. EDHEC-Risk North American index survey 2011. EDHEC-Risk Institute (see: http://docs.edhec-risk.<strong>com</strong>/<br />

mrk/000000/Press/EDHEC-Risk_North_American_Index_Survey.pdf).<br />

Amenc, N., F. Goltz and L. Tang. 2011. EDHEC-Risk European index survey 2011. EDHEC-Risk Institute (see: http://docs.edhec-risk.<strong>com</strong>/mrk/000000/Press/EDHEC<br />

Risk_European_Index_Survey.pdf).<br />

Arnott, R.D. and J.C. Hsu. 2008. Noise, CAPM and the size and value effects. Journal of Investment Management 6(1): 1-11.<br />

Arnott, R., J. Hsu and J. West. 2008. The fundamental index: A better way to invest. New Jersey: John Wiley & Sons, Inc.<br />

Bernstein, P. 2003. Points of inflection: Investment management tomorrow. Financial Analysts Journal 59(4): 18-23.<br />

Bogle, J. 2002. An index fund fundamentalist. Journal of Portfolio Management 28(3): 31-38.<br />

Ferreira, A. 2006. The importance of industry and country effects in the EMU equity markets. European Financial Management 12(3): 341-373.<br />

Fuller, R.J., B. Han and Y. Tung. 2010. Thinking about indices and “passive” versus active management. Journal of Portfolio Management 36(4): 35-47.<br />

Goltz, F. and C.H. Campani. 2011. Review of corporate bond indices: Construction principles, return heterogeneity, and fluctuations in risk exposures.<br />

EDHEC-Risk Institute publication, June.<br />

Goltz, F. and V. Le Sourd. 2010. Does finance theory make the case for capitalization-weighted indexing? EDHEC-Risk Institute.<br />

Graham, J. 2012. Comment on the theoretical and empirical evidence of fundamental indexing. Journal of Investment Management, First Quarter.<br />

Grinold, R. 1992. Are benchmark portfolios efficient? Journal of Portfolio Management 19(1): 34-40.<br />

Hamelink, F., H. Harasty and P. Hillion. 2001. Country, sector or style: What matters most when constructing global equity portfolios? Working paper. FAME.<br />

Haugen, R. and N. Baker. 1991. The efficient market inefficiency of capitalization-weighted stock portfolios. Journal of Portfolio Management 17(3): 35-40.<br />

Hsu, J. 2006. Cap-weighted portfolios are sub-optimal portfolios. Journal of Investment Management 4(3): 1-10.<br />

Kamp, R. 2008. Debunking 130/30 benchmarks. Invesco.<br />

Malevergne, Y., P. Santa-Clara and D. Sornette. 2009. Professor ZIPF goes to wall street. Working paper. National Bureau of Economic Research.<br />

continued on page 63<br />

March / April 2013<br />

35