annual - Maxis

annual - Maxis

annual - Maxis

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

86 | <strong>Maxis</strong> BERHAD Annual Report 2009<br />

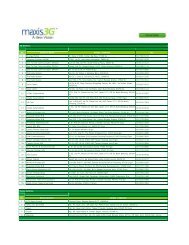

All risks identified are assessed to determine the risk ranking<br />

and they are displayed on a 5x5 risk matrix. With this visual<br />

representation, the business owners and Senior Management<br />

team are able to prioritise their efforts and manage the different<br />

classes of risks appropriately.<br />

The Board of Directors is ultimately responsible for identifying<br />

principal risks and ensuring the implementation of appropriate<br />

systems to manage these risks. The oversight of this critical area<br />

is carried out through the Audit Committee and reported to the<br />

Board at quarterly meetings.<br />

The ongoing effectiveness of the risk management framework<br />

is confirmed by Internal Audit through <strong>annual</strong> audit and review<br />

procedures.<br />

There is a dedicated independent risk management department<br />

responsible for managing the risk management process in the<br />

Group. The responsibilities of the department amongst others<br />

are to:<br />

• Steer the Group’s Risk Management programme and ensure<br />

timely updates of risk profiles by the respective business units;<br />

• Provide quarterly reports to the Audit Committee on the<br />

consolidated risks faced by the respective business units and<br />

action plans to mitigate such risks;<br />

• Present a summary of key risks to the Audit Committee<br />

quarterly;<br />

• Conduct risk awareness and review sessions with relevant<br />

heads of departments/risk owners to promote a proactive risk<br />

management culture and track risk implementation issues, if<br />

any;<br />

• Provide assistance to key business units to ensure risk<br />

management is firmly embedded as a process and that all key<br />

risks are identified and appropriate mitigating actions and<br />

controls are in place;<br />

• Analyse risk assessment reports from all business units and<br />

conduct quarterly presentations at the Senior Leadership<br />

team meeting (chaired by the CEO), for deliberation of risks<br />

that impact the <strong>annual</strong> operating plans and objectives by<br />

senior management; and<br />

• Provide relevant information on risk management to all <strong>Maxis</strong><br />

staff through the internal website.<br />

Risk Rating Scale Scale – 5 x – 55x5 Matrix Matrix<br />

1.<br />

CATASTROPHIC<br />

HIGH<br />

2.<br />

MAJOR<br />

IMPACT<br />

3.<br />

MODERATE<br />

MEDIUM<br />

4.<br />

MINOR<br />

5.<br />

INSIGNIFICANT<br />

LOW<br />

1.<br />

UNLIKELY<br />

2.<br />

LOW<br />

PROBABILITY<br />

3.<br />

POSSIBLE<br />

4.<br />

HIGH<br />

PROBABILITY<br />

5.<br />

ALMOST<br />

CERTAIN<br />

LIKELIHOOD OF OCCURENCE<br />

HIGH MEDIUM LOW