Download complete issue - IndexUniverse.com

Download complete issue - IndexUniverse.com

Download complete issue - IndexUniverse.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

which means that although the vast majority of equity<br />

investors use equity indexes, equity indexes do not appear<br />

good enough for quite a lot of them. The rate of satisfaction<br />

is even lower with corporate bond indexes, with only<br />

53 percent of respondents answering they were satisfied.<br />

Figure 2<br />

Equity<br />

Indexes<br />

Gov’t<br />

Bond<br />

Indexes<br />

Corp.<br />

Bond<br />

Indexes<br />

Source: EDHEC<br />

Figure 3<br />

Equity<br />

Indexes<br />

Gov’t<br />

Bond<br />

Indexes<br />

Corp.<br />

Bond<br />

Indexes<br />

Source: EDHEC<br />

Usage Of Indexes Across Asset Classes<br />

Have you used the following indexes in your investments,<br />

in the respective asset classses?<br />

73.0%<br />

70.5%<br />

88.9%<br />

0% 20% 40% 60% 80% 100%<br />

Satisfaction Of Those Who Use Indexes<br />

In Diferent Asset Classes<br />

Are you satisfed with the products you have used?<br />

53%<br />

68.8%<br />

68.5%<br />

0% 20% 40% 60% 80% 100%<br />

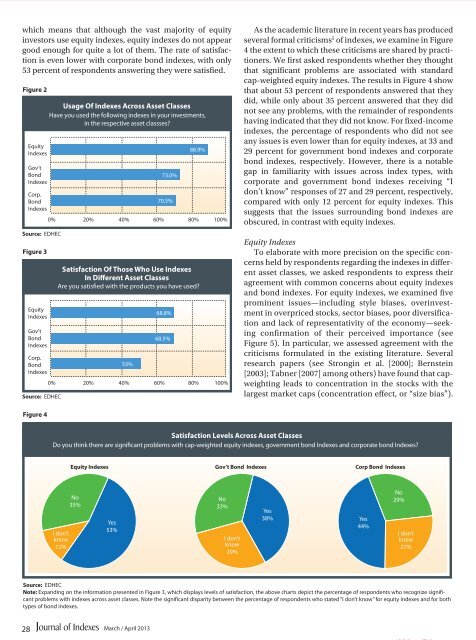

As the academic literature in recent years has produced<br />

several formal criticisms 5 of indexes, we examine in Figure<br />

4 the extent to which these criticisms are shared by practitioners.<br />

We first asked respondents whether they thought<br />

that significant problems are associated with standard<br />

cap-weighted equity indexes. The results in Figure 4 show<br />

that about 53 percent of respondents answered that they<br />

did, while only about 35 percent answered that they did<br />

not see any problems, with the remainder of respondents<br />

having indicated that they did not know. For fixed-in<strong>com</strong>e<br />

indexes, the percentage of respondents who did not see<br />

any <strong>issue</strong>s is even lower than for equity indexes, at 33 and<br />

29 percent for government bond indexes and corporate<br />

bond indexes, respectively. However, there is a notable<br />

gap in familiarity with <strong>issue</strong>s across index types, with<br />

corporate and government bond indexes receiving “I<br />

don’t know” responses of 27 and 29 percent, respectively,<br />

<strong>com</strong>pared with only 12 percent for equity indexes. This<br />

suggests that the <strong>issue</strong>s surrounding bond indexes are<br />

obscured, in contrast with equity indexes.<br />

Equity Indexes<br />

To elaborate with more precision on the specific concerns<br />

held by respondents regarding the indexes in different<br />

asset classes, we asked respondents to express their<br />

agreement with <strong>com</strong>mon concerns about equity indexes<br />

and bond indexes. For equity indexes, we examined five<br />

prominent <strong>issue</strong>s—including style biases, overinvestment<br />

in overpriced stocks, sector biases, poor diversification<br />

and lack of representativity of the economy—seeking<br />

confirmation of their perceived importance (see<br />

Figure 5). In particular, we assessed agreement with the<br />

criticisms formulated in the existing literature. Several<br />

research papers (see Strongin et al. [2000]; Bernstein<br />

[2003]; Tabner [2007] among others) have found that capweighting<br />

leads to concentration in the stocks with the<br />

largest market caps (concentration effect, or “size bias”).<br />

Figure 4<br />

Satisfaction Levels Across Asset Classes<br />

Do you think there are signifcant problems with cap-weighted equity indexes, government bond Indexes and corporate bond Indexes?<br />

Equity Indexes Gov’t Bond Indexes Corp Bond Indexes<br />

I don’t<br />

know<br />

12%<br />

No<br />

35%<br />

Yes<br />

53%<br />

No<br />

33%<br />

I don’t<br />

know<br />

29%<br />

Yes<br />

38%<br />

Yes<br />

44%<br />

No<br />

29%<br />

I don’t<br />

know<br />

27%<br />

Source: EDHEC<br />

Note: Expanding on the information presented in Figure 3, which displays levels of satisfaction, the above charts depict the percentage of respondents who recognize significant<br />

problems with indexes across asset classes. Note the significant disparity between the percentage of respondents who stated “I don’t know” for equity indexes and for both<br />

types of bond indexes.<br />

28<br />

March / April 2013